Yesterday’s Fortune & Freedom explored currency resets. We learned what they are, why they matter, and that one may be lurking just around the corner according to the International Monetary Fund (IMF) and World Economic Forum.

But what could actually happen?

Today, we learn from history’s many currency resets to try and predict how things will unfold this time.

There are three big questions which will decide the shape of our coming currency reset.

- Will we return to some sort of asset-backed form of money?

- Will the currency reset be orderly or chaotic?

- Will the global currency system be multipolar or dominated by one nation?

These three questions suggest a variety of different possible outcomes.

For example, the Bretton Woods currency reset, which the IMF’s managing director mentioned we need to do again, took place during the last stages of World War II.

During the war, the international currency and trade system was upended. So Allied nations met to decide what the system would look like after the war.

Britain’s representative John Maynard Keynes argued for a global currency called the bancor. Each bancor would be backed by gold and nations would settle their trade deficits and surpluses in bancors and thereby gold. Within each nation, currencies would be used as before.

But the Americans had other ideas. And won the argument. Thus, the US dollar, backed by gold, became the global reserve currency. Nations traded between each other in US dollars, which were redeemable for gold. They still use US dollars today, but the link to gold is long gone.

Now I don’t think for a minute that another gold-backed US dollar is what IMF managing director Kristalina Georgieva has in mind when she calls for a new Bretton Woods.

Politicians and the leaders of international institutions hate gold because it reins in their power and provides accountability. They like being able to make the rules however they see fit. And to change them. But you can’t change gold.

So, if a currency reset is announced, I expect it’ll be the IMF’s Special Drawing Rights (SDRs) which will be the new global reserve currency. Nations will settle their trade deficits and surpluses in SDRs.

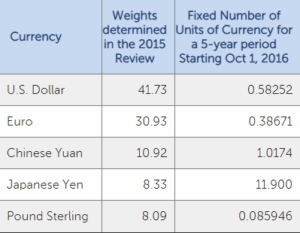

But what are they? Well, one SDR is a mix of other currencies tied into a sack and labelled “1 SDR”. Here are the current SDR currency weights:

Source: IMF

Source: IMF

If SDRs become the new reserve currency as part of a currency reset, it would mean a huge loss of demand and prestige for the US dollar – the current reserve currency.

The game would be about the weights in the SDR sack – how much of each nation’s money becomes part of the global reserve currency.

But this presumes some sort of cooperation between nations – one of our three key questions above. The US was only able to impose the Bretton Woods resolution on the world because of its military and economic might, truly awoken by World War II. US ascendancy came at the expense of Britain, but that’s another story.

This time, the currency reset comes at a very different point in geopolitics. China is ascendant, but the US is far from willing to accept this. They are not allies like Britain and the US were. The world is much more multipolar too. All this suggests a currency reset might not be so coordinated or cooperative this time around.

Should nations fail to agree on a new global reserve currency, they have two options. An asset like gold, which can work independent of a global rules-based system because nations are willing to accept payment in gold. Or a few different economic regions of the world operating under a few different reserve currencies.

That’s sort of what did happen after Bretton Woods too. The Soviet Union had its Transfer Rouble to settle international trade between its nations and satellite nations. This operated apart from the US’ international system of US dollars, of course.

But China’s ascendancy is very different to the Soviet Union’s. It is integrated in trade whereas the Soviet Union was isolationist. Global trade will have to continue somehow. The question is which currency system it does so under.

Lately, central banks have been discussing using a cryptocurrency type of system as a global reserve. The reason is simple. Cryptocurrencies are hard for any particular nation to manipulate. By their very nature, they are decentralised, so they are independent of any institutions. This means that the Chinese and American government might both be willing to trust such a system. It can’t be manipulated for one nation’s gains. A bit like gold.

If all of this strikes you as vague or ambiguous, consider that the questions being raised are already being answered by some nations. Iran, for example, is locked out of the US dollar using international currency system by sanctions. So it pays for trade in oil or gold. Venezuela too.

Their examples show how, when the international system breaks down, nations turn to something of objective value.

So, what’ll it be in the next currency reset?

Well, SDRs strike me as what politicians and institutions favour. Of course, they’ll rename SDRs – perhaps Keynes’ bancor will make a comeback.

But the question is whether Western nations will manage to get China to agree to participate or not. If not, the Chinese could launch their own system or demand trade is settled in oil or gold. This would call out the West’s fiat currencies too, because investors and traders would have a choice between something of objective value, or something controlled by the IMF and US. Not everyone wants their ability to pay for trade hinging on the US’ approval.

How should investors react to all this uncertainty? Well, gold benefits from uncertainty. As do gold miners. Especially if there’s a chance nations will turn to gold in a crisis.

Owning debt that’s at risk of being cancelled under the currency reset is also dangerous. That’s what the IMF’s managing director spoke about. And, as Nigel messaged me yesterday in response to my article, “The vast levels of debt built up before and during this crisis will, I believe, lead to debt cancellation. Private investors need to be alert to this.”

Which debts?

Not yours, of course. You’ll still have to pay up.

We’re talking government debt, for the most part. The bonds that are likely in your pension fund, not to mention your bank owning them.

Just as in Greece, governments will come to some arrangement to default on their government debt. It won’t be called that. It’ll be called a Great Reset. That’s what the World Economic Forum is already calling it…

Nick Hubble

Editor, Fortune & Freedom