One of the great disappointments of the last three years is gold’s poor performance. The gold price has been trending sideways since the middle of 2020. At least, that’s the story in terms of US dollars…

But what about other currencies?

Well, if you flick through the ones I follow, the story looks a little different to say the least.

In terms of pounds, gold recently hit a record high.

In terms of Australian dollars, gold recently hit a record high.

In terms of euros, gold recently hit a record high.

In terms of Japanese yen, gold recently hit a record high and is in a steady uptrend.

I’m sure you get the idea. But you won’t hear it from the media in any of those countries. Instead, there are plenty of articles about gold’s poor performance.

What explains the divergence? Something called the gold quadrants, which feature in our free reports section of the Fortune & Freedom website for those who have subscribed.

But, for today, I’ll reveal them for website visitors, and remind those of you who have forgotten…

***

The Gold Quadrants

There’s a particular reason to own gold which most British investors don’t know about, or never consider.

That’s because the majority of investment advice in favour of gold comes out of the US.

Ironically enough, American investors benefit least of all from owning gold. The Brits are somewhere in between, while the Australians and Canadians see their gold returns skyrocket during a crisis.

Why? Currencies and their exchange rates.

Gold, like oil, is priced in US dollars. That price is then converted to your local currency to get the local gold price. Even if the gold price is steady, changing exchange rates mean changing local gold prices around the world.

This creates an added complication for gold investors outside the US. They also have to take into account exchange rate moves.

How will their currency perform in different scenarios? Will it offset their gains or losses in gold, or will it add to them? After all, similar variables affect both the gold and currency markets. Money printing, crises and plain old GDP growth, for example.

If you want to understand how the exchange rate and the gold price work together, you can think about it in terms of what I call the gold quadrants.

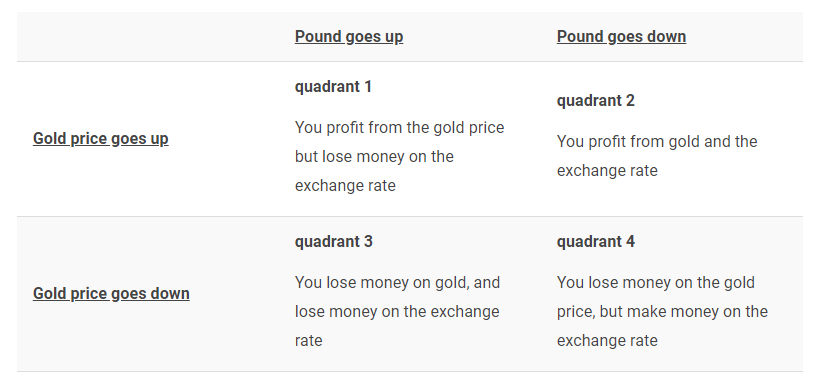

The gold quadrants are the four possible outcomes when you invest in gold as a British investor. The gold price in US dollars can go up or down. And the US dollar to pound exchange rate, which gives you the pound gold price, can go up or down too.

Two variables give you four possible outcomes.

Say the gold price in US dollars goes up 5% and the pound goes up 5% too. That leaves the UK gold price with no change. That’s because the gains in gold are cancelled out by the lower amount of pounds you get for your US dollars.

This is only one of four possibilities. I’ve put all four possibilities in a table – the Gold Quadrants Table.

It shows all four possible outcomes for British investors. What I call “the four gold quadrants”.

The thing to understand is that these four quadrants are not equally likely to occur. Each one has a particular set of scenarios which will bring it about. Different combinations of money printing, GDP growth, inflation and everything else that can affect both the exchange rate and the gold price.

For example, during a financial crisis, the US dollar surges against just about all currencies. That means a weaker pound against the dollar. Gold is a safe haven, or safe investment. It spikes when risks in the economy rise, like in 2008.

This combination makes gold a brilliant investment for Brits because the currency move supercharges the gains from gold during a crisis – just when you want gold to perform well as an investment. As Quadrant 2 explains above, you profit from the gold price and the exchange rate.

Compare this to what happens to an American gold investor in a crisis. Their dollar currency is a safe haven. The US dollar surges alongside the gold price during a crisis. This decreases the benefit of owning gold, as it cancels out some of the gains.

Usually, gold surges faster than the US dollar, making gold a good crisis hedge for Americans too. But far less beneficial than for Brits.

Does it really work like this?

The proof is in the pudding…

Take a look at the charts below. The pound gold price hit all time highs in 2019. The gold price in US dollars took far longer to hit all time highs during the Covid-19 crisis.

Source: Goldprice.org

This is an example of currency moves supercharging your gold returns – quadrant 2 in the table above.

***

Since publishing that report, the same trend has played out.

Uncertainty in financial markets and the Federal Reserve leading the charge against inflation has meant that the US dollar held strong.

This undermined the gold price in terms of US dollars, but supercharged its returns in terms of pounds, which is what UK investors care about.

We hope you’ve enjoyed the stealth bull market in gold since we recommended buying it in the report. It’s up about four times as much as the FTSE 100, after all. And that was one of the best performing stock market indices…

Nick Hubble

Editor, Fortune & Freedom