I’ve received feedback on my piece about bank bail-ins and depositor protection. It was sent on 22 October 2020 and called “The Reverse Bank Robbery“.

In my piece I discussed bank bail-ins and what it could mean for you.

So, today, we’re going to dig into all that. But first, I have to set something straight. The feedback called me out on some of my facts in the piece – the key points being the risk of a bail-in happening (it’s remote) and the amount in accounts that is protected (in some circumstances it’s more than the £85,000 I mentioned).

I took a fresh look at the article, along with ones I had written earlier on the same subject – “Account blocked, money taken, retirement plans postponed” and “Who really controls your money?” and I want to take this opportunity to correct and clarify some mistakes and omissions in the articles.

Let’s do a quick reminder on the topic to start.

A bank bail-in is when money that is owed by the bank to other people is used to rescue a bank. Unlike in a bail-out, that money doesn’t come from the government. Instead, it comes from people the bank owes money to.

This is a long list of people. On that list of people is depositors. They’re at the bottom of that list, in fact, meaning their money gets used last, if at all.

So, while it is correct to say that depositors’ money is at risk in a bail-in, the level of losses for the bank would have to be very high before depositors are at risk of being caught up in the bail-in.

The Special Resolution Regime gives five different options, of which the bail-in is only one.

Over the past decade and more, bank regulators have been requiring banks to add to the buffers which keep depositors safer from a bank bail-in. These buffers come in several shapes and sizes. They are designed to protect depositors.

Whose money is used in a bank bail-in?

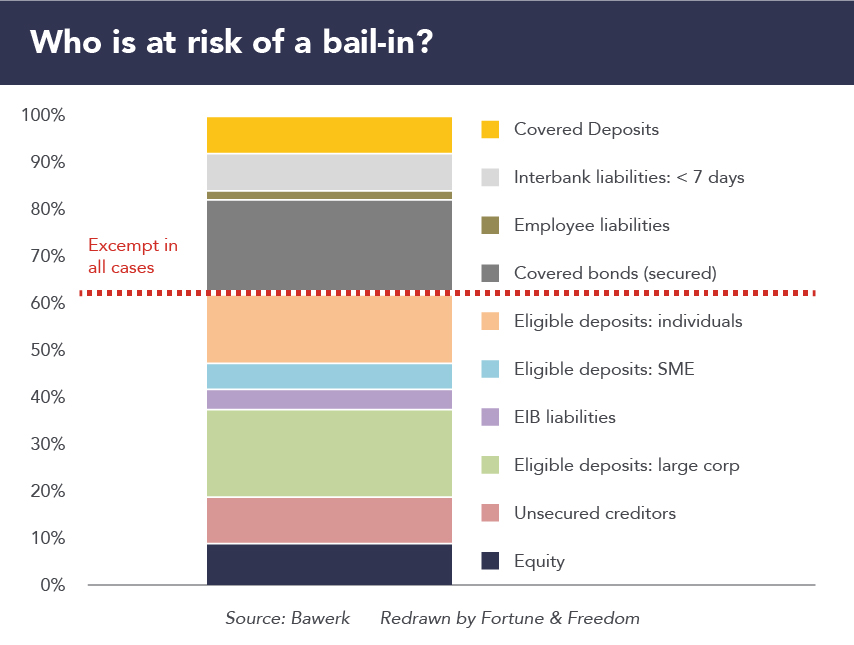

This chart from the blog Bawerk is the best I could find to show the hierarchy of who can lose out in a bank bail-in.

At the top, we have those entirely exempt from the bail-in. That’s “protected deposits” (generally up to £85,000 per person per bank in the UK, but in some cases more as we’ll get to, and in this chart referred to as “covered deposits”), short term debts owed to other banks, debts owed to bank employees and bank bonds that are secured – meaning the bank has pledged collateral, just as you pledge your house in a mortgage loan.

These are safe from the bail-in. As the rules stand, no matter what.

Those at risk start from the bottom of the chart. That’s important because those in the middle are only at risk once those at the bottom have their claims bailed in.

The first people to be affected in a bail-in are the shareholders of the bank. They stand to lose the value of their investment. Bank shareholders should take note of this.

Next up are the banks’ unsecured creditors, then large company deposits, then European Investment Bank liabilities, then small and medium sized company deposits and then, and only then, retail customers’ deposits.

This means a large amount of losses would have to occur for the bail-in to affect depositors. And an increasingly large amount given the government policy of adding to other forms of buffers. I won’t detail that here though.

What happens to depositors’ money?

The reality is that money over and above the “protected deposit” amount is not in fact simply taken by the bank. It is converted into shares in the newly reformed bank.

This is what helps save the bank. It used to owe money to depositors and other creditors. After the bail-in, those people own shares in the bank instead. The banks’ debts become equity. It owes less and its ownership changes.

While this would almost certainly involve a large loss of value for depositors, it’s not an outright and simple confiscation. It’s a conversion.

Why bail-in at all?

The key point of a bank bail-in is to rescue a bank which is putting the rest of the financial system at risk. It therefore seeks to minimise damage spreading, and therefore risk to everyone else in the financial system.

Because of this, not all banks are subject to bank bail-ins. Only systemically important ones, meaning they’re large enough to pose a risk to the entire system should they fail.

This also explains why a bank need only be at risk of failing for the bail-in to come into play. The Bank of England wants to be able to act proactively to prevent contagion, if it needs to. It doesn’t want to wait for the bank to technically fail.

But what about building societies? Well, the government’s guide to the bail-in powers implementation specifies that, “[t]he bail-in stabilisation option provides a new option through which the Bank of England will be able to resolve failing (or likely to fail) banks, building societies and investment firms[…]”

But don’t forget, only systemically important ones, meaning they risk causing contagion.

Important guarantees should a bail-in occur

And how does the deposit guarantee work in a bail-in?

The Financial Services Compensation Scheme (FSCS) website is clear about this, and this is an area that my original article didn’t cover properly:

If you hold money with a UK-authorised bank, building society or credit union that fails, we’ll automatically compensate you.

- up to £85,000 per eligible person, per bank, building society or credit union.

- up to £170,000 for joint accounts.

We protect certain qualifying temporary high balances up to £1 million for up to twelve months from when the amount was first deposited.

In my original article about bail-ins, I didn’t explain the protections for temporarily high deposits. That’s especially relevant for the examples I gave too, like selling a home and solicitors’ accounts. These would be included, depending on how much was in the account and how long you held the deposits there.

The lesson is similar – you need to be aware that there is more at stake with large balances at the bank especially if you are holding them in an account for more than a year. But sums of up to £1m in certain circumstances (and you should check here to ensure the protection applies to your funds) will be guaranteed for a year thanks to this support for temporary high balances.

This is doubly relevant because it means the past examples I gave of those caught up in bank bail-ins in Cyprus would not fare as badly in the UK today.

The examples I gave in my earlier articles happened to Brits back in 2013 in Cyprus and under Cypriot law, not in the UK. The bail-in legislation and the guarantees which minimise the risk to depositors were brought in as a reaction to what happened in Cyprus.

On a point of detail, whilst the UK’s Special Resolution Regime was initially implemented in 2009, and bail-ins now come under that legislation, bail-ins specifically did not become part of the UK framework until 2013. They were added in as another option for the Bank of England.

Easy ways to protect yourself and your money

I suspect you are wondering what does all this really mean for you?

Well, being aware of a threat, however remote, is worth it. That threat could become more relevant to your life at some point in the future, as unlikely as it may be that another banking crisis happens.

Examining the topic in this level of detail also helps identify ways of minimising the risk further. For example, the deposit guarantee applies per person, per banking license. That sounds odd, but the FSCS’s website helps explain how it might matter a lot:

Where you hold your money could affect how much compensation you’re entitled to. If you have money in multiple accounts with banks that are part of the same banking group (and share a banking licence) we have to treat them as one bank. This means that our compensation limit applies to the total amount you hold across all these accounts, not to each separate account.

If you open another bank account to double your protection under the FSCS, you need to make sure it operates under a separate banking license.

Another point to be aware of is the risk of holding large balances of cash in your account for long periods. If you fear a crash in property and stocks, for example, you might do so, mistakenly thinking that your money is 100% safe in the bank.

Unfortunately, there is the threat – albeit a small one – of the bank failing. And, should this happen, some of your deposits could be part of the bail-in. Depending on the size of losses and other factors just discussed. But having more than one account, with your money spread across different banking groups will give you added protection.

Any change to these levels of protection will not happen overnight – investors will have a chance to react.

What’s more important than a theoretical discussion of bank bail-ins is to have an overall diversification plan. It is a prudent idea to hold a small portion of your wealth in cash, and in other assets such as real estate and precious metals…. And it’s always smart to diversify early…well before a crisis begins.

Historically, the best way of doing so is to invest a small part of your wealth in physical gold, like bullion or gold coins. That’s because this is the original way of opting out of the banking system, as our discussion about the nature of money explained.

To be clear, we are all for a holding good stocks spread across different sectors – but holding a small percentage of your wealth in non-financial assets is the definition of true diversification. And the remote threat of a bank bail-in is just one of many reasons why it’s a good idea to diversify in this way.

Nick Hubble

Editor, Fortune & Freedom

PS: I always enjoy receiving your emails…so please keep sharing your thoughts, ideas and discoveries with me at [email protected]