Editor’s note: If you want to know exactly why today is so critical and how you can potentially take advantage with my “AI Master Key”, I’ve gone into my detail in an urgent presentation – don’t delay go straight here to find out more.

In today’s issue:

- Today is a big day for global markets, and your portfolio

- Is the Fed behind the curve again?

- Which assets will be impacted – and which stand to benefit most?

The start of a falling rate cycle is not the good news many people would expect, for equity markets at least…

The most powerful economic body in the world is set to change its core policy this week, with clear winners and losers. In fact, it could signal the start of one of the great bull markets for one particular asset.

The Price of Time

The dollar, US bonds, oil and global markets are all closely linked. At the centre of it all is what famed financial historian Edward Chancellor calls “the price of time”. That’s because the rate of interest is the price one party charges another to lend/borrow money for a set period of time.

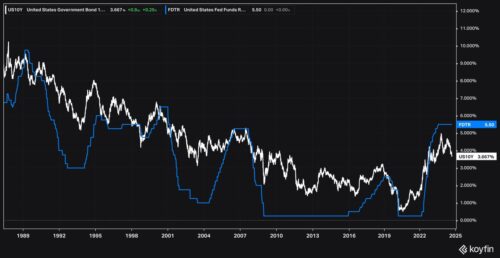

As the chart below shows, the bond market for 10-year bonds (white) is currently pricing in one of the biggest gaps below the stated federal funds rate (blue) for 50 years or more:

Source: Koyfin

Source: Koyfin

That suggests that rates should be coming down imminently, which is exactly what I want to talk to you about today.

The dollar (below in blue) has traditionally been a core asset for most investors who either buy American stocks or bonds. Rising rates (below in white) helped strengthen it as money poured into buying higher yielding US bonds. If you’re getting paid 5% for buying a $100 US bond instead of just 1%, more people are going to want to buy them.

You can see this as the dollar and rates have risen in sync:

Source: Koyfin

Source: Koyfin

So if rates and the dollar continue their correlation, the dollar will weaken against other currencies as rates fall. That makes US products cheaper for foreigners to buy, supporting exports.

There has also been a notable correlation between oil (grey) and the dollar (blue), as per below:

Source: Koyfin

Source: Koyfin

That’s because a weaker US economy means lower inflation, lower rates, and lower demand for oil. They all go together.

Equity markets are very optimistic about falling rates because low rates were so good for asset prices in the 2010s. In a Pavlovian fashion, stocks respond positively to news that suggests rates will be cut. However, it’s very clear that rate-cutting cycles have often turned out to be very bad for stocks, as they tend to be driven by economic weakness, rising unemployment and declining investment.

It’s not for certain, but stock owners should approach the coming months with caution rather than reckless abandon, especially with many global stock markets at or near all-time highs.

To explain, let’s step back a little.

The dollar rules

You see, because of how the world was shaped following WW2, the dollar became the central reserve currency. It’s what all major commodities are priced in, and it is used as the savings or “reserve” currency by most national governments.

This was exacerbated in the late 1990s by the Asian Financial Crisis. Following the collapse of many currencies and stock markets at that time, many foreign nations began accumulating US government bonds so that never again would currency flows out of their country jeopardise their real economies.

They kept their currencies weak, so their goods could be cheaply bought by Americans, thus exporting deflation to the US and other developed nations. This contributed to the low-inflation and low-rate era we have seen for the last 20 years.

Today, people are talking a lot about the size of the US deficit. The US is spending a lot more money than it is bringing in. The eagerness of foreign governments to buy US debt instruments over the last 25 years has allowed this excess spending to occur without problems. The US could spend, and foreign buyers would subsidise it.

However, the move to neutralise Russian dollar reserves following Russia’s invasion of Ukraine – although certainly justified on geopolitical grounds – may have caused some governments to consider alternative reserve assets.

The dollar is central to all this, and the interest rate on dollar bonds is set by one entity: the Federal Reserve.

And this week, the Fed is set to make an important pivot and start cutting rates, having hiked them up above 5% to combat inflation. A small committee of, let’s face it, unelected financiers will reset the price of time.

Inflation has now fallen far below its peak, and very nearly back to the Fed’s 2% target (depending on which exact metric you use).

The Fed was late to hike rates as inflation rose. Now it has waited for inflation (in red) to fall a long way before starting to cut rates (blue) back down:

Source: Koyfin

Source: Koyfin

The Fed is often criticised for being “behind the curve”. That is to say, it reacts too slowly to new data, being so desperate to confirm it’s doing the right thing that it misses the right time, even if the decision ends up being correct. You can see that perfectly in the above chart.

But there’s one final chart I want to show you.

It shows an asset we’re very interested in at the moment at Southbank Investment Research. The chart shows the fed funds rate in grey during the period from 2005 to 2010.

Source: Koyfin

Source: Koyfin

You can see how this asset, in blue, jumped noticeably in three parts. Firstly, as the final rate hike was near. Secondly, when the first cut was happening. And, finally, once rates had fallen to a stable low level.

This shows that investors react very much to the big turning points rather than responding smoothly to new data over time.

It’s the final hike or the first cut that can cause the big swings in this asset’s price.

And that’s why I’m writing to you today. Because it’s looking nigh on inevitable that the Federal Reserve, guardians of the price of time and rate setters for the most important bond market in the world, will make its first pivot to reduce rates since the Covid crisis – today.

The last time this happened, during Covid, this asset shot up by 145% in the space of just a few months. That was, admittedly, a particularly extreme time. But it’s also significant that around the financial crisis, this asset also performed very well around the rate-cutting cycle. So it certainly has form.

This is why I believe today could be the catalyst for another great run-up in price for this asset, and why I want to share our private research with you today.

All the best,

James Allen

Contributing Editor, Fortune & Freedom