- John Butler’s mysterious midnight messages

- Oil and US bond yields are diverging

- Financial market instability is now sinking the economy

I’ll be honest, sometimes I have absolutely no idea what our Investment Director, John Butler, is on about. It always starts to make sense in hindsight, or once he explains it. I suppose he just spent too many years on the inside… of investment banks, that is.

This week, his comment on our internal chat is a good example:

I’m looking at various market cross-correlations and they’re beginning to break down across the board. The usual relationships between interest rates, curve steepening/flattening, stock vs bond vs commodity correlations, gold, FX etc, are just all over the place.

To me this is a possible signal of general distress i.e. pockets of forced selling that just have to take place as credit and collateral lines are cut for whatever reason.

All this is code for “something has changed” in financial markets. Today we ponder one example of such a “correlation breakdown” and what it means for you: the relationship between oil and US bond yields.

At first glance, the two couldn’t be less related. One measures how much interest the US government would have to pay in order to borrow money for ten years. The other is the price of oil.

Yet, the two tend to reflect the same thing: the health of the economy. That is why, historically, they tend to move in tandem… more or less. This is one such “cross-correlation” that John was referring to.

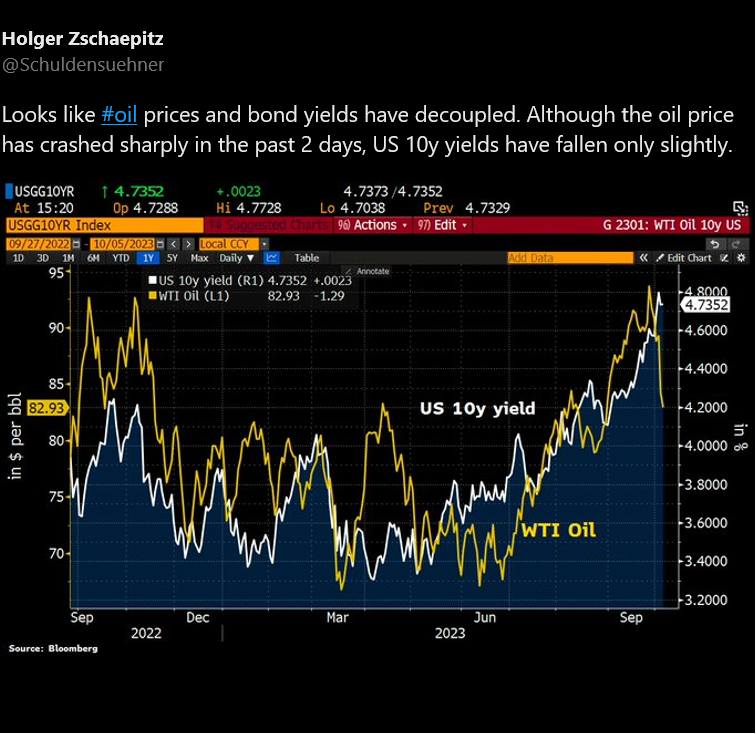

But it has broken down, as this tweet from the excellent German journalist, Holger Zschaepitz, highlighted best:

Source: @Schuldensuehner

Source: @Schuldensuehner

Holger’s Twitter handle means “debt atoner”, by the way. He usually tweets in English. I highly recommend following him.

Anyway, the point of the chart is that oil and the US ten-year bond yield usually move up and down together. Not to the same extent, but the direction usually matches up.

Lately, though, something has changed. While US bond yields continue to surge ever higher, the oil price has tanked. This is just one such correlation that has broken down lately. However, it may prove to be the most important for investors because of what it signals is coming next.

The inference we can make from the divergence is that the crash in US bonds may be getting so severe that it is causing trouble in the economy itself. The spike in interest rates is beginning to choke off economic activity.

Here’s how that narrative goes, in a little more detail…

The US ten-year bond yield may be the most important number in financial markets. That’s because it is the alternative against which all other investments are measured because it is the proxy that we use for something called the “risk-free rate”.

Every measure must have a benchmark. Just as heights are measured relative to sea level and temperature relative to water’s freezing and boiling points, investments are measured relative to the US ten-year bond yield. (Unless some other more relevant figure is obviously at hand.)

Look up any financial market maths formula and you’ll see the term rf in there somewhere. It’s a reference to the risk-free rate and it’s usually the US ten-year bond yield that’s used.

This is because the US is considered the safest jurisdiction in the world, the US dollar is the world’s reserve currency, the US government is considered the most creditworthy and the US military has the capacity and tendency to cause trouble for anyone who disagrees with any of those statements…

Because of the US ten-year bond yield’s importance, it is watched very closely. When it moves, all other asset prices are impacted by way of association. That’s because investing is a game of alternatives – you’ve got to put your saved money somewhere.

You can think of the list of choices as being a spectrum of options, with the US ten-year bond being the base case of risk-free and then any other investments as adding more risk and more potential return from there. Investors choose what to invest in based on whether the risk-free rate is an acceptable level of return, or whether they want to take on more risk in the hope of higher returns.

So, if the US ten-year bond yield is rising, this is like the tide rising on all other investments. Everything must adjust by offering better returns in order to compete with the US ten-year bond yield.

There are two ways to offer more returns in the financial world: one is to pay more and the other is to fall in price. This might sound counterintuitive, but a cheaper investment implies a better future return. A company with a dividend of £1 and a share price of £20 has a 5% dividend yield. If the share price falls to £10, the yield rises to 10% – much more enticing.

Given that the US ten-year bond yield has risen from 0.52% to 4.78% since 2020 (at the time of writing), you can imagine that stocks would have had to fall quite a bit to remain attractive to investors… or their prospects must have improved quite a bit to justify their high prices. The question is which.

Oil might help us answer that question and warn us whether to expect a booming economy that justifies higher stock prices relative to bond yields or a crash in the stock market.

Think of oil as a bit like copper… in the sense that its price is a measure of the health of economic activity. Just about everything we do requires oil. So, the price of oil tells us a lot about how much we are doing in the economy.

Of course, the price reflects supply too. It’s not like the oil supply hasn’t been chaotic lately. However, up until the latest chaos in the Middle East, the divergence between oil and bond yields has come during a period when oil supplies weren’t troubled by new shocks from Russia or the Middle East. This suggests it reflected oil demand.

Which brings us to the real point of today’s analysis (at last). Usually, bond yields and the oil price are correlated because they tell the same story. When they’re both rising, the economy is doing well and investors are optimistic. The economy is using more oil and investors are looking to add risk by selling bonds and buying other riskier assets like stocks. This makes the oil price rise and bond prices fall (which means higher yields).

When times are tough, people use less oil and prefer the risk-free status of US government bonds. This bids up bond prices (causing yields to fall) and leads to lower oil prices.

However, recently, we’ve seen falling oil prices and rising yields. So, what’s going on?

It could be a supply shock in the oil market, with a sudden glut. But I doubt it…

Instead, the explanation is that the record-breaking rout in US government bonds is causing trouble in the economy. The yield against which all other investments must compete is going up too fast. The tide is threatening to drown the economy instead of floating all boats.

Normally, when the economy is crashing, US ten-year government bonds are a good investment. But, as John explained, something has changed. The usual rules don’t apply. Bond prices are falling even as oil is too and this is just one such correlation that has broken down.

This change means your usual investment strategies are less likely to work and unusual things are more likely to occur instead. Are you ready?

Until next time,

Nick Hubble

Editor, Fortune & Freedom