Editor’s Note: While Nick is away attending to the birth of his daughter, we’re taking this opportunity to share some market perspective from Fortune & Freedom’s sister publication, Southbank Investment Daily. Below is a piece, first published in February, on what to expect as this historic bull market – already history’s oldest – turns 13. Enjoy!

I pay attention to bearish commentators and even stock market doomsayers for a simple reason: they’ll be right eventually.

In March 1997, Warren Buffett said most stocks were overvalued and therefore bad deals for investors. He looked foolish for almost three years as the Nasdaq roared 366% after his warning.

But he was eventually vindicated: the infamous dotcom collapse was around the corner.

Billionaire Jeremy Grantham was years early when he exited Japanese equities in the mid-1980s, citing historically high valuations. But his caution was justified… even 32 years later, Japan’s Nikkei 225 hasn’t recovered from its 1989 crash.

Today, most observers disregard the pandemic-triggered crash of March 2020 as a blip on the radar for a bull market that has run essentially uninterrupted since March 2009.

That means we’re entering the 14th year of this bull market next month. It’s already the longest bull market in history… topping the 1990s run that lasted just shy of a decade.

They say that bull markets don’t die of old age. And yet, not a single one has lasted forever…

One day, the bears will be right again. And history shows the reckoning could crimp your investment returns for years, even decades, to come.

What the bears are saying for 2022

Now, I don’t mean to label either Buffett or Grantham as perma-bears. Buffett is actually known for his sunny optimism, while Grantham correctly predicted the beginning of today’s bull market, almost to the day, in March 2009.

A perma-bear is someone who issues dire market warnings year after year, for much if not all of their career.

Take fund manager Russell Clarke, whose RC Global Fund bet against stocks for much of the last decade.

Unfortunately for Clarke, the S&P 500 has returned 232% over the last ten years… and few things are as futile as fighting a “rip your face off” rally.

Investors in RC Global Fund can attest to that… the fund has dwindled from $1.7 billion in assets under management in 2015 to about $200 million in November 2021, according to Bloomberg.

And in November, Clarke called it quits, telling clients he was shutting down RC Global Fund after a streak of losses.

His farewell note had a hint of despondency… Clarke said it was “time to step back, have a think about where we are going, and then come back when I see an opportunity for my skill set.”

Short sellers giving up

And RC Global Fund isn’t alone in its surrender… as the S&P 500 hit 65 new all-time highs in 2021, short-sellers – those betting money that stocks will fall – came under increasing pressure.

Short-selling activity fell to a nearly 20-year low in late 2021. Part of this decline came from short sellers getting “squeezed” out of their positions as their mounting losses became untenable.

But the 20-year low also has something to do with the historic, 13-year bull market. Many would-be short sellers are coming of age at a time where the long-term, upward trend in markets seems unstoppable. So why fight it?

Not many people are going to be lamenting the fall of short-sellers, whose plans to profit from the stock market’s struggles sometimes come across as vulture-like or even unpatriotic behaviour.

But from an investing perspective, the decline in short-selling is a warning sign… it means that a bull market many already see as toppish could soon reach even more dangerous heights.

Jeremy Grantham explained this well in his January note to investors, “Let the Wild Rumpus Begin”.

In it, he acknowledged that his 2021 warning of an epic bubble bursting by summer 2021 at the latest had been incorrect. But this wasn’t because markets stabilised, or reached more reasonable valuations…

Instead, they got worse. As Grantham put it:

This time last year it looked like we might have a standard bubble with resulting pain for the economy. But during the year, the bubble advanced to the category of superbubble, one of only three in modern times in US equities, and the potential pain has increased accordingly.

It may sound to you as if Grantham is being stubborn here, doubling down on a bearish prediction after the market disproved his stark warning a year ago.

But I take the opposite view… conservative investors like Grantham and Buffett have often been years early in their warnings, but they’re seldom wrong. And with each passing year, the odds increase that the reckoning is nigh and they’ll be proven right.

“What’s Wrong, Warren?”

Take the 1999 cover from Barron’s mocking Warren Buffett, for example…

In December 1999, the vaunted financial publication ran a cover story titled “What’s Wrong, Warren?” The issue noted that Buffett had stayed out of the tech stocks that had made so many people fabulously wealthy over the last few years, and speculated that “Warren Buffett may be losing his magic touch.”

But of course, Buffett had the last laugh… the infamous dotcom collapse began only weeks later. Ultimately, the tech-heavy Nasdaq would lose 65% of its value over the next 18 months.

Market history is clear on one thing… it’s easiest to mock the voices of caution at exactly the moment when it’s most important to listen to them.

Which brings us to the present moment…

The market has marched higher, almost uninterrupted, for nearly 14 years now. A lot of people think it can’t go much higher.

Of course, we’ve heard these fears for years now – almost since the start of the rally in 2009. This may be the most hated bull market in history.

Our top tech analyst here at Southbank Investment Research, Sam Volkering, can attest to that…

In October 2016 Sam spoke at an investing conference before an audience of more than 1,000 people.

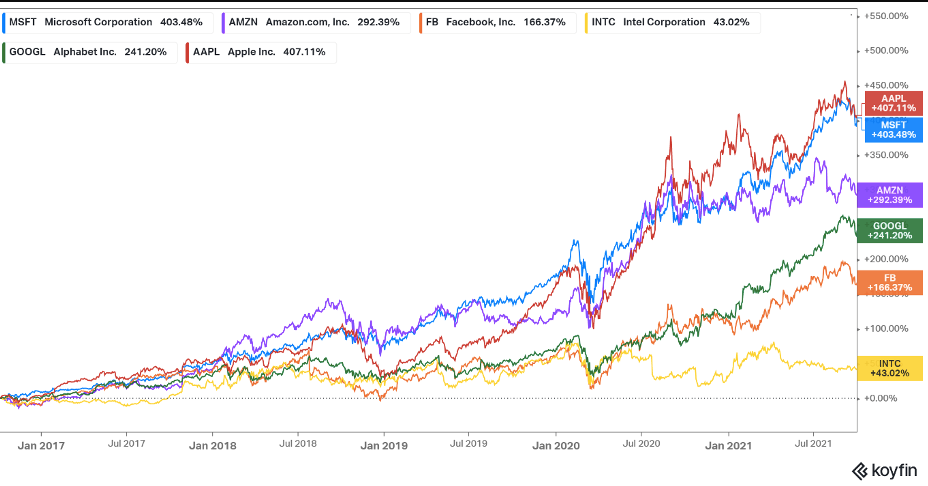

He told them that they needed to get into MAFIAA stocks (Microsoft, Amazon, Facebook, Intel, Alphabet and Apple).

At the time, the Nasdaq had hit all-time highs. Tech stocks going higher sounded improbable. Impossible even. I’m sure most people thought the tech market was topping out.

But not Sam… He told them directly the Nasdaq would double from that point and head higher.

The media was telling investors to steer clear of tech.

So, Sam’s views of these six tech stocks raised quite a few eyebrows.

But, as things turned out, Sam was right.

Source: Koyfin

Today, each of the MAFIAA stocks is in the green.

The average return from October 1st 2016 – February 1st 2022 is over 250%. And the overall Nasdaq Composite doubled (and then some!).

Which brings me back to my second point…

Staying in until a market crash can be expensive. History shows you can lose 65% of your money or more… and it could take decades for markets to recover.

But abandoning the markets too early can actually be even more costly… anyone who ignored Sam’s advice in 2016 left hundreds of per cent gains on the table.

Given the historical stakes of this moment, our analysts will be watching carefully for any shift in market psychology. And should anything fundamentally change, readers like you will be the first to know.

Regards,

William Dahl

Editor, Southbank Investment Daily

PS Whatever the state of the markets, there are few more effective strategies than by jumping on irreversible, long-term trends.

My colleague James Allen has uncovered what he believes to be the hottest uptrend of the next decade or more.

In just a few days, he’s hosting a Southbank Investment Research “first-of-its-kind” online event designed to show you how to act on this trend now, before the big wave of capital floods in.

He’s even invited six leading experts to join him.

If you’re interested in where the big money will be made in future, I suggest you claim your free ticket today.