- The government backtracks on net zero yet again

- This time, gas is in focus and prices have risen

- There may be an even bigger energy opportunity

Last week the UK government announced that it would authorise the construction of a handful of new, gas-fired power plants. While the government claims that it is still fully committed to its ambitious net-zero plans, it pointed out that, due to the unexpectedly poor performance of both wind and solar, in particular for base power production, more traditional, backup capacity was necessary.

The alternative would be an unacceptably high risk of blackouts in the event that the sun didn’t shine brightly or the wind blow strongly enough. The vagaries of weather are one of the key reasons why both wind and solar are not particularly well suited to base power production. Hence gas plants or other traditional power sources will continue to exist alongside their zero-carbon counterparts indefinitely.

Given the surprising and significant implications of the above, at the end of the week I invited our in-house energy expert, James Allen, for an impromptu chat. It’s less than 15 minutes long and I recommend you view it here if you haven’t already.

The key takeaways included not only a recognition that the additional gas power capacity was necessary but that nuclear almost certainly will play a growing and evolving role.

What didn’t get mentioned, but could well have been, was coal. I’ve written about coal before. Following decades of demonisation, coal had become the four-letter word of the energy world until it came to the rescue of Germany and a handful of other European countries when their supplies of cheap and plentiful Russian-supplied gas were abruptly cut off due to the onset of war in Ukraine.

Here is a pertinent excerpt from the article linked above:

[L]et’s not forget another of the UK’s traditional fossil resources: anthracite. The UK still has meaningful anthracite reserves. Should it choose to re-tap this traditional domestic energy source, it will go a long way towards helping the UK manage its energy requirements for some time. Centra and eastern Europe also have substantial anthracite reserves, for example in the Czech Republic, Slovakia and Poland.

Anthracite is commonly referred to as just “coal”, but this is unfair. There is coal, and there is anthracite coal. Whereas low-grade, lignite coal is both dirty and not particularly energy-dense – it is comparable to dried wood or wood charcoal – anthracite is nearly as energy-dense as diesel. Yes, you read that right. Anthracite typically releases about 36,500MJ per cubic metre combusted. Diesel comes in at about 37,200MJ. There’s not much in it, as they say. Anthracite is the other “black gold”, as crude oil is colloquially known.

Anthracite isn’t as clean as diesel, but as it happens there have been great strides made towards “clean” coal in recent years. For example, the SO2 and NO contents – the primary pollutants of anthracite combustion – can be largely mitigated by “scrubbing” technology, a proven process. And while anthracite combustion releases mercury in trace amounts, this is negligible when compared to the various heavy metals pollutants associated with battery/EV production and recycling.

The potential appeal of coal is now all the greater given that global oil and gas energy transport has been compromised by the effective closure of the Red Sea and Suez Canal to shipping. Liquified natural gas (LNG) transport is a particularly acute problem as the cargoes are so highly explosive. (A large LNG tanker explosion would be comparable in power if not toxicity to the Hiroshima and Nagasaki atomic bombs.)

Global energy security relies on freedom of navigation. This includes vital chokepoints such as the Bab al-Mandab strait between Yemen and Africa. There are other chokepoints that could also be at risk in future.

Given growing signs that the some 80-year-long Pax Americana global security order is becoming unstable, if not breaking apart entirely, energy security becomes more of a national priority for countries with limited domestic energy resources. The UK has some fossil energy flexibility in this regard, but adding coal to the mix would help to deal with both energy security and affordability.

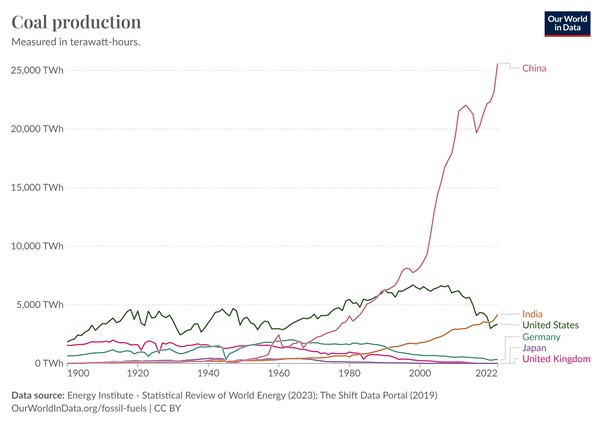

Regardless of the specifics of UK energy policy, it is worth noting that the UK produces and consumes only a trivial amount of global fossil fuel production, as the following charts illustrate. Here is a look at global coal production:

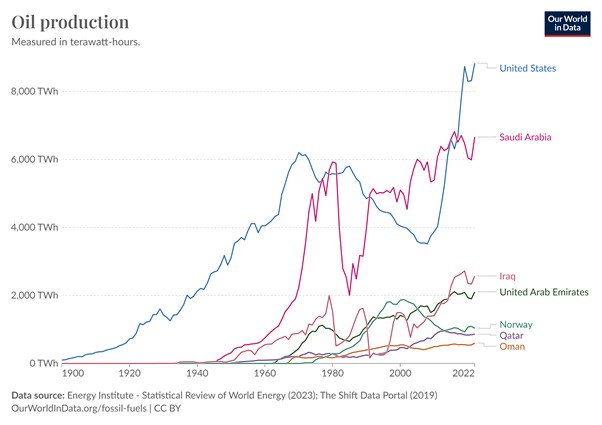

Here is global oil production:

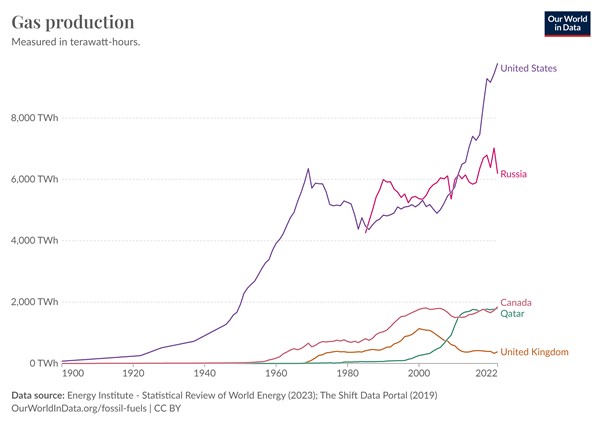

Here is global gas production:

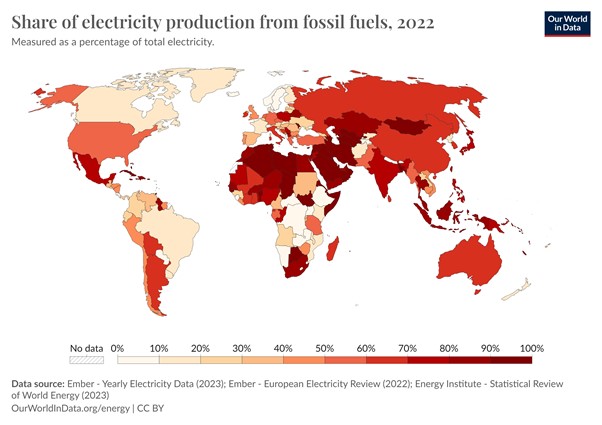

Finally, here is a look at global fossil fuel power generation, including coal, oil and gas. Note how the UK uses proportionately less than most developed as well as developing countries.

What really jumps out from the map graphic above is how dependent so much of the world remains on fossil fuels, which in many cases must be transported over the world’s oceans. Countries seeking to improve their energy security need either to find more domestic resources or they need to diversify their import mix, or both.

Given the chokepoint risks noted above, that diversification should not only be by type of fuel, but by geography. It is considerably less likely that multiple major global shipping chokepoints would be compromised at the same time rather than just one becoming problematic, as is the case today.

Focusing again on coal, given that resources are so widely distributed globally, rather than concentrated in a few potentially risky regions such as the Persian Gulf, coal could be seen as an ideal way for some countries to kill two energy diversification birds with one (black) stone. Investors should take note and include coal in their overall energy portfolio mix.

Fortunately, there is a new way to get diversified exposure to the global coal industry, including production, exploration, development, transportation and distribution. Earlier this year, Range ETFs launched a global coal fund. Listed on the NYSE, it has the ticker symbol COAL and is currently invested in 29 companies. If interested in learning more, you can do so here.

Until next time,

John Butler

Investment Director, Fortune & Freedom