“Money isn’t everything but it ranks right up there with oxygen.”

Those are the words of the legendary sales trainer, Zig Ziglar.

And I think it’s fair to say that Ziglar, known for his charming Southern drawl, had a point.

Money isn’t the be all and end all.

But it is the single most important tool we have for navigating the world around us.

It allows us to do the things we want to do.

Whether that’s buying the latest iPhone… sending your kids or grandkids to private school… or simply sitting back and watching your money pile up!

Like it or not, money IS the oxygen of life. It’s in all our interests to keep it growing, year in year out.

The sad thing is, most people don’t have a clue how to go about it.

They leave their money sitting in their current account. Or invest their money in a FTSE 100 tracker fund.

I want to show you a better way…

That by using my Wealthmaker Rulebook you’ll be able to take on LESS risk than investing in a FTSE 100 tracker fund…

Yet at the same time, you’ll be using a method that in back testing beat the market by 7-to-1.

(Back tested results. Simulated past performance is not a reliable indicator of future results. All investing involves risk to your money.)

My special broadcast tomorrow at 2pm will show you how to put this method into action.

I’ll show you why this is the ONE strategy that I trust above all others. And in fact, pass on to my own son.

I’ll lift the lid on the 12 years of rigorous historical testing I’ve put the strategy through. Testing that proves it could have turned a £10,000 starting pot into £177,000.

And I’ll show you how it’s designed to work through any market environment.

I’m serious.

Bull market.

Bear market.

Sideways market.

It doesn’t matter.

This strategy has the potential to come up with the goods.

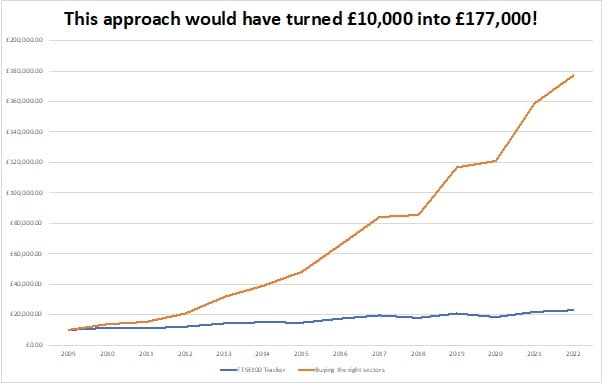

To be more specific, it’s capable of doing THIS:

Back tested results. Simulated past performance is not a reliable indicator of future results.

See the blue line?

That’s what will have happened if you’d invested in a FTSE 100 tracker fund. You’d have turned £10,000 into £22,000. By many measures, a decent return.

But that orange line… the one racing away from the grey line… that’s what back testing shows you’d have made if you’d invested in my approach.

You’d have turned £10,000 into £177,000. A full £155k MORE than investing in the FTSE 100… whilst taking on less risk.

That’s why, to me, this strategy is a no-brainer. It’s not risk free, by any means. This is still investing, and all investing comes with a risk to the money you invest. Back testing assumes making certain calls right every time, which isn’t necessarily how the method will have performed “live”, as it were. But it gives us a good indication of how it would have performed and of the method’s potential.

And it’s why, as Investment Director at Southbank Investment Research, I have one major priority.

To tell YOU how you could use it.

As I said, tomorrow at 2pm, you’ll have the chance to do just that.

Now, if you’ve been following my Wealthmaker Rulebook series so far, you already know the first two rules that I follow with this strategy.

If you’re yet to get up to speed, click the links below to catch up on what you’ve missed.

Rule 1 – Choose the right sectors at the right time

Rule 2 – Slash your risk… whilst maximising your upside

Today, I want to tell you about my third and final rule.

The Third Law

My third rule is designed to take advantage of the most powerful force in all of financial markets.

I’m talking about megatrends.

The term “megatrends” was first coined in the early 80s by an American futurist called John Naisbitt.

Naisbitt described megatrends as large, transformative processes with “global reach, scope, and a fundamental and dramatic impact”.

But what you really need to know about megatrends is that they have three characteristics:

- They are unstoppable.

- They permeate every facet of the way we live.

- If you’re smart, they can make you a lot of money.

Examples of megatrends include the obvious ones like the industrial revolution, computers and the rise of the internet.

But then there are the not-so-obvious megatrends.

I’m talking about megatrends like the ageing population in the Western world.

As modern medicine has progressed, it’s meant the population of elderly people has ballooned over the years.

Which has triggered a boom for healthcare companies like AstraZeneca, MSD and Pfizer.

In fact, in the case of Pfizer, it has grown from just 80 cents per share in the early 90s…

Past performance is not a reliable indicator of future results. Five-year performance of Pfizer: 2018 +39.33% | 2019 +48.8% | 2020 +28.69% | 2021 -0.39% | 2022 -11.18% | 2023 (to 30/9) -12.01%

Past performance is not a reliable indicator of future results. Five-year performance of Pfizer: 2018 +39.33% | 2019 +48.8% | 2020 +28.69% | 2021 -0.39% | 2022 -11.18% | 2023 (to 30/9) -12.01%

… to more than $33 today – a 4,000% gain.

As you can see, investing in the right megatrends can be incredibly lucrative.

But here’s the best part:

Tomorrow, I’ll show you how to combine this third rule with my first and second rule to squeeze even more juice out of your portfolio.

And crucially, to do so without increasing your risk.

Now don’t worry… as you’ll see, it won’t involve doing anything complicated.

In fact, you won’t have to worry about doing any of the work.

Because tomorrow, I’m going to give you the opportunity to find out how you can copy and paste my Butler Family Portfolio.

That’s right.

You’re going to be offered the chance to use the very same strategy that I’m using with my son’s money…

And that I’ve been using with my own money for the past 20 years.

This strategy has helped to put my four children through private school…

And it helped me to sidestep every major market crash of the last two decades, including:

The dotcom bust… the 2008 Great Financial Crisis… the European Sovereign Debt Crisis… and the bear market we find ourselves in today.

And tomorrow, you’ll find out how to put it to use yourself.

See you at 2pm sharp.

Sincerely,

John Butler

Investment Director, Fortune & Freedom

PS The markets have left you with something even worse than losses – uncertainty.

But one thing IS for certain…

The old (lazy) strategies of set and forget aren’t working. We’re not going back to “business as usual” any time soon. Perhaps ever. The world has changed. The 15-year bull market was an anomaly. If your plans don’t change, your results won’t change either.

So, I want to hear from you about your wealth-building experiences:

What’s the biggest financial challenge you face right now?

What changes have you made to your own investing philosophy in order to navigate the new financial landscape?

And are you willing to try something new – something that has worked tremendously well for me over the years?

You can send your feedback here: [email protected].