You’ll notice something different about Fortune & Freedom today.

In fact, it’s something that you’ll see for the next week or so…

A new focus on something important to me, and, I sense, important to you too.

As a member here at Southbank Investment Research – and a reader of mine – I know you take your money seriously. Like me, you’re probably responsible for your family’s financial security.

That’s a big responsibility. An important one and something that much of society seems to overlook.

It can weigh very heavily on us, let’s be honest.

It can lead to plenty of sleepless nights, wondering if you’ve made the right decisions and if you’ll ultimately be able to provide what your family needs.

In the end, will your plans deliver?

Believe me, I know. I’ve got four children.

As someone who was once voted the #1 investment strategist by Institutional Investor magazine, the pressure is really on for me not to screw this up (!).

Fortunately, my career experience has provided me with insights that – in my view – stack the odds heavily in my favour.

In fact, my own work over the last 20 years – building lucrative investment strategies for some of the world’s largest institutional investors and wealthy family offices – has given me a big advantage.

This week is all about sharing that advantage with you.

Our ambitions here are not modest. I want to help solve the biggest challenge you face: providing a growing core base of wealth for yourself and your family. Not just this year, or next year – but for decades to come.

Something that you can use for the years ahead to grow your wealth in good times and bad… and pass on to your children, just as I will be doing.

Over the coming days I’m going to share the three powerful rules I used to create lucrative investment models throughout my career.

This is the same approach I have been using to provide a comfortable life for my family and put all four of my kids through good private schools.

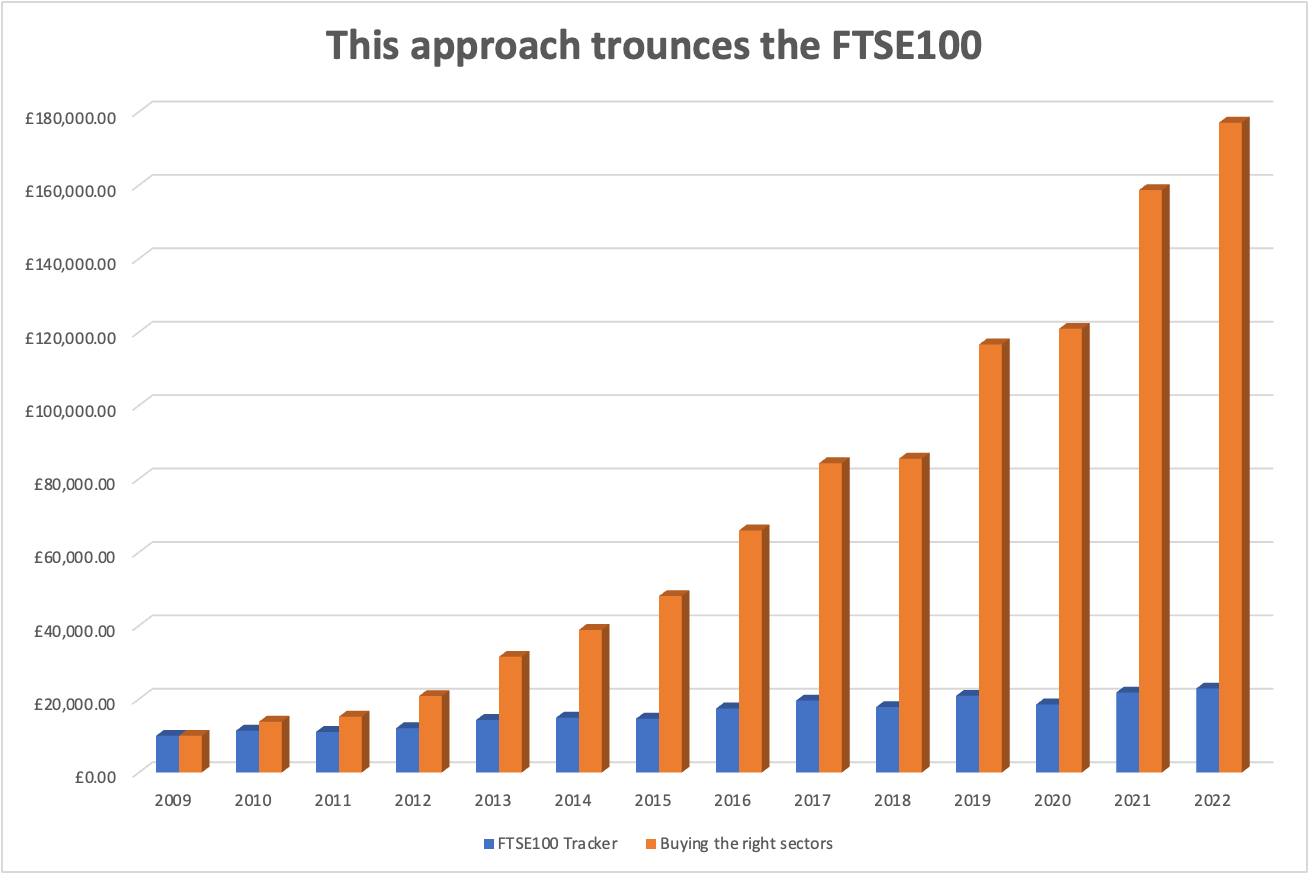

The same approach that my historical testing shows would have grown a £10,000 starting pot into £177,000 – over the last 12 years alone (not accounting for costs and taxes)…

(Calculated using back testing. Simulated past performance is not a reliable indicator of future results.)

While exposing you to LESS RISK than investing in the kind of “safe” FTSE tracker most people invest in.

Calculated using backtesting, simulated past performance is not a reliable indicator of future results. Figures do not take into account any investing costs or taxes.

The strategy I’m going to be sharing this week is not magic. It doesn’t rely on bull markets to work. It’s a set of simplified rules I’ve developed and applied through the years to gain an advantage on the market.

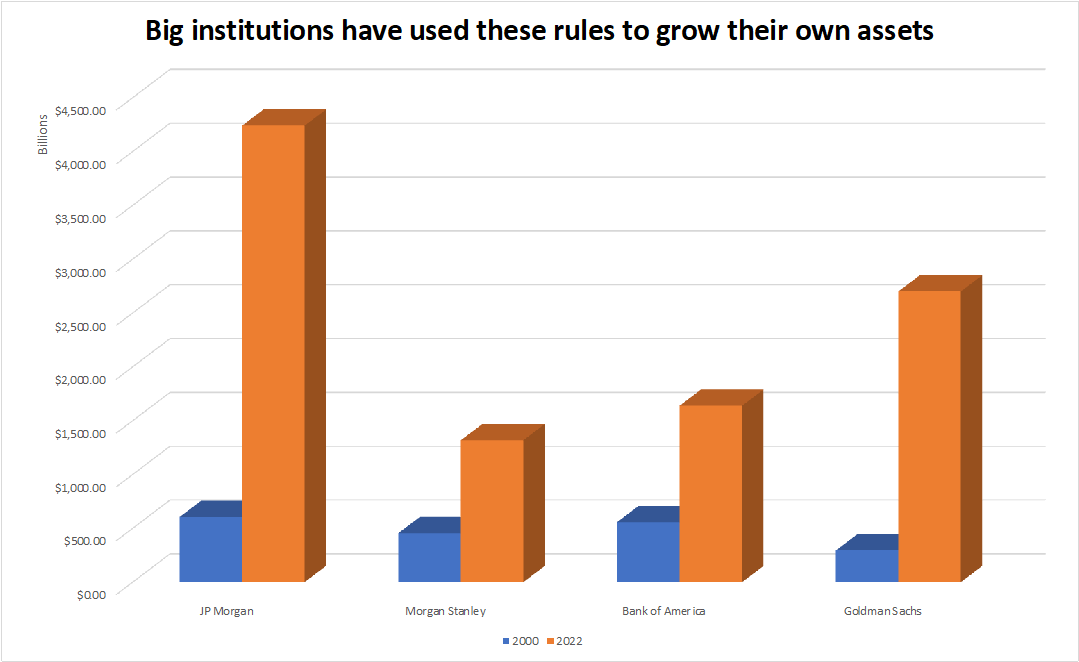

An all-weather wealth creation model that has created hundreds of billions of pounds, dollars and euros for institutions like these, who have grown their assets immensely over the years, as a result…

It won’t surprise you to hear that this sort of valuable information rarely leaks out of the skyscrapers over in the City of London or on Wall Street. If it does, it’ll cost you an arm and a leg to get someone controlling your money this way.

These guys have the secrets – the rules – that give them the ability to beat the market time after time. They’re not going to share it out of the kindness of their hearts.

Fortunately, I wrote this particular rule book.

As we go through the coming week, I’m going to be walking you through:

- How and why these rules work so consistently

- The hard numbers: besting the FTSE 100 for 12 years straight

- How it can lower your risk, utilising a Nobel-prize winning model

- And how I’ll be starting a brand-new project – exclusively for Southbank readers – to follow my lead and build your own Family Wealth portfolio.

If you’ve been a reader of Fortune & Freedom over the last few months, or even years…

The coming days will provide you with the most important and valuable intelligence we have ever shared.

Please pay attention.

In many ways, what I’ll be sharing is the culmination of my career. It is the reason I joined Southbank in the first place. My mission is to share the best wealth-building strategies with as many people as possible and this method is the pinnacle.

As you’ll learn, the responsibility to provide for my family has taken a bit of a twist recently. As a young man, my son is really starting to make his way in the world now… and he’s asked me for advice on how to grow his money.

Given my contacts and years of experience on the market, I could have shared any number of effective strategies or contacts with him. Strategies that I am confident could double or triple his savings over the course of the next few years.

However, there is one that stands above them all.

That’s the strategy I’m sharing with you this week. It is the only strategy I’ll be sharing with my son.

I’ve relied on it to deliver for more than two decades. I owe my professional and personal prosperity to it. Not only has it provided me with a financial advantage in life. But it has delivered a priceless confidence and peace of mind when it comes to my own investing and the advantages my family deserves.

As we go through the coming week, I want you to start understanding and using this powerful wealth advantage too.

If you’re ambitious about growing your family wealth – and you take that responsibility seriously – you have an obligation to learn about this.

Everything will be in plain English. Simple terms. No jargon. I want you to see the power of this approach – not get lost in the complexities.

So, let’s get started. Let’s open up “The Wealthmaker Rulebook”:

RULE #1

Knowing what to invest in – and when

If this sounds rudimentary, it is!

However, if you’re investing in the wrong assets at the wrong time, you have zero chance of making a success of your investing life.

Knowing what to invest in – and when – is the single most powerful factor in determining whether you will be counting profits or losses.

So, we have to get this part right.

Fortunately, although institutions and family offices spend hundreds of thousands of euros or pounds a year to develop and implement investment processes of this sort, I’ve developed a simple way for anyone to do it.

It took me years of sifting through the data available to me to build a simple “map”. A map that tells me which stock market sectors to invest in, depending on what “phase” the market is in.

These “phases” are called the business cycle.

Put simply, you can say the economy is only ever doing one of four things:

- Expanding

- Slowing down

- Contracting

- Recovering

Certain sectors of the stock market do better than others, depending on what phase we’re in. With me so far? It’s not complicated. What IS complicated is sorting through the endless data that tells us which sectors do better and when.

But as a principle, it’s easy to grasp.

For example, prior to 2022, we were in the Expansion phase.

The economy was growing. Jobs were being created. And importantly, people were making more money and spending it.

As a result, the tech sector – responsible for the job creation – soared…

And because people were flush with cash and spending on new clothes, gadgets and eating out…

So did the “consumer discretionary” sector. I’m talking about the stocks that produce all the goods and services people buy beyond basic living costs. In other words, for “fun”.

How much difference can investing in the right sector at the right time make?

A (bloody) big one.

Take a look:

RIGHT sectors at the RIGHT time

I think you can see where I’m going with this. If you build your core family wealth portfolio around the concept of investing in the right sectors at the right phase of the business cycle…

You could enjoy considerable rewards. To be precise – according to my historical analysis – beating the market by seven-to-one (assuming you got every call right).

Or the difference between turning £10,000 into £22,870 just tracking the FTSE 100…

Calculated using back testing. Simulated past performance is not a reliable indicator of future results. Figures do not take into account any investing costs or taxes.

And turning £10,000 into £177,000 by investing in these “super sectors” when my timetable tells me to.

Now, I don’t know what your main goal is when it comes to investing your money.

Whether you’re looking to fund your retirement…

Build a financial legacy for your children or grandchildren…

Or just to enjoy the extra cash…

Of course, these results come with the benefit of hindsight. It is an indication of how the strategy would have performed in the “real world”, had you made all the calls correctly. However, in the real world you need to accept that your money is always at risk and that there are no guarantees. But following my first rule could get you there A LOT quicker.

Do you want to know the best part?

That’s just the first rule.

Tomorrow, I’ll let you in on my second rule and I’ll show how you could get these types of returns – while taking on LESS risk than investing in a FTSE 100 tracker fund.

See you tomorrow.

Sincerely,

John Butler

Investment Director, Fortune & Freedom

PS If what I’ve shown you today has piqued your interest, make sure you’re free on Thursday at 2pm.

That’s when I’ll show you how to join me and my son in using this strategy yourself.

So that you too can grow your wealth – no matter what the market throws at you.