In today’s issue:

- The market rebellion against the Fed

- Why the Trump factor matters more than the economy

- The quiet winner from the macro and Super Micro

Very curious things are happening in the market.

Things are diverging, surprising, breaking and moving in unusual ways.

It all started two months ago.

The US central bank, the Federal Reserve, moved to begin cutting interest rates with a double cut of 0.5%. It also signalled further interest rate cuts would be coming, as inflation was now clearly coming under control, and the risks to the economy were rising in importance.

Historically, the Fed has always reacted to inflation late, making it slow to raise rates, and it’s also historically been slow to spot economic weakness, making it late to cut rates.

It has other tools, but the level it sets rates at is the most clearly watched and communicated, as it dictates what financial historian and journalist Edward Chancellor called the price of time.

The Fed chose a dramatic double rate cut to open its account for 2024, and even more unusually, bond markets have reacted by. starting a steady month-long rise?

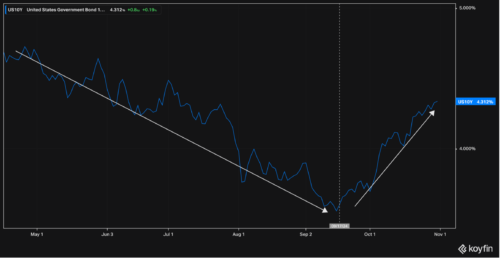

The US 10-year yield, the most watched in global markets, has rebounded sharply from 3.6% and a clear downtrend, back up to 4.3% in a matter of weeks. The Fed announcement is marked in the chart below by the vertical dashed grey line:

Source: Koyfin

Given the double-cut, and the clearly communicated expectation for further cuts, this is surprising, and it has caused a bit of market chaos.

Most notable has been the huge spike in the MOVE index, which measures bond volatility. It has risen from 90 to 130 in October alone. Bond volatility is back.

If you cast your minds back a few years, the framework was quite clear: inflation would bring higher interest rates, both of which were bad for stocks. The small bear market of 2022 was a reasonably clear consequence of those things playing out, in an overvalued and highly concentrated US market.

Hence, when the blue line (bond yields) is rising sharply, the white line (US stocks) has fallen:

Source: Koyfin

We now have those conditions once again, of an overvalued and highly concentrated market.

Except, inflation is supposed to be ending, not starting?

Well, there have just been a few things which have made people worry it’ll be stickier than the Fed hopes.

For a start, commodities like aluminium and sugar have been rising 15-30% in the last few months. These key feedstocks have knock-on effects through the system.

In the US, the job market and various economic indicators have held up, or even strengthened. High rates are supposed to damped spirits and economic activity, but they seem to have had a muted effect this time.

One final factor is the Trump trade. The expectations that he will cut taxes if elected are seen as a boost for growth, but he is also expected to deliver larger deficits (unfunded spending). This would raise the cost of borrowing in the form of higher interest rates priced by the market. His odds of victory have risen steadily in September, and so, therefore, have bond yields.

So overall, we have data that is, at least on the surface, showing a solid US economy, with Trump’s odds of victory rising, and commodities rising too. Together, these add up to enough reasons for bond yields to rebound a bit.

But while bond yields have risen, the stock market indices have broadly shrugged this off so far…

Until now.

Because this time, it’s AI at the centre of the bull market. And those stocks are wobbling too…

We became accustomed to seeing Nvidia go up 50% or 100% every month or two, but now it’s flat since June, had fallen over 30% at one stage, and lost almost $300 billion in a single trading day.

Meanwhile, market darling Super Micro Computer is down over 30% since the Fed meeting and has fallen 75% since March. The AI bull market isn’t as robust as some think, and investors ought to be very careful with it now.

The tech is advancing rapidly, the rollout is rapidly underway… but it’s hard to keep up that rate of gains for long.

Meanwhile, with all this dislocation, our favourite asset of the moment has quietly sat on its upward escalator, quietly nudging higher, bit by bit… In fact, it’s one of the best performing assets of the year, except no one is talking about it (except us).

I think the Fed’s next meeting on Thursday and Friday this week could once again drive this asset higher, even as other assets move erratically around it…

Because it actually prefers falling interest rates, something we are almost guaranteed to get at the Fed’s next meeting unless a real surprise unfolds over the next week. Last time the Fed was due to meet, I wrote that the start of the rate-cutting cycle would be a boost to this asset.

Ironically, a lower Fed policy rate was followed by rising bond yields.

But if the Fed is committed to steadily pulling rates back down as inflation continues falling, despite occasionally mixed data like in October, this asset will have a rally powerful tailwind. And given that it has risen all year without cuts, and held up in October as yields rose, if the Fed is cutting and markets are aligned, it could be a powerful double-boost.

Throw in the fact that even after a great year so far, it is historically undervalued on various metrics, you have a trio of good reasons to look at it: momentum, macro, and valuation.

If you want to know what it is, be sure to have a look at this special research we’ve put together before 7 November.

Until next time,

James Allen

Contributing Editor, Fortune & Freedom