How do feel about artificial intelligence?

Do you see there being more benefits in using AI?

Or do you see more drawbacks in using AI in our future?

I would love to know what you think. So, I want to run a quick poll, all you have to do is click on one of the options below…

I think AI will have more:

The reason I ask is simple.

Last week my mother-in-law asked me about AI as I was making a coffee in the kitchen. She wanted to know if I thought it would take a lot of white-collar jobs. It’s not that she was afraid of it, but she was unsure.

Furthermore, I could tell she’d heard about it on the radio or TV, and clearly wasn’t sure the information she was given was true and accurate.

I suspect you might have similar thoughts?

Maybe you can see there’s something exciting there, but at the same time, when the “boffins” on the TV are saying it’s an existential threat to humanity… well you can’t ignore that completely either, can you?

It is a confusing area of understanding.

Or is it?

Are we overcomplicating things just a tad?

Are we biased towards a negative reaction to AI because the only existential threat is to all those productivity bludgers out there who now realise the gravy train is about to slam shut as smart computers do things better, faster and with far, far less pay?

Is it simply that rich folks are the only ones scared of AI, while poor people can’t wait for the incredible opportunities it might bring?

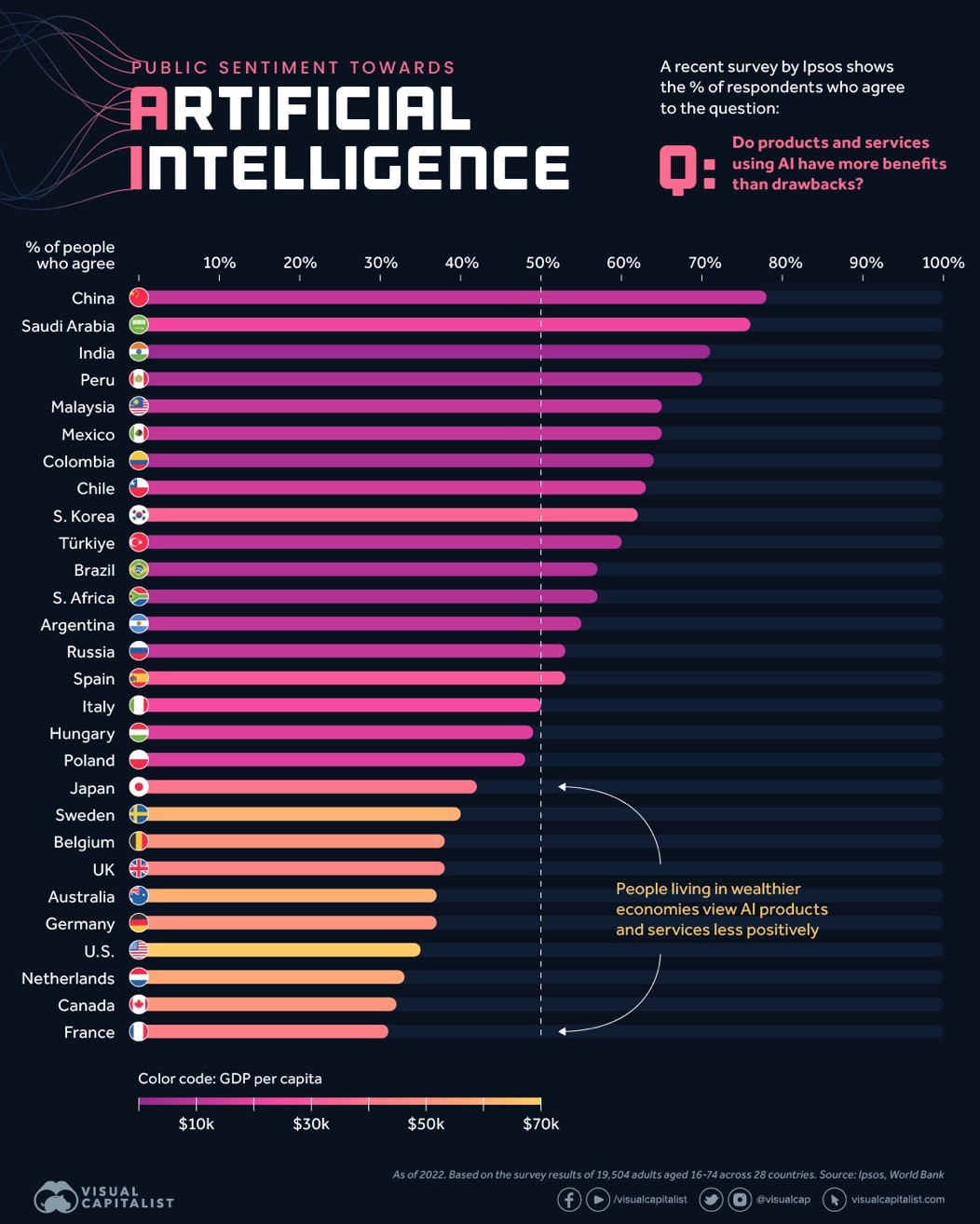

Look at the following data analysis…

Source: Visual Capitalist

The data here is a clear link between wealth and views on AI. It is of course quite general, but it’s clear there’s correlation between AI attitudes and the relative wealth of a nation.

I find this data fascinating because AI is nothing more than another revolutionary technology.

I contend you could go back through history, running the same survey and plotting the same data, but switch out AI for other revolutionary technologies, electricity, cars, planes, television, personal computers, nuclear energy, the internet and cryptocurrency.

I don’t think it matters that the subject of the survey above is AI. I think that in general, people fear what they don’t completely understand – the unknown – and the risk/reward opportunity that we live with day in, day out, but never really stop to think about.

How risky are (or aren’t) you?

Not understanding something is no reason to fear it.

Furthermore, fear of the unknown nature of the future is also a bit of a cop out.

And finally, not doing a proper analysis of risks vs potential reward is a fast-track way to mediocrity.

Thinking about how you answered the poll earlier, how likely would you be to invest in an AI-focused stock?

If you thought AI has more drawbacks than benefits, would that change your decision to invest in, or not invest in, a stock that? One which has huge growth potential but which is predominately in AI?

Would you ignore the wealth-creation potential of a stock because of your perceptions of something like AI?

Or would you learn more, try and understand the technology, be open minded to the opportunity before making your decision?

I’d like to think you’re forward-looking enough that you’d take the time to learn more before you made a decision. And it’s not just AI that this applies to.

When you are looking to buy an energy stock, what biases get in the way of the opportunity? Think about nuclear energy. Are you for it or against it? Either way, what if a stock with huge upside potential in nuclear was standing there right in front of you?

What would you do? Dismiss it or learn more and understand before making a decision?

The same can be said for stocks that are involved in green energy like battery tech, novel medical technologies that are in early-phase trials or new digital networks that are still emerging from their embryonic stage.

Party like it’s March 2009

Throughout history we always stumble across new ideas, inventions, innovations, technologies and opportunities – and to start with, we typically have very little understanding and a lot of fear.

But if you’re capable of turning off the fear switch and turning on the curiosity switch, then my view is that, in the long term, you’ll do very well in the markets.

When the wider fear level of society, the market and the media is turned up to 11, and everywhere you turn is fear, uncertainty and doubt – that’s precisely where I think you get the best edge in the market.

It’s easy to revert to the mean when it comes to that fear and uncertainty of technologies and opportunities. But for me, right now, while there’s proverbial “blood in the streets”, particularly in the market, the ability to have an edge can put you in a position for long-term wealth that is rarely seen in the market.

I’d argue that right now is one of those few times when fear is at 11, where the stock market is primed for investors to take a punt on some of the most exciting opportunities in the market.

For me, the only other time in my investing life like this was March 2009, as the market bounced out of its bottom and depths of the global financial crisis.

When something like AI can come along and the default reaction is that it’s an existential threat to humanity, this tells me that there’s asymmetric risk to the upside for investment in this tech.

Any other time in the last 15 years and it would be revered as the greatest thing we’ve ever seen. But now, it’ll be the end of humanity. You know that’s not going to happen. So, what can you do about it?

Well, the good news is that now, as I say, might be the most exciting, perfect opportunity to invest in the market in tech like AI. But why stop there?

Green energy, cryptocurrency, data and connectivity, nuclear, autonomous systems, biotech, cloud technologies – there’s so much to get excited about, to learn more about, to understand and take smart, educated moves into.

All you must do is manage your biases, have an open mind, be curious and prepared to learn, but also, most importantly, have the conviction to act – and invest while everyone else is too scared to.

Do that, and I think you’ll find 2023 is perhaps the best long-term opportunity for investing in stocks we’ve seen since March 2009.

Regards,

Sam Volkering

Editor, Fortune & Freedom