Editor’s note: If you haven’t seen this yet, we suggest you take a peek – our top energy expert James Allen has just released a presentation on what he calls the “AI Master Key” – a way to profit from the AI craze without owning a single stock. He believes its catalyst is coming as soon as next week on 17 September – so don’t miss out on this opportunity.

Now on to Bill…

In today’s issue:

- Dishonest money can only goose things in the short run

- Stocks, debt and money are stretched to their limit

- We await the reckoning

The secret, dear reader, is the money itself. Real money comes from output, not from the feds’ printing presses.

As we keep saying, when the money goes, everything goes. So today we wonder why….

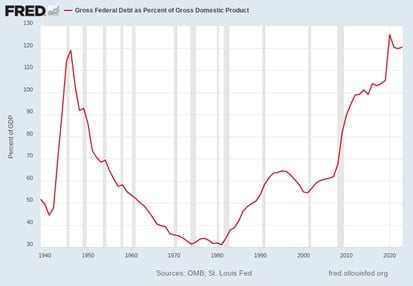

Federal debt was 32% of GDP under Jimmy Carter. Now it is 125% of GDP. So what?

The total value of the stock market (Wilshire 5000) was about 40% of GDP during the Carter years. Now it is almost 200%. Why not?

But it’s not enough just to look at the numbers. The data is meaningless without context. What we are looking for is patterns. And analogies.

If you say, the current market capitalization/GDP ratio is 191%, the number is meaningless… until you add the context. Then you see a pattern. And you can make an analogy.

‘Oh… this is like 1999… or 2021…’

Now you can guess that there may have been things going on back then that are analogous to what is going on now. And at least you can make a plausible forecast about what happens next.

You have a pattern.

Here’s another one. Boy meets girl. Boy falls in love. Boy and girl get married. They have more boys and girls.

How often has that happened? Billions of times.

So, a boy meets a girl today. They fall in love. Will they marry and have children?

We don’t know. But we wouldn’t bet against it.

And stocks? For the last 100 years, the typical stock has sold for between 12 and 15 times its company earnings. Why not 30 times? Or only 2 times? And why does Buffett believe the stock market should worth only about 100% of GDP… and not 200%?

And total debt? It averaged only about 30% of GDP during the Carter years. Today, it is three times as high. What’s wrong with that?

Natural things have natural limits. Tomiko Itooka is the world’s oldest living person. She is only 116 years old. Not 300 years old.

And financial indicators, such as debt and market prices, have their limits too. Because they do not exist in a world of numbers alone. They are part of a system, more like a living thing than a theoretical, numerical notation.

Ultimately, debt, GDP, and prices—all represent real things. And those real things are weighed out, measured, valued… in money.

To make a long story short, in an honest money system, people earn money by providing goods and services (often, labor) to others. So, the more they earn, the more ‘things’ they produce.

Prices tend to be stable. No inflation – neither of consumer prices nor of the stock market. Nor of debt. That’s why price levels in 1913 were not much different from what they were 100 years before.

But wait. People can borrow money in an honest money system too. Can’t they lend too much? Can’t debt still get out of hand?

Unlikely. Because borrowed money comes from savings. And savings must be earned before they can be lent out. So, credit represents goods or services that already exist.

In a dishonest system, on the other hand, the feds ‘print’ more money and lend it out at artificially low interest rates. No additional goods or services are added. Then, prices rise with the increase in the money supply. People who own assets get richer as asset prices rise. People who don’t own assets – in the large, ‘working class’ – get poorer as the things they buy become more expensive. And the whole system gets distorted and enfeebled by false money signals.

Want a financial history of the US from a guy standing on one leg? That was it. The US money system was fairly honest. Then, it became progressively more dishonest in three major steps — the creation of the Fed in 1913, the introduction of fake, credit-based dollars in 1971, and then the Fed’s active manipulation of interest rates, post-1987.

And now, the very rich are richer than ever. Debt is approaching $100 trillion. Stocks have never been more expensive. And we await the reckoning. Already, since 1913, the dollar has lost 98% of its value.

In the years ahead it will lose the rest.

Regards,

![]()

Bill Bonner

Fortune & Freedom

PS Note from Nick Hubble: Over in the UK, we are facing our own reckoning. Keir Starmer has made no secret of Labour’s intentions to increase tax. But what if I told you I’ve got my hands on a document that reveals a plan for the Bank of England to bring in what I’m calling a “secret tax” – one that could take as much as 38% of your wealth. It could come into effect within weeks, which is why over at The Fleet Street Letter we’re sharing how you can prepare before it’s too late. You can find out more over here.