- “Inflation is taxation without legislation”

- You’ve seen this used before

- Why inflation had to rise out of control… on purpose

What if central banks and governments deliberately unleashed inflation? A false flag financial attack on your standard of living designed to reinflate the government’s own finances, at your expense.

It sounds extreme. But back in July of 2020 I predicted a spurt of inflation would be unleashed for precisely that reason.

Yesterday I republished the first half of that prediction, which set the scene for the inflation we saw – how it would happen. We also discussed a certain Australian bull’s testicles, so don’t skip reading part 1…

Today, as I did in 2020, I reveal the motive for the inflationary crime committed against you. Why the government and central bank conspired to devalue your savings, income and investments….

***

Inflation is the only way out of this much debt

You might’ve heard that government debt is now at levels comparable to WWII – an impossible level.

But we did pay off the war debt.

And so, that just begs the question – how did we pay it down? And therein, as the bard would put it, lies the rub.

Now, I don’t think the following renowned economists (and politicians) could agree on anything other than inflation. So, notice just how congruent their claims are…

By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.

– John Maynard KeynesThere are only three ways to meet the unpaid bills of a nation. The first is taxation. The second is repudiation. The third is inflation.

– Herbert HooverIt is a way to take people’s wealth from them without having to openly raise taxes. Inflation is the most universal tax of all.

– Thomas SowellInflation is taxation without legislation

– Milton FriedmanI do not think it is an exaggeration to say history is largely a history of inflation, usually inflations engineered by governments for the gain of governments.

– Friedrich August von HayekAvoiding inflation is not an absolute imperative but rather is one of a number of conflicting goals that we must pursue and that we may often have to compromise.

– Paul Samuelson

The last quote from Samuelson is key. Given the level of debt we now find ourselves in, only partly due to Covid-19, central bankers face a choice between helping to engineer inflation, or letting their governments go bust. Which do you think they’ll choose?

The book Lords of Finance by Liaquat Ahamed explains the dilemma a central banker faces in times of excess government debt. Ahamed uses the Weimar Republic’s “independent” central banker Rudolf von Havenstein as the example:

Von Havenstein faced a real dilemma. Were he to refuse to print the money necessary to finance the [government] deficit, he risked causing a sharp rise in interest rates as the government scrambled to borrow from every source. The mass unemployment that would ensue, he believed, would bring on a domestic economic and political crisis, which in Germany’s current fragile state might precipitate a real political convulsion. As the prominent Hamburg banker Max Warburg, a member of the Reichsbank’s board of directors, put it, the dilemma was ‘whether one wished to stop the inflation and trigger the revolution’, or continue to print money. Loyal servant of the state that he was, von Havenstein had no wish to destroy the last vestiges of the old order.

Funny how little has changed. We’re right back where Rudolf was today, as the Bank of England governor Andrew Bailey admitted to the Guardian recently:

Britain came close to effective insolvency at the onset of the coronavirus crisis as financial markets plunged into turmoil, the governor of the Bank of England has said.

Laying bare the scale of the national emergency at the early stages of the pandemic, Andrew Bailey said the government would have struggled to finance the running of the country without support from the central bank.

Rudolf von Havenstein was a lawyer, not an economist, by the way. As is the ECB’s new leader Christine Lagarde. As is Chairman of the Federal Reserve Jerome Powell….

The reason why central bank independence is so crucial is for precisely this scenario. To keep low inflation as the priority, above financing the government, even if it may go bust. But we have lost both central bank independence and the goal of low inflation. Keeping the government functioning is now the top goal of central banks.

But perhaps I’m preaching to the converted. After all,…

You’ve seen all this before

Many of you experienced the challenge of paying down Britain’s war debts with inflation in the 60s and 70s. Given I expect history to repeat, I thought it might be a good idea to hear from readers about that period.

Here’s some of what readers sent in when I asked them to recall it. They certainly make the issue come alive…

Surely big government debts are paid off by inflation.

I was born in 1943 and for the next two or three decades I remember my father wondering when he would be repaid his ‘post war credits’, which I believed was money confiscated during The War, with an undated IOU in return. At first he believed he was due a significant sum, but such hopes gradually dwindled to be replaced by an aggrieved ridicule.

I think he was finally repaid in the 70s (?) by which time a once useful sum had shrunk to be enough to half-fill a supermarket trolley. Isn’t that what’s going to happen now ?

I think it is. With government bonds as the “post war credits” of the day.

The next email put on display most of the points I think you should keep in mind about inflation. The value of your money overseas falls. There is economic chaos which results in falling living standards. Asset prices boom and household debt is inflated away. And the people who rely on income from their investments become poor:

You asked for memories of those who can remember the sixties. Born in 1953 my two sixties economic recollections are of Harold Wilson’s ‘Pound in your pocket’ broadcast after devaluation (because my parents were seething) and the slogan ‘export or die’ (I don’t think we did either).

The first part of the seventies was university and job training from which my most vivid memory is trying to study by candlelight during the miners’ strike, giving up and going to the pub by candlelight. Not romantic, more Dickensian. A pint in the student bar was 10p when I started, 25p when I graduated. I entered the world of paid employment about the time Denis Healy trotted off to the IMF for a loan.

A few years later in 1980 I bought my first house after scraping together the deposit and getting a max 2.5 times salary mortgage. I think the interest rate was 15%, so the first year was tight. This was a time of double digit pay rises and inflation, so after a few years my mortgage payments weren’t so big, and I could move up the housing ladder. I did this a couple more times and was able to do it without any significant promotion. So folks, if you wonder how us boomers got to live in nice houses, it’s inflation wot done it not tax cuts or promotion. I suspect inflation also reduced the government debt/GDP ratio at the same time.

During this period I witnessed my grandparents on fixed pensions go from comfortable to poor, which, in retirement is one reason I fear inflation.

As you should. You saw what it did to people living off their investments back then.

This reader mail highlighted how inflation feels good for some, but robs others:

I now think dad was right, debt is bad but young people love inflation because it inflates away debt. I didn’t understand all this while it was happening but managed to make enough money in the 80s, 90s and naughties by buying, developing and selling property. Riding the property inflation wave in other words. I’m now debt free but had to pass some of the property down a generation because I realised that if I left it for them as inheritance they could never pay the tax. Phew! What a relief but now I’m scared inflation will take off again and my pension funds will be whittled away so I’m frantically learning about investing from Southbank and Money Week.

Capital controls like these are also common in periods when governments try to pay off their debts with inflation:

[In 1968] Four of us decided to skip graduation and go to the Olympics in Mexico but the Harold Wilson government had run up such debts that we had to get a loan from the International Monetary Fund and there were controls on the amount of money you could take out of the country, £50. So we realised that we would have to go a few months early and earn some money in Canada to get us by in Mexico. We pre bought tickets for just about every day then three weeks before we were due to leave dear Harold announced that any pre bought tickets had to come out of the £50. So theoretically we had £15 each and a few quid in our socks.

I think there are several things we can learn from reader emails like these. During periods of high inflation:

- Living standards struggle as prices go up

- Inflation results in a redistribution of wealth from savers and investors to borrowers and the government

- Asset prices boom, but not adjusted for inflation

- Capital controls are imposed

- Those living off their savings and investments struggle

It’s also important to note that inflation itself is only half the danger to you and your wealth. Its twin, known as financial repression, is what makes inflation so dangerous when governments are using it to pay off their debts. Let’s dig into that now.

Repressing the interest rate

This month’s issue of The Fleet Street Letter Monthly Alert doesn’t just predict high inflation. Something far more insidious and nefarious is going to happen to investors specifically. It’s called financial repression.

In a nutshell, financial repression means that interest rates will be kept below inflation rates. That probably sounds a bit melodramatic, but it turns the monetary system and financial markets into quicksand. Explaining why requires a comparison to what is supposed to happen as inflation rises.

When inflation rises, interest rates tend to rise too. Central banks raise them to nip inflation in the bud. And investors require higher interest rates to compensate them for inflation – particularly in bonds. New Yorker journalist James Surowiecki explained this nicely: “if investors believe that inflation is going to get out of control, you end up with higher interest rates and capital flight, and a vicious circle quickly ensues.”

The ability of interest rates to rise is what makes inflating away debt so hard. Interest rates simply rise to adjust for the inflation, leaving borrowers with a whopping interest bill that should cancel out any gains from inflating away their debts. Or people can flee the currency itself, as they do in places like Argentina and Zimbabwe, which need capital controls to stop them. The reader’s experience above, about getting his £50 out of Britain, is an example of this.

Higher interest rates protect savers and investors by increasing returns to adjust for the higher inflation. But what if investors are not allowed to escape bonds, or the pound? And central banks allow inflation to surge without raising interest rates?

That is financial repression. And it is how governments inflate away debt.

Why inflation must get out of control, on purpose

Remember, inflation is like tomato sauce. You shake the bottle and nothing happens; you hit the bottom of the bottle and still nothing happens; you hit it even harder – and you ruin your shirt!

– Southbank Investment Daily reader

Russell Napier calls it, “Stealing money from old people, slowly”. Because the return on bonds is lower than the losses from inflation. This is known as “negative real rates”, meaning that once you adjust for inflation, interest rates are negative. Investors who think they’re making money are really losing purchasing power.

Financial repression is what makes inflating away government debt possible. But it leaves the investing and saving classes bearing the losses in (badly) hidden ways. Back to that in a moment.

It’s important to note that, in this environment, inflation can go out of control very quickly. With central banks deliberately refraining from their responsibility to rein in inflation, because inflating away the government’s debt is considered more important, inflation is allowed to surge.

Of course, none of this is theoretical. It’s what happened in the UK in the 60s and 70s.

And it has already begun in Europe, with negative real rates on government bonds. In other words, inflation is higher than what government bond investors earn in interest. Governments are already inflating away their debts, just at incredibly low rates of inflation. So far, they’re stealing money from old people, very slowly.

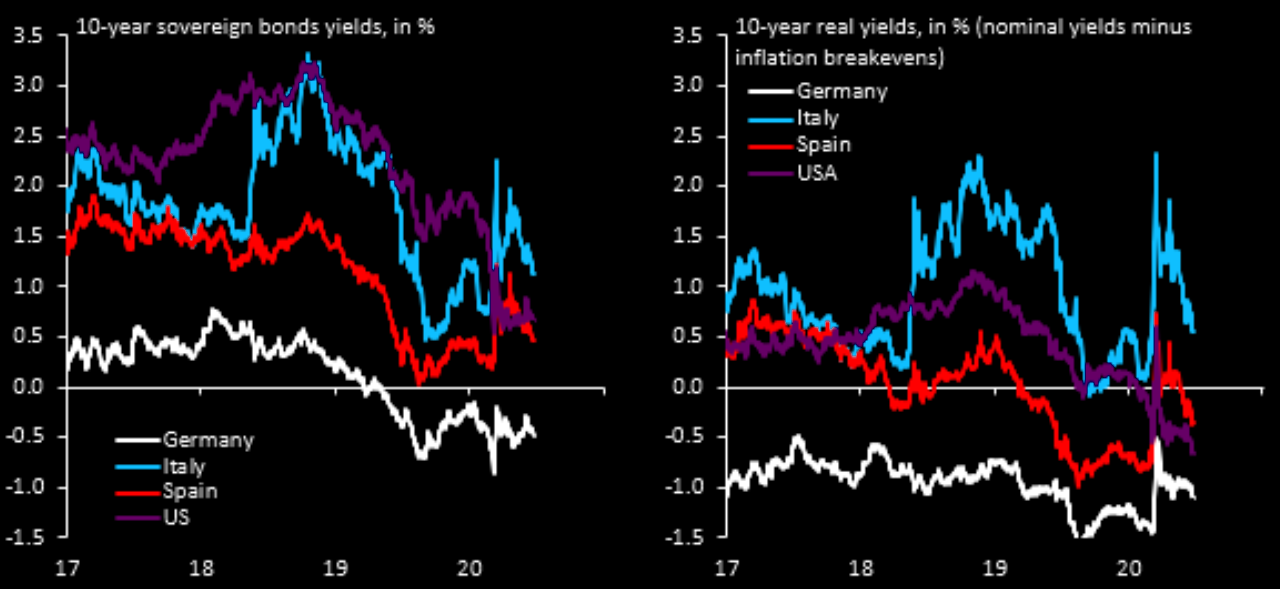

This chart shows how interest rates on government bonds are very low, on the left. But, adjusted for inflation, on the right, they’re negative.

Holding bonds during a reflation will be financially devastating. Although inflation-protected bonds may offer some reprieve.

But back to stocks. Warren Buffett wasn’t the only one who understood how inflation swindles the equity investor. But J.M. Keynes was a little blunter about it…

Slaughter of the capitalist pigs (also known as investors)

There’s a sophisticated way of explaining why shareholders will be especially badly hit by inflation, again. It is by design. A design first laid out back in 1932, if not before.

In the world of economics as politicians, central bankers and J.M. Keynes see it, capital is money. And money can be printed. Which means that money printing creates capital.

And this solves many “problems” our economy faces. One such “problem” being the income you earn from your shares and bonds in your capacity as an evil lazy capitalist, believe it or not.

Now there’s a simple flaw in Keynes’ thinking. Money and capital are not the same thing. Capital is really foregone consumption – savings. It is the decision to spend your time building a ladder instead of picking cherries, thereby enhancing your ability to pick more cherries more efficiently in the future.

In other words, creating capital is not free. It involves saving and forgoing consumption first. And it involves investing those savings wisely. Using up time to make an axe will not enhance your ability to get cherries for long…

But, as Keynes saw it, such savings and foregone consumption are not necessary to create capital. Ladders and axes can be printed out of thin air, in Keynes’ models. And, he predicted, when the world figures this out, it will simply print enough money to provide the capital we need.

In such a world, where capital is free, the people who save money and have capital will no longer be needed. Nor will they be rewarded for saving and investing. And that will be the end of the line for those people living off their income from capital – past savings and present investments.

How inflation will euthanize the rentier (that’s you)

When I say “end of the line”, I’m being polite. Keynes’ word was “euthanise”.

And he was talking about today’s shareholders, pensioners and investors when he used the word “rentiers”. People who live off their investments or plan to in retirement. Keynes called them things like “idle classes” and “rentiers”, because they were living off economic “rent” without having to earn that income the hard way, by working.

He called the gradual realisation that capital was in fact free “the euthanasia of the rentier” in his book The General Theory:

It will be, moreover, a great advantage of the order of events which I am advocating, that the euthanasia of the rentier, of the functionless investor, will be nothing sudden, merely a gradual but prolonged continuance of what we have seen recently in Great Britain, and will need no revolution.

– John Maynard Keynes, The General Theory of Employment, Interest, and Money (1936), .VI.24.ii.)

The fact that Keynes was wrong doesn’t matter for our purposes today. Rentiers will still be euthanised as central bankers print “capital”, leading to inflation instead of prosperity. The hard-earned money you saved and invested will be rendered worth less, or worthless, by the printing of more money. The returns you make will be inflated away, and then their capital gains taxed to add insult to injury.

***

That monthly issue of The Fleet Street Letter went on to describe how investors could protect themselves from the inflation and financial repression to come. But that sort of thing is for subscribers’ eyes only…

Until next time,

Nick Hubble

Editor, Fortune & Freedom