With the Fortune & Freedom production team still recovering from whatever they got up to this Christmas, we’ll be reviewing a “best of” series of articles this week.

That is, segments of the best articles I can recall from my ten years in financial newsletter publishing. From myself and others.

I hope you enjoy today’s piece, published very recently in one of my other newsletters…

Ready for take-off

Abraham Wald was a Jewish man which the Nazis badly regretted letting escape. This month, we try to learn from his most famous insight.

Wald happened to be in Colorado Springs when the Nazis annexed his home of Austria. He went on to fight his very own version of the war at the Statistical Research Group (SRG) in New York.

If you enjoyed the film about the Enigma machine and how Alan Turing cracked it, you’re going to enjoy a particular story about what happened next…

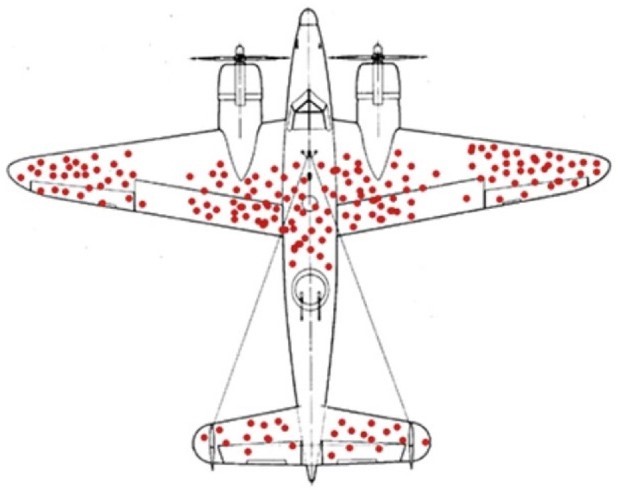

One problem delivered to the SRG was where to place armour on American planes. Given the obvious weight restrictions, you had to choose carefully.

The data handed over to the SRG was from the American planes which came back from Europe riddled with bullet holes. The military’s engineers had noticed something. The bullets weren’t uniformly distributed across the planes.

There were many bullet holes in the fuselage, but very few in the engines, for example. The conclusion was obvious. By placing more armour where planes get hit more often, they could be protected the most with minimal loss of performance.

Source: Research Gate

Source: Research Gate

The SRG was tasked with telling the military engineers exactly how much armour to place where the bullet holes were most concentrated.

Wald came back with a simple answer which made him famous. The armour shouldn’t be put where the bullet holes are. It should be put where the bullet holes are not.

It’s obvious in hindsight, of course. But the sample which the military engineers were working with wasn’t fair. It didn’t include the many planes that hadn’t made it back. And those were the most important ones, when it came to deciding where to place the armour.

Wald argued that the planes which had made it back had been the lucky ones. They’d been hit in non-vital places not worth putting armour on. The fact that they’d made it back demonstrated it wasn’t worth putting the armour there.

The planes that had been hit in vital places, like the engines, hadn’t made it back. Thus, placing the armour where there were no bullet holes on the planes that had made it back was the best policy.

What does this have to do with investing? Well, when it comes to Covid-19, I think we’re making the same mistake as the US military’s engineers. In reverse, strangely enough, but don’t let me confuse you.

Investors today are focusing the planes that aren’t flying instead of the ones that are. And, once you shift this perception, you’ll realise something about the nature of the economic recovery. Its potential to take off very rapidly and very suddenly in some sectors. Especially air travel and tourism.

Just days before Britain went into its second lockdown, two of your editors decided to escape. I’ll let Boaz Shoshan tell his own story later in this issue. But first, my own.

Facing the prospect of another lockdown, but this time without any relatives to help us with our eight-month old daughter, my wife and I decided it was time to follow the in-laws to Japan.

They’d been travelling freely between Japan, the UK and Spain for months, including at the height of our lockdown in Britain. My mum, meanwhile, moved house from Austria to Germany when the border was supposedly closed. But let’s focus on our air-travel story today.

My Japanese visa took a few days, that’s all. The real challenge was getting a

Covid-19 PCR test within 72 hours of the flight. I had to travel across the breadth of London to get one. These days, some people can get tests at the airport before they fly.

The airport was eerily normal. A little emptier, a little quieter, but not really any different. Our Japan Airlines flight was a third full, which flight stewards told us was a bumper amount.

The flight was normal too. No restrictions on moving around. Masks weren’t policed in any noticeable way. After all, you seem to spend most flights with some sort of food or drink within reach.

Upon arrival, things began to diverge from the norm for the first time. We ran a gauntlet of paperwork, spat copious amounts into a tube and then waited for test results to pop up on a screen. It took about two hours, all with plenty of assistants ready to help.

Everyone had to explain how they would get to their self-quarantine accommodation without using public transport – the only real constraint I saw policed. One foreigner fell afoul of this rule and promptly had a cadre of people assisting him to get to his accommodation some other way.

We self-quarantined for two weeks in an Airbnb. I can’t comment on how strict the rules are, nor how closely people abide by them…

In the end, the trip was fairly normal. The additional cost of testing in the UK and the inconvenience of waiting at the airport in Japan was a small price to pay for a completely normal life in Japan now. Well, as normal as life can be in Japan.

The rest of my monthly issue is for subscribers only – I’m sure you understand.

But the message I had for my subscribers was a simple one. The recovery in world travel is well underway. You’ve just missed spotting it by focusing on the wrong thing.

But change your perception from what we’ve lost thanks to Covid-19, to what is returning, and you may change your investment outlook too…By the way, Nigel Farage and investment director Rob Marstrand have unveiled their own investors blueprint for what they expect to happen in 2021. Have you seen it yet?

Best wishes,

Nick Hubble

Editor, Fortune & Freedom