- Industrial commodity prices have been declining

- Cyclical stocks have been underperforming

- Signs are growing the global economy is slipping into recession

As a relatively small, open economy, the UK basically imports global economic conditions. Whether it be growth, or inflation, what happens abroad is decisive for what happens at home.

Hence, we should be worried not so much by just one month of stagnant UK GDP growth, but by growing signs that the global economy is slipping into a recession. Indeed, it may already be there.

What signs am I talking about?

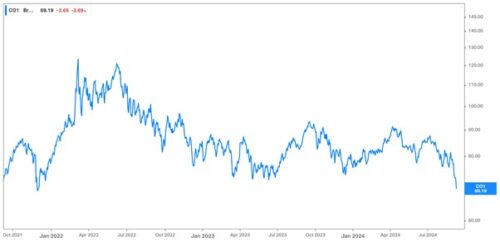

Let’s start with the price of oil. While both supply and demand factors can impact the price, the former has not materially changed over the past few months. But the price has fallen sharply of late to the lowest level since lingering Covid lockdowns were still in place:

Brent crude at nearly 3y lows

Source: Koyfin

Source: Koyfin

Demand for oil, it would seem, is off hard. That is an indication of slowing global economic activity.

And not only oil. Economic bellwether commodity iron ore has also traded sharply lower of late.

Iron ore at nearly 2y lows

Source: Koyfin

Source: Koyfin

Not all commodities are down. For example, industrial commodity copper is trading near its 3-year average. But given all the inflation that has rolled through the global economy during that period, this would still imply tepid demand, in particular, in the large manufacturing and construction economies such as China, India and the US.

Speaking of inflation, gold, as we know, is near all-time highs. But that is hardly an indication of a healthy global economy. It helps to confirm what is a global “stagflationary” outlook, albeit one in which the “flation” has largely shifted to “stag” over the past year.

[As an environment that normally results in low or even negative returns for both stocks and bonds, stagflation is hostile to investors. Commodities however, in particular energy and precious metals, can outperform strongly. My colleague James Allen, editor of Strategic Energy Alert, is currently recommending two precious metals royalty companies in addition to multiple energy firms he considers well-positioned to benefit strongly from current and future developments. If you’d like to learn more you can talk to our Customer Care team on 0330 808 7916 to claim a specials deal over the phone.

Capital at risk. Forecasts are not a reliable indicator of future results ]

Commodity prices aren’t exactly leading indicators, however. They are coincident, telling us more about the patient’s pulse than prospects.

But when looking at the latter, things also look poor. In the US, commercial and industrial loan growth, when adjusted for inflation, has been outright negative for over a year. That doesn’t normally happen outside of recessions, but it is happening now.

Prolonged weakness in US bank lending

As a general rule, the stock market cares far more about the future than about the present. Hence why the chart above gives investors good reason to worry.

For months I’ve been watching the stock market closely for signs of internal weakness. By “internal” I mean things such as concentration, sector rotation and momentum. That is, the market can still be trending higher but internal weakness can point to a potentially imminent correction.

Let’s focus first on the world’s leading stock market, the US. There has been unusually high concentration for some time, with seven firms in particular leading the way: the “Magnificent Seven” as they are often called.

At one point in July these firms represented over 35% of the total market capitalisation of the entire S&P 500 index. Following some recent underperformance their share has declined somewhat but remains historically elevated.

This underperformance has impacted overall market momentum. Here is the S&P 500 chart:

Source: Koyfin

Source: Koyfin

To be honest, it doesn’t look too bad. One could easily conclude that we are merely observing a period of consolidation. (The little bounce seen just this past week is largely due to Magnificent Seven members recovering somewhat.)

Let’s turn now to cyclical stocks, which had been doing well earlier this year but have done quite poorly of late. Materials, a leading cyclical sector, has already seen an abrupt reversal. Here’s global leader Glencore:

Source: Koyfin

Source: Koyfin

And here is BHP Billiton:

Source: Koyfin

Source: Koyfin

And so, we have a stock market that is highly concentrated, has lost some momentum and has seen some sector rotation out of cyclicals. Hence all the internal factors mentioned above have turned at least slightly negative.

If I were more upbeat on underlying global economic conditions this wouldn’t concern me so much. Indeed, it is against the recessionary backdrop described above that market internals need to be evaluated. And when I do that, I see a stock market that now smells trouble.

It remains, as before, a time to be defensive in one’s portfolio allocation. Income and dividends should be favoured over growth. Defensive sectors should be favoured over cyclicals.

It is precisely a defensive investment posture that I continue to recommend in my FTSE 100-oriented service, Southbank Wealth Advantage. If you’d like to learn more about it, you can do so here.

Until next time,

John Butler

Investment Director, Fortune & Freedom