- A $72,000, 15-year prophecy

- Some people trust banks… I trust code

- BlackRock woke up and smelt coffee

On 3 January 2009, Satoshi Nakamoto launched the bitcoin network at 18:15:05 UTC, changing the world forever.

And when Satoshi mined the genesis block – that is, the first block of bitcoin ever mined – he encoded a message onto it.

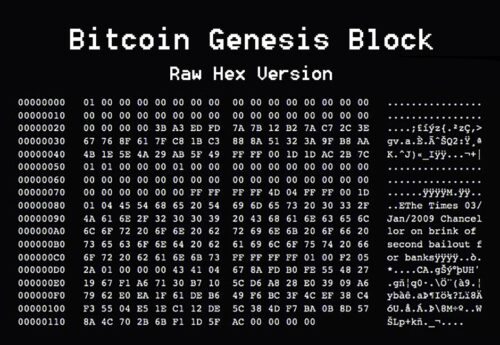

The genesis block’s message reads:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

You can see that here, just off to the right-hand side..

Many see this as a prophecy for what bitcoin and cryptocurrency would become. For me it’s very much the essence of what bitcoin is all about, and the history it was built from.

Fundamentally, it is a rival to the legacy financial system.

One that rises alongside it, in parallel, and then eventually over time, eclipses it.

January 2009 is now over 15 years ago. It seems like a long time, but it is nothing really. Not when you compare it to the 5,000-or-so-year head start traditional “money” has on it.

If the age of money as we know it today was the equivalent of an hour on a clock, bitcoin would be roughly ten seconds old. That’s how early we are.

What’s most exciting though is that while we’re still so early in this, the potential value that’s still there up for grabs is far more than I believe most people can conceive.

And in about two weeks’ time, everything the bitcoin and crypto markets currently stand for is about to radically change, again. Which means if you’re prepared and switched on to what’s happening, there could be serious profits up for grabs.

To understand how serious, you do need a grounding in why bitcoin exploded into the world, and what’s coming in two weeks that could set the market alight again.

Trust in code

You see, when the Satoshi mined the genesis block it was in the immediate aftermath of the 2008 financial crisis.

Central bankers had cranked rates to near-zero for the first time. And embarked on the first round of quantitative easing (QE). The US Federal Reserve bought $1.725 trillion worth of assets with money created out of thin air.

To put that into perspective, with the press of a button, the Fed added more money to its balance sheet than all of the physical USD in existence in 2008.

At the time, the powers that be insisted these were temporary measures.

They were not.

The money printing barely ever stopped.

As you can see from the chart below, ten years later in 2018, the Fed balance sheet had ballooned to $4.4 trillion. (We’ll get to that vertical leap in 2020 in just a second.)

Now, let me ask you a question.

When central bankers are manipulating a system on such a grand scale, what does it do to the people who use that system?

They lose trust in it. And eventually, they move to another one.

And it was in 2008, when the Fed embarked on its first round of QE that the door opened for the rise of an alternative financial system.

Because where the fiat money system is characterised by debt, bailouts and blind faith in those that control it, bitcoin and cryptocurrency is its complete antithesis.

It’s corruption proof. Inflation proof. And trust in it is based on its immutable, unchangeable code.

Given this, it’s no wonder that during this era of extreme manipulation and money printing, the crypto-led financial system has soared in popularity.

In 2009 bitcoin was worth just $0.0024. At the time of writing it’s hovering over $72,000. That’s a gain of 2,900,000,000%.

And just when we thought the scale of central bankers’ manipulation couldn’t get any worse… they went and put the 2008 crisis to shame.

In January 2020 the total money supply in the US totalled $15.38 trillion. By January 2022, that number had soared to $21.55 trillion. That’s a 40% rise in money supply in two years.

In addition to this, government debt was escalating at a pace unheard of in the last 100 years.

US national debt was already high in 2008 at around $14 trillion. By 2019 that had ballooned to $27 trillion. It now stands at over $33 trillion.

In fact, as Covid-19 was cutting the global economy to its knees, the US Fed said it would embark on a programme where it would purchase an “unlimited” number of Treasuries and mortgage-backed securities to support the financial system.

In other words, Infinite QE.

The build-out is happening now

Now, I’m not positing that the legacy financial system is going to be on its knees tomorrow. But it’s fair to say, that with this much spiralling debt, inflation continuing to be way above historic levels and a major burden on savers and investors, and the threat of even more money printing down the track… things don’t look great.

But as far as making money from this situation, that doesn’t even matter.

Because with every cent, pound and peso that central bankers create out of nowhere, it gives greater credence to the crypto-led system.

It’s not quite like it used to be, but I know that some people still think the idea of bitcoin and cryptocurrency is a crazy, fringe idea. But you need to wake up and smell the coffee because the signs are there right now that the future of finance is deeply entrenched in bitcoin and crypto.

The build-out of the crypto-led system is happening. And it’s happening now.

- The launch of bitcoin exchange-traded funds (ETFs) in the US has led to the most successful and fastest growing ETFs in history.

- BlackRock, the world’s largest wealth manager, is now setting up tokenised asset funds. Larry Fink (CEO) has said the future of all real-world assets (RWAs) is tokenised – that means stocks, money, bonds, all kinds of financial instruments.

- The UK has finally come around to opening the gates to get in on the action with approval now in the works for bitcoin and crypto exchange-traded notes (ETNs) to begin listing and trading on the London Stock Exchange.

Now, I could talk to you for several hours about the developments and advancements happening in the crypto sphere. After all, this has been going on for the better part of the last decade.

But in my experience, you either get it or you don’t.

That is, you either understand that this is the biggest shift in monetary history since William III put such great power into the hands of central bankers with the formation of the Bank of England…

… or you can’t see that change. You’re adverse to it – despite it being in front of your eyes.

In my mind you’re missing out on the greatest financial opportunity of our lifetime.

As I said, this rise of the crypto-led system – ultimately soaring above that and eclipsing the legacy system – is something that you must give attention to.

And you’ll be hearing from me more this week about it all.

What we’re now seeing come to fruition is a future that I’ve been writing about for over a decade. And from my view, I see it as the fulfilling of Satoshi Nakamoto’s prophecy when he mined the genesis block.

Make sure to keep an eye out for what’s coming in the next few days. I’ll explain more about why now is the time to strike this moment, and how sometimes the story isn’t all just about bitcoin.

Sam Volkering

Contributing Editor, Fortune & Freedom