- High tax rates are economically destructive

- Fortunately, the solution is simple: lower them!

- Aspiring politicians take note

Arthur Laffer, legendary US economist and adviser to two presidents, visited the UK last month. His message: taxes are way too high. If not lowered dramatically, high rates of tax threaten an economic “destitution”.

He could have observed that economic stagnation set in some time ago. Perhaps he was just being polite. Or perhaps, as he doesn’t visit Britain too frequently, he wasn’t aware. No matter, his point remains valid.

By way of background, Arthur Laffer has been remarkably consistent during his half-century as a popular economist. Remarkably for a profession in which luminaries seem to change their minds a great deal, that is.

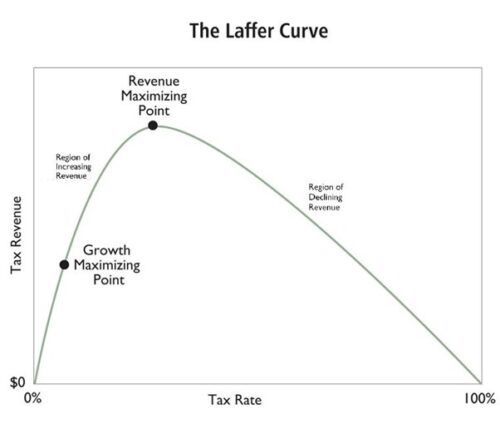

He has always held that his eponymous curve, that which illustrates how tax revenues rise and fall with marginal rates, applies in principle to any economy, not only that of the US. Here is an example of the “Laffer Curve”:

Source: freedomandprosperity.org

Source: freedomandprosperity.org

What the chart shows is that, at low levels, small increases in marginal tax rates can give a huge boost to government revenue. Beyond a certain point, however, higher rates become a drag on economic growth. Not far beyond that, due both to weaker growth and rising tax avoidance, tax revenue peaks.

Beyond that point, higher marginal rates are both negative for growth and for future revenue. Taxes become a lose-lose proposition. According to Laffer, this is where Britain finds itself today.

Naturally, there is a huge dispute within the economics profession regarding where precisely the growth- and revenue-maximising points lie. Some argue at around 15-25%. Others would place them much higher. But that these points do exist is not seriously disputed. Hence Laffer’s framework is a useful one.

Laffer is also associated with so-called “trickle-down economics”, the idea that tax cuts release much spending from those relatively better off, which subsequently trickles down into all strata of society. The growth-maximising point in the chart above would be that at which the trickle-down effects are the greatest.

While resources left to the private sector naturally circulate within it, it is disputed to this day whether the trickle-down theory is just a convenient excuse for a policy that clearly favours the wealthy. Do tax cuts for the wealthy really make the poorer better off or is that just spin?

Let’s approach this from a different perspective. What happens when you raise taxes on the wealthy? According to Laffer:

What do these rich people do? When you raise the tax rate on them, they change their behaviour. They hire lawyers, they hire accountants. They hire deferred income specialists. They hire business planners, they hire lobbyists.

In other words, higher taxes largely don’t actually get paid. They do result in a hiring boon for tax specialists of all kinds. By contrast, the savings from lower taxes gets spent throughout the private sector. This creates jobs generally, rather than specifically for otherwise-unnecessary tax specialists. (Economists refer to the redirection of labour to otherwise unnecessary or undesirable ends as “dead-weight loss”.)

Such thinking is hardly original to Laffer. Among other classical economists, Adam Smith and John Maynard Keynes both argued that, beyond a certain point, tax rates became nothing more than an incentive for avoidance and hence were wholly counterproductive, if not necessarily immoral.

But does such classical thinking actually hold true today? Let’s run some recent numbers, shall we? As reported by the Telegraph:

In December the Scottish National Party announced plans to raise the top rate of Scottish income tax from 47pc to 48pc. In theory this should bring in an extra £53m in tax revenues, according to the Scottish Fiscal Commission (SFC). In practice, the watchdog expects so much behavioural change that the gain for the Scottish taxman will in fact only be £8mn.

Some in the Scottish government might argue that £8 million is better than nothing and that the rate should be higher still. But would anyone argue that the top marginal rate today remains below the growth-maximising point in the Laffer Curve? That’s really quite a stretch.

Perhaps it should be no surprise that Laffer praised the previously proposed Truss-Kwarteng tax cuts, even if the execution of their plan left something to be desired. As quoted in the Telegraph, Laffer says:

It was an excellent thing. The thing that was not excellent was that it didn’t get implemented. It’s amazing how tax cuts don’t work until they’re actually put into effect. If it had been tested, it would have worked wonderfully for Britain.

For Laffer, the Truss-Kwarteng approach could have been a success on par with the Thatcher tax cuts of the early 1980s, no less. “When she came to power in 1979, the top rate was 83%. By the end of her premiership, it was 40%.”

Total tax revenues were also far higher, although not at first. It takes a while for the “Laffer tailwind” to kick in, as it were. A similar dynamic was seen in the early Reagan years in the US, much as Laffer predicted.

In part 2, we’ll use Laffer’s framework to take a look at Britain’s possible tax and spending future. While hardly all bad, some tough choices will need to be made if the economy is to ever return to high rates of growth.

John Butler

Investment Director, Fortune & Freedom