- Why the sudden radio silence on CBDCs?

- If guns don’t kill people, do CBDCs freeze you?

- Time to escape the digital world with more of your wealth

The last few months of 2023 were especially noticeable for the dog that stopped barking – the sudden silence on central bank digital currencies (CBDCs). From being a major global talking point for policymakers, journalists, conspiracy theorists and business executives for years now, CBDCs suddenly dropped off the radar.

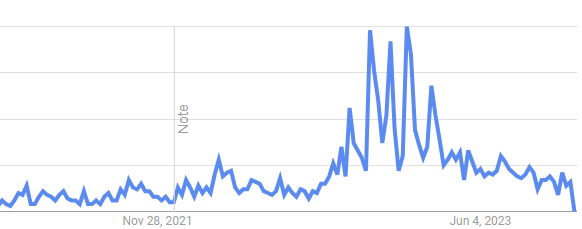

In the UK, this drop-off was especially stark, according to Google Trends, with Google searches for “CBDC” plunging faster than a wind farm developer’s share price in the last few months of 2023. It’s almost as stark in the US and Australia, but the UK’s chart is especially noteworthy:

Source: Google Trends

Source: Google Trends

What’s going on?

Well, the rollout and development of CBDCs certainly haven’t slowed down. In November, the International Monetary Fund even provided a “Virtual Handbook” on how to do it. It is “a reference guide for policymakers and experts at central banks and ministries of finance.”

I’m not sure why this terrifying tool of government control and surveillance is no longer getting the attention it deserves. But I do know that exactly one year ago, I argued that…

***

It’s not the CBDC you should be afraid of

[This article was first published on 4 January 2023.]

My fellow sceptics of government interference in our lives are up in arms about central bank digital currencies (CBDCs).

They’re telling you about “surveillance,” “Big Brother” and something called the panopticon – a prison optimised by the fact that you never know when the prison guard is watching you.

But do you fear the NHS having your personal medical information? Do you worry about the DVLA knowing where you live? Are you concerned that HMRC knows how much you earned last year?

To be honest, I don’t worry about these things. The nincompoops on the other end of that information are not capable of using it for good or evil, in my experience.

In much the same way, CBDCs are not what you should be worried about. The truth about CBDCs is a little more awkward than that.

To understand what’s really going on, think about the following scenarios…

What would the lockdowns have looked like if the government really could have forced people to stay at home? And I mean everyone, with not even shopping trips allowed.

What would the pandemic QE have looked like if the government could’ve sent people cash directly? Actually, that did happen, didn’t it?

And now we know the result of shovelling cash at people, don’t we? Whopping inflation…

What would the 2008 stimulus packages have looked like if the government had followed this model? We’d have seen inflation back then too.

What would the vaccine mandates have looked like if the government really could’ve forced, not just incentivised, people to get vaccinated?

What would speeding fines look like if every moment above the speed limit meant an automatic fine? Would the government impose such a policy if it could?

What would our energy prices look like if the government ran our energy policy?

What would the pandemic have looked like if Wuhan’s labs really could engineer a disease with a death rate worth locking down everyone for?

In each case, it is the government’s ability to achieve policies that is the main constraint. And I believe that applies very broadly.

In arenas where the government can make mad policy, like energy and cash handouts, it does. In areas where the government is too incompetent to make mad policies, it does not.

What CBDCs do is widen the arena of possible government policies.

Massively.

My point is that CBDCs are not the problem. It’s what they allow governments to achieve which is the worry. It’s what they make possible that you should be worried about.

You see, I bet there is a long list of mad government policies which politicians would love to implement, but which cannot because compliance of the population would be too low (banning meat), the cost of imposing the policy would be too high (100% renewable energy), or the effectiveness of the policy is questionable (complete lockdowns).

CBDCs do away with a lot of the constraints that hold the government back. They make the currently impossible government policy possible.

How?

Well, CBDCs offer the government complete information about you. How much you spend on what, when and where. How much you earn too – no declarations needed.

And then CBDCs offer the government the ability to successfully impose fines, taxes, limits, refusals and much more on you. Or “bribes”, of course, for doing what the government wants.

These policies become inherently possible because the government itself manages the monetary system. Theoretically, it is in complete control.

That doesn’t mean the government will necessarily pursue policies like expiring cash to encourage spending, automated fines for purchases deemed environmentally damaging, limits on unhealthy spending, or punishments for donations to the wrong political cause, such as limits on travel.

The point is that they could do so and it would actually work – that’s what has changed: they could actually do so successfully.

Now, if you ask me, it’s only a matter of time before governments actually use their new-found powers once CBDCs exist. It always works that way, historically speaking. Totalitarianism creeps, one enticing issue at a time.

Remember when vaccine passports were considered too outrageous to contemplate?

I believe the only thing holding the government back is their inability to actually implement the policies they want to. And CBDCs can make many of those possible.

For now, it’s possible to do something about this. You can shift some of your wealth outside the system which, I believe, will be ringfenced and corralled into CBDCs over time. First with beneficial incentives, then with costs, governments will encourage and then pressure people from the mainstream financial system into CBDCs.

But they will not be able to shift certain assets held independently of the financial system. Real assets that they cannot control at a keystroke. And that’s why you need to own more of them.

Until next time,

Nick Hubble

Editor, Fortune & Freedom