A happy new year from us at Fortune & Freedom. Let’s hope it’s better than 2020…

Although it’s our job to offer you far more than just hope, isn’t it…?

And so I’d like to share with you a key opportunity I expect to play out this year.

It’s a story I’ve been following since 2010. The fragility of the paper gold market. And its potential to trigger a huge spike in the gold price.

Today, I’d like you to discover what it’s all about. Because events in March of 2020 exposed just how powerful the effect really is.

It convinced me to buy gold, many years ago. So I thought it might help you to do the same.

But we have to start at the beginning. Let me introduce you to…

Paper gold promises

There are many ways to invest in gold. But by far the largest in terms of volume is gold futures. That’s why the global gold price is effectively set in the futures market.

Put simply, futures are a financial contract between a buyer and a seller. The buyer agrees to buy gold from the seller at an agreed price on a set date.

Most futures contracts for trading metals change hands at the COMEX trading exchange, operating out of the World Financial Centre in Manhattan, New York.

But here’s what very few understand…

Most futures traded on COMEX are what we call “naked”.

It means the seller doesn’t have the metal to deliver.

Usually, that’s not a problem, since lots of gold futures are used to take a bet on the changing of the gold price, known as speculation. They are often settled in cash, instead of real gold.

But what would happen if investors decided they wanted physical gold instead of mere promises?

What if they asked for physical gold to back their futures contracts… only to find out gold is not there?

Gold expert Alasdair Macleod explains:

“I think it will be the end of the futures market because nobody would trust it as a means of delivering gold.”

In other words…

The whole paper gold market would break down… and investors would flock to buy as much physical gold as they can.

We caught a glimpse of such a panic this spring.

Covid-19 comes for the gold futures market

On 23 March 2020, three of the world’s biggest gold refineries in Switzerland had to shut down due to coronavirus.

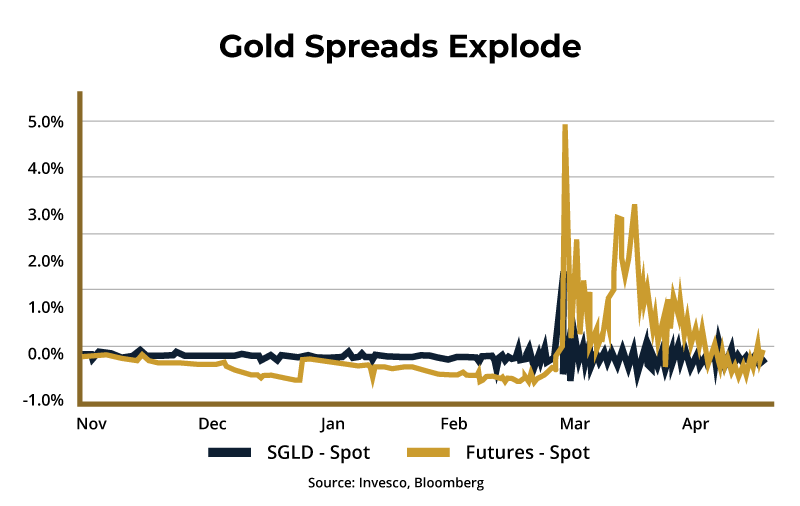

As on cue, the next day, the difference in price (also known as spread) between futures and physical gold, shot up.

Investors trading on COMEX were uncertain that the physical gold to back their contracts could get to New York. So they demanded a premium.

Normally, the premium is less than 50 cents… but fears of a gold shortage pushed it to an unreal $100 extra per ounce!

Gold spreads explode

What happened next was unprecedented…

Reuters reports that:

The divergence created a lucrative opportunity for banks who have the infrastructure to buy metal outside the United States and deliver it to New York to profit on the difference.

The Wall Street Journal reported that bankers were literally searching the corners of their vaults for any gold… so they could pocket the premium.

“Everyone’s looking through the cupboard,” said a former banker.

Because those who held physical gold had the upper hand.

Roy Sebag, CEO of Goldmoney Inc., said some were ready to pay $100 or more per ounce over the London price to get their hands on some of his New York gold.

An executive from one of the largest bullion-trading banks said that for people with access to gold, the situation was like “free money”.

And people who understood the gold dislocation… and were on the right side of it… started taking advantage.

To fix the supply chain, planes were literally charted to fly gold around the world. From as far as Australia.

But did the shortage go away? Not really…

Because the problem in the paper gold market is systemic.

How much “gold” is actually gold?

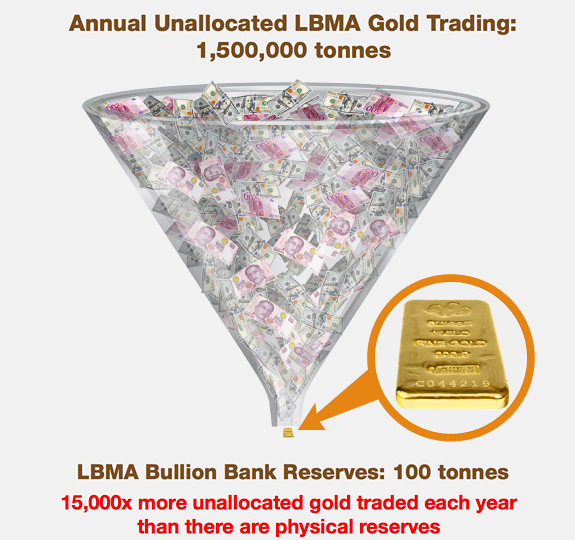

The value of gold traded through ETFs, gold contracts, futures, options, and the like is estimated at $200 trillion to $300 trillion.

The value of physical? Gold that actually exists? Just $11 trillion.

As Les Nemethy, former world banker and CEO of Euro-Phoenix Financial Advisors, explained in September:

In March 2020, there was a dislocation in the New York gold market, as bullion banks came very close to not being able to deliver physical gold against contracts. While this was blamed on Covid-19, and the lack of ability to ship in supplies from European refineries (some of which were closed due to Covid), it demonstrates the danger of thin physical gold inventories.

What might be a trigger for such a run on physical gold? Despite the very recent (and probably temporary softness in gold), one doesn’t need to go too far to think of theoretical examples: a contested US election, leading to major domestic violence; a Chinese invasion of Taiwan or a war in the middle east; a sudden surge in inflation, leading to higher interest rates, triggering a wave of bankruptcies and defaults, to name a few.

So is a gold panic guaranteed to happen? No, that’s not what I’m saying.

What I’m saying is that the paper gold market is fragile.

How fragile?

According to the London Bullion Market Association, data shows that 15,000 times more gold is traded than is in the vaults.

Florian Grummes, a precious metals analyst, said in March:

The situation in the futures market (paper gold) has been extremely overstretched and completely unhealthy since last summer already.

In September it was reported by Seeking Alpha that gold deliveries are up 310x since 2018!

Egon von Greyerz, a gold expert who forecasted the present problems in the world economy back in 2002, said in July:

There is a massive shortage of physical gold in the futures markets and LBMA (London Bullion Market Association) system. As gold goes up and the holders of gold ask for physical delivery, there will be no gold available to settle the paper claims. […] The problem is that there is no gold available at current prices but only at multiples of the current price. And the more money central banks print, the less it will be worth and the more the gold will cost.

Does this mean that all paper gold markets will collapse? No. Although it is a possibility, albeit incredibly small, it’s not what I’m predicting.

What’s certain is that there’s too much paper gold sold to investors, relative to how much actual gold there is.

This is hard data. Out in the open. Data that anyone can find.

So what am I saying?

The more investors start asking for physical gold to back their contracts… the higher the price of physical gold will get. And the possible fragility in the futures market means this could occur in a series of sudden and surprising spikes. Like the one we saw in March.

It’s just human nature…

Remember… Human nature never changes.

George Gero, who’s been trading gold for more than 50 years, said in March:

When people think they can’t get something, they want it even more.

That’s why I would like you to be in position before that.

Now I want to be clear. The gold futures market won’t somehow implode thanks to the lack of gold. That’s not the nature of the prediction here.

It comes down to a question of price. At what price would the market clear if investors demanded physical gold instead of paper promises?

Let me explain that. If investors call the paper promises of the gold futures market into question and begin to demand physical gold instead, this will create a spike in demand for that physical gold.

And the only way to get physical gold holders to sell into the market is by offering them a higher price. A much higher price – that’s what I’m arguing could happen.

That’s what we saw in March. The futures market didn’t break down. It merely sent physical gold prices spiking instead.

I think this is just one of many forces driving the gold price higher in 2021.

And my suggestion to you is to be on the physical gold holding side of the equation when the market clears, at a higher price. Just in case paper gold breaks down, creating another spike in the price of physical gold.But how? Well, there’s a particularly clever way to go about it. That’s what Nigel Farage and investment director Rob Marstrand revealed in their report on the matter. Find out how to get access to it here.

Best wishes,

Nick Hubble

Editor, Fortune & Freedom