- The EV industry is harbouring its own nasty secret

- Why we believe net zero is doomed to fail

- Watch our investigation now

The climate crusaders will tell you that net zero is going to save the planet.

But have they done their homework?

Over the past week in Fortune & Freedom, we have been exposing the flaws and fallacies of the drive to meet impossible net zero targets.

Today, we’re going to look at some of the horrifying consequences that come hand-in-hand with clean energy. Consequences that are criminally underreported.

You may have heard about the claims about atrocious crimes against humanity happening in the Xinjiang region of China.

Over the last decade, it is believed that the Chinese Communist Party has detained more than one million Uyghurs against their will.

Held in what the state calls “education camps”, these people have been subject to forced abortion, sterilisation, torture…

And shuttled into forced labour camps.

And do you know what?

If you’ve got solar panels sitting on top of your roof… parts of those panels have almost certainly been manufactured in one of these labour camps.

That’s because a full 95% of ALL silicon-based solar modules are manufactured using Xinjiang silicon.

Again, this isn’t speculation on my part…

This is the result of analysis straight from Bloomberg New Energy Finance.

And unfortunately, the use of slave labour isn’t just limited to the solar panel supply chain.

The electric vehicle (EV) industry is harbouring its own nasty secret.

Take cobalt for example. This is a metal that the EV industry cannot live without because it’s a critical component in the vast majority of EV batteries.

And cobalt mining has some particularly nasty pitfalls.

Not only can acute or chronic cobalt exposure lead to breathing problems, heart failure, memory loss and blindness…

But its ore is usually found alongside arsenic. So, if you don’t take proper precautions when mining it, it can have catastrophic consequences.

And it just so happens that a full three-quarters of cobalt is mined where there’s very little thought given to safety precautions…

And even less thought to human rights.

I’m talking about the Democratic Republic of Congo (DRC). A country that has a long and storied history of dictatorship, corruption and human rights abuses.

Now, recently, the DRC’s cobalt mines caught the attention of Amnesty International.

Amnesty, along with a group of reporters, personally travelled to the DRC to investigate reports of child slavery in the region’s mines.

What it found was shocking.

Every day in the DRC, as many as 40,000 children – some as young as four years old – are forced to work in makeshift cobalt mines.

At best, these children run the risk of growing up with birth defects or being plagued by seizures…

At worst, they end up tragically losing their lives to the perils of these makeshift mines.

The same thing is occurring over in Indonesia, too.

Are the tragic deaths of these people worth the supposed benefit of EVs…

Vehicles that – according to reports – do not even have a better environmental record until they’ve been driven some 50,000 miles?

Again, if you own an EV, I’m not saying this to judge you.

I’m revealing the truth – the underreported impact – so that you can make your own judgements. We can’t shy away from this.

And believe it or not, the impact on human lives is just one side of the coin when it comes to the damage net zero is doing.

Because it turns out the energy transition could leave its own wake of mass pollution in its path.

That may come as a surprise, given that practically every company you can name is scrambling to go green. Publicly, they all want you to believe they’re all friends of the Earth.

But a recent report by research firm Scientific Beta reveals that companies with “good ESG scores” pollute just as much as their low rated rivals.

These are the same ESG-rated firms your pension advisor is being strongly encouraged to put your money into. Their priority should be making you a return… not throwing your contributions into greenwashed stocks.

What happens if it all comes crashing down is anyone’s guess. But it won’t be pretty.

Now, let’s cycle back to the damage being done by rare earth minerals again.

The metals that are crucial for medical devices, computers, smart phones, heavy machinery, and of course renewable energy technology.

It may surprise you to know, that for every tonne of rare earth minerals extracted, miners also produce 2,000 tonnes of toxic waste.

Given that rare earth production could need to increase by as much as 7x to meet net-zero targets…

Just how much waste do you think stands to be produced?

We’re looking at 4.8 BILLION tonnes of toxic waste annually.

That’s the equivalent of 30 Mount Everests of waste produced every single year.

And that’s JUST rare earths.

It doesn’t take into account the plethora of other materials we need to pull out of the ground to achieve net zero. And the strain that’ll have on the surrounding environment.

When it comes to lithium, for example, you need to suck up two million tonnes of water just to produce a single tonne of the stuff.

You can imagine the devastating impact that has on the surrounding area, like the destruction of wildlife.

None of it makes any sense, when you actually look at the consequences.

Take the fact that the Scottish government felled SIXTEEN MILLION TREES to make way for its latest wind turbine wheeze:

Or take the cargo ship that turned into a fireball after an electric car on board spontaneously combusted, creating a major environmental disaster…

Isn’t this exactly the type of thing the climate crusaders are railing against?

If you think this all sounds completely backwards… it is!

So little of it makes any sort of sense. I think you can see that, already.

We’d like to share the full story with you, and give you some guidance on how you can use all the money flowing into the energy system to your potential advantage.

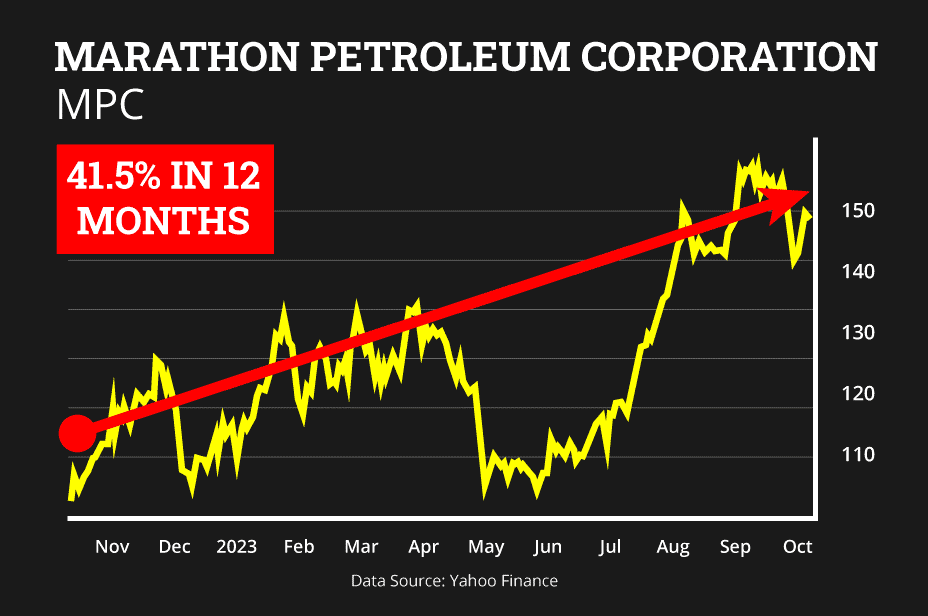

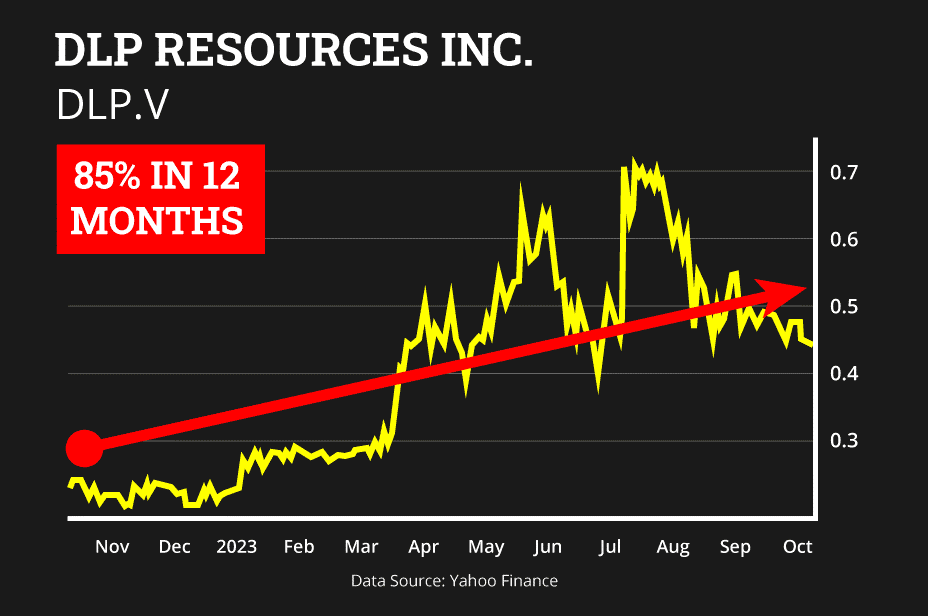

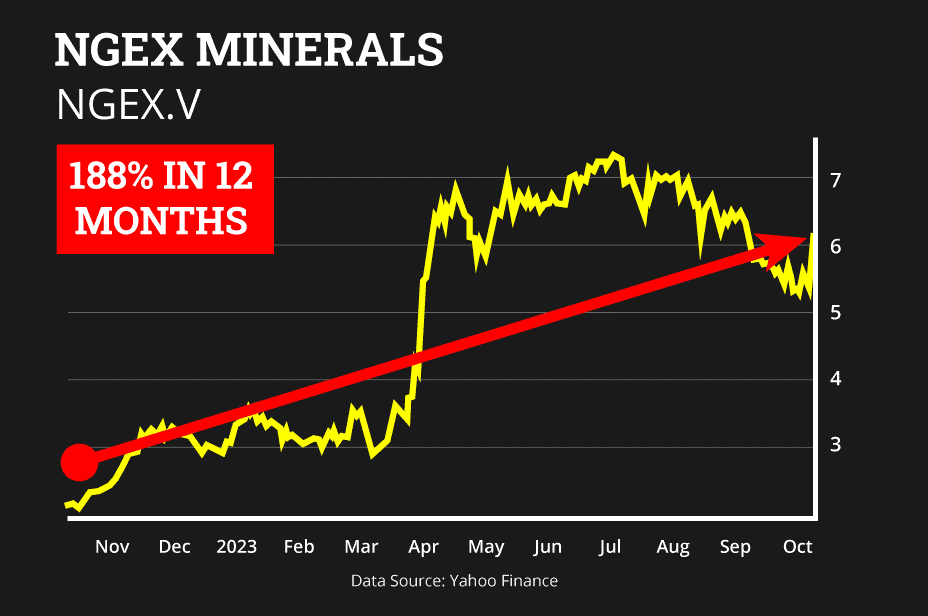

Because – make no mistake – the capital flooding energy stocks right now is having a big reaction:

Past performance is not a reliable indicator of future results. Five-year performance: 2018 7.78% | 2019 +5.69% | 2020 -27.5% | 2021 +6.32% | 2022 +85.78% | 2023 to 30/9 +31.96%

Past performance is not a reliable indicator of future results. Five-year performance: 2018 n/a | 2019 n/a | 2020 n/a | 2021 -14.98% | 2022 +12.2% | 2023 to 30/9 +108.7%

Past performance is not a reliable indicator of future results. Five-year performance: 2018 n/a | 2019 n/a | 2020 +35.06% | 2021 -255.77% | 2022 +66.49% | 2023 to 30/9 +82.47%

To get fully informed about the real impacts of net zero…

And a clear idea of where the big money could be made…

Watch our investigation, now: “The Truth About Net Zero”.

Many thanks,

Nigel Farage

Founder, Fortune & Freedom