“So, that’s the end of Bitcoin then…”

That’s how a Forbes magazine article from 2011 started.

It began a grand tradition of the mainstream, writing bitcoin off. There’s nothing the media love to do more than lash out at the cryptocurrency.

They keep kicking it. But, so far, it just won’t die.

Here’s how that article continued:

No, that doesn’t necessarily mean the end of the Bitcoin experiment, but it’s a pretty good indication of it. For there are certain things that we want from a currency. A medium of exchange, a store of value, we’d also like to it be liquid and security is important as well.

No currency can have all of these features (and humans have used some pretty odd things as currency over the centuries, from copper sheets to cowrie shells via butter, salt, gold, silver and even pieces of paper with Dead Presidents on them, surely the final lunacy?) to perfection but a currency which doesn’t have any of them in appreciable quantities isn’t going to last very long.

The price of bitcoin back then?

$15.

It now trades above $40,000, having hit an all-time high of around $70,000 last year.

So, that wasn’t the end of bitcoin then, was it?

We’re 13 years into the experiment and, so far, all the naysayers have been wrong.

And not just a little wrong, either.

The bitcoin bashers – and there are plenty of them – have been on the wrong side of one of the great financial trends in modern human history.

There’s a fantastic website that tracks so-called “Bitcoin Obituaries”. There have been more than 440 of them since the cryptocurrency was created, and from the great and good of the financial world, too.

Every single one has been wrong.

I’ll give you a few of my favourites. Let’s skip forward to 2015, a vintage year for wrong-headed bitcoin bashing.

That’s when Jamie Dimon, CEO of JP Morgan, got in on the act:

Bitcoin will not survive… this is my personal opinion, there will be no real, non-controlled currency in the world. There is no government that’s going to put up with it for long … there will be no currency that gets around government controls.

The price then was… wait for it… $395.

So we’ve seen the price increase roughly 100-fold since then.

Or what about the chairman of UBS?

He claimed that bitcoin would not succeed as “private currencies will fail to take off because there is no lender of last resort – there will always be boom and bust”.

And how about our friends at The Guardian? In 2015, the paper claimed that bitcoin was “embarrassing”:

Spare a thought for the companies scrabbling to jump off the bitcoin ship before it sinks.

The currency’s value has been static for months (except for a brief boom and bust in early November when it was caught up in a Chinese ponzi scheme), but perhaps more damningly still, the hype has all but disappeared.

The hype has disappeared? Now that is about as stupid a thing as you’ll ever see published.

(The price of bitcoin back then was $318, by the way.)

Let’s fast forward to 2020, and a Seeking Alpha takedown. The price at this point was $22,805:

Bitcoin is fundamentally worthless. Sometimes there’s something so absurd that you hardly know where to begin to make the argument, for it’s so obvious and self evident that it should not have to be explained. Bitcoin and similar cryptocurrencies are such a case.

The price had tripled within a year of that piece.

Not so worthless, after all.

So, what’s going on?

What is it that makes so many mainstream pundits hate bitcoin so much?

And why have they all been so wrong so far?

Well, it’s a story as old as time. And one I’m intimately familiar with…

First, they ignore you.

Then they laugh at you.

Then they fight you.

Then you win.

That’s just how it works. The really important ideas emerge on the fringes. They’re out in the cold: ignored, unloved, despised. But they don’t stay on the fringes for long.

That was the case with Brexit. And it has certainly been the case with bitcoin.

When the cryptocurrency first emerged in 2009, it was the kind of thing only geeks and nerds would care about.

But today, it has found its way to the very heart of the financial system.

Of course, the powers that be have fought it every step of the way. But many of them have eventually fallen in line:

- Warren Buffett once called bitcoin “rat poison”. Then his firm spent a billion dollars on a crypto-focused fintech firm this year.

- In 2017, JP Morgan’s CEO threatened to sack any of the firm’s employees trading in bitcoin. Now the bank offers crypto services to retail investors.

- Goldman Sachs called it “a vehicle for fraudsters” in 2017. Now the company has a whole crypto trading desk.

|

And that’s really been the story here. Bitcoin is up a staggering six billion per cent since 2009, driven by staggering real-world adoption.

And when I say staggering, I’m not exaggerating.

Today, more than 300 million people the world over have chosen to invest their money in cryptocurrencies.

Cryptocurrencies have been adopted by huge companies such as Apple, Tesla, Microsoft, and even titans of the “old money” world such Goldman Sachs and JP Morgan.

Whole countries – including Britain, Europe, and the United States – have begun to explore making crypto part of their money systems.

They ignored it… laughed at it… fought it…

But bitcoin won.

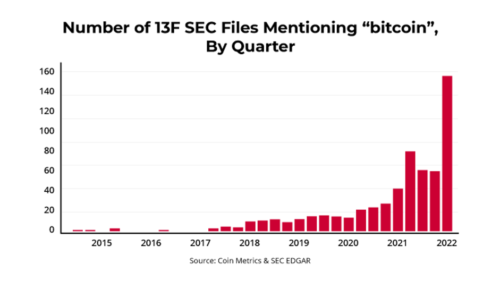

And the likes of Apple and Tesla are just the tip of the iceberg. Take a look at the number of SEC filings in the United States mentioning “bitcoin”.

And there’s more to come – another wave of adoption that could send prices even higher.

- Amazon could be next. Jeff Bezos has personally instructed the company to accept payment from digital currencies.

- Bitcoin could be made legal tender in the United States before the end of the year in either Arizona or Texas.

- And you’re going to hear much more about powerful people putting money into crypto. The average wealthy family office already has 1% of its capital in cryptocurrencies.

The question is… what can you do about any of this?

Everyone knows that cryptocurrencies are high risk. They’re also high potential reward. Perhaps now is the time to start seriously considering making cryptocurrencies part of your long-term plans.

This is why I have invited Sam Volkering to join me at UK Independent Wealth. Find out what we’re up to, here.

Until next time,

Nigel Farage

Founder, Fortune & Freedom