- C3.ai snog, marry, avoid?

- HeyGen’s AI is really good

- Elon and Larry sitting by the fire…

Editor’s note: Today, we bring you a guest piece from Sam Volkering from one of our newest publications, AI Collision, which was first published on 5 December. We hope you enjoy it.

Welcome to AI Collision 💥,

C3.ai: is now the time to buy?

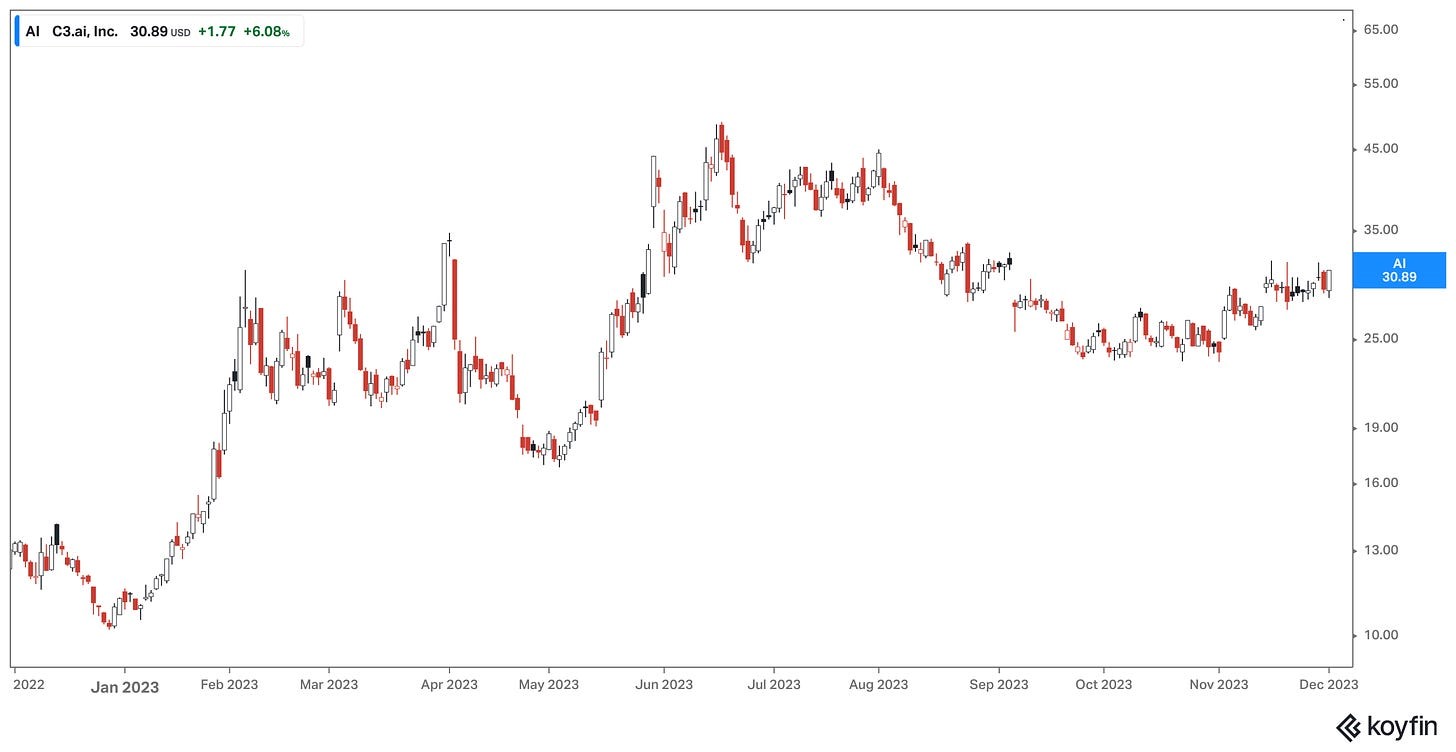

A picture sometimes says 1,000 words.

Sometimes that picture says £1,000 too.

And the picture below shows that if you’d invested £1,000 into AI just as ChatGPT was hitting the mainstream news in late 2022 then by June of this year, you’d have made around £3,500 on top of your starting £1,000.

Ok, so maybe this picture tells 3,500 words…

Source: Koyfin

Source: Koyfin

The investment in question here is C3.ai – the AI market darling of the AI boom during 2023.

It’s interesting that C3.ai isn’t as important to the AI boom as a company like Nvidia is. However, there’s one thing that C3.ai has going for it that not a lot of other companies do.

It has .ai at the end of its name. And its ticker symbol on the Nasdaq is AI.

I’m not saying C3.ai is a dud company. We’ll find that out if that’s true or not in a moment. But when you’ve got arguably the best AI ticker symbol in the entire market, then the FOMO (fear of missing out) crowd is going to take aim at your stock.

C3.ai was all anyone could talk about in the first half of this year. It was everything this AI market explosion was all about. But now, a year on, with everyone coming to grips with the AI hype train, the question remains…

Is C3.ai still the market darling it was? Or is it on track to disappoint investors?

C3.ai originally started in 2009 as “C3”, with the “C” signifying “carbon” and the “3” denoting “measure, mitigate, and monetize”.

The company initially aimed to help manage corporate carbon footprints. This later expanded to include a broader range of industries. By 2013, C3.ai had partnered with the US Department of Energy to develop a big data platform for energy analytics.

The company underwent a significant rebranding in June 2019, changing its name from C3 IoT Inc. to C3.ai, Inc. This change reflected its broader focus beyond the Internet of Things (IoT) applications, positioning itself squarely in the AI space.

C3.ai’s IPO occurred in December 2020, as the market was in the midst of an almighty bounce from the market dramas of what we just now call “Covid March”.

This IPO was a pivotal moment, transitioning C3.ai from a private enterprise to a publicly traded company on the NYSE under the ticker symbol AI.

That ticker has been everything in the last year for the company. The period leading into the AI boom of 2022/23 saw a significant shift in investor sentiment towards AI companies, notably C3.ai.

As investors were seeking the next big trend to latch on to, the release of ChatGPT to the public in late 2022 provided the perfect investment idea for investors.

While C3.ai was definitely riding investor sentiment and a fair bit of hype, the company’s strategic collaborations, including an expanded agreement with Amazon Web Services, were helpful in fuelling its stock surge.

However, the latter part of 2023 painted a different picture for C3.ai. Despite a reported 10.8% year-over-year revenue increase in Q1 2024 and a strong pipeline indicating future revenue growth, the company’s stock price has been a little more subdued than in the first half of the year.

A major factor contributing to this was C3.ai’s $70 to $100 million operating loss forecast for fiscal year 2024, which raised concerns about its profitability. From mid-year highs near $48, the stock halved into October as questions were finally asked about the company’s high valuation (over $4 billion at the time) relative to its growth rate.

Low double-digit growth with triple-digit stock returns happens – quite a lot, actually, but it never lasts forever as the market readjusts to reality.

Also while there’s no doubt that AI is here to stay and will find its way into seemingly everything, more questions are now asked about whether C3.ai is the way to play this boom, or are there better opportunities in the market now emerging?

Long-term growth makes C3.ai something to run the ruler over further, and there’s a momentum play potential (just for the AI ticker alone) if “meme stock” investors are looking for something to play with.

But in the short term, it’s hard (not impossible, but hard) to see that explosion in price returning now that the world is a little more accustom to the AI investment idea. And maybe better opportunities are found elsewhere.

AI gone wild 🤪

A couple of weeks ago, I was in London filming our AI Advantage Workshop.

In between time in the studio, we were speaking with the recording crew about some of the developments in AI for video.

The conversation obviously turned to the use of voice cloning and AI avatars for real people.

I’ve tested this out a bit over the last year.

I found that voice cloning is very good but comes across as a bit robotic. I also found AI avatars very good too, but they struggle with things like beards and there’s also something just not quite right about the way they look.

That said, the speed at which this tech has been developing over the last year alone is astounding.

It’s why, if you’ve not seen my interview with Idan Schmorak from Unith.ai earlier this year, make sure you check that out. The company is right at the pointy end of AI avatar development.

And if you want to see how bad AI avatars deal with beards, check out the AI Gone Wild section from my piece on 10 October.

Anyway, as we were talking with the film crew, someone mentioned another AI avatar company called HeyGen.

I’d not seen or heard its work before. Luckily, one of the guys had a demo video of a real person (who I knew) as an HeyGen avatar.

Wow!

The person in the video was the person I knew and I knew it was AI, but also… I didn’t see it.

This was one of the best AI avatars I’d ever seen. And right away, I said to our guys that we need to start looking at this kind of thing.

Not for long-form, detailed research pieces or anything that requires a bit of human-to-human contact, but maybe if we want to send a quick market update about some raw numbers from the stock market, maybe people would be cool with that?

Either way, HeyGen was on my radar. And then, when I saw this video on my X.com feed the other day, I was absolutely convinced HeyGen was one to look out for.

You can see from the screenshot here how real it looks. I’d suggest clicking that link to see the video for yourself, though.

Source: @saranormous

Source: @saranormous

If this is how fast and how good AI avatars get, then I guess we’ve just got to figure out if we want them at all.

And it makes us wonder: is something like AI avatars solving a problem and an unmet need… or is a solution looking for a problem?

Boomers & Busters 💰

AI and AI-related stocks are moving and shaking up the markets this week. (All performance data below over the rolling week.)

Boom 📈

- Symbiotic (NASDAQ:SYM) up 38%

- iRobot (NASDAQ:IRBT) up 36%

- Cyngn (NASDAQ:CYN) up 25%

Bust 📉

- Appen Ltd (ASX:APX) down 28%

- Amesite (NASDAQ:AMST) down 11%

- DotDigital (LSE:DOTD) down 5%

From the hive mind 🧠

- You can’t be a fly on the wall when Larry Page and Elon Musk sit down for a chin-wag. But this is pretty close.

- Not everyone drank the AI Kool-Aid, but to come from high up at Meta… well, that’s quite something else. And it’s not just AI that he’s sceptical about.

- Do you remember the guy who invented Oculus VR, the VR headset that Meta now builds? His name is Palmer Luckey. And he’s moved on to other things, like AI-enabled military drones.

Weirdest AI image of the day

Leonardo Da Vinci’s Anatomical drawings of Shrek compared to Modern science – r/Weirddalle

ChatGPT quote of the day

“Intelligence is the ability to adapt to change, but true wisdom lies in shaping the future.” – An AI Perspective

Thanks for reading, see you next time!

Sam Volkering

Editor-in-Chief, AI Collision

Photo by

Photo by