In today’s issue:

- “Digital gold” reaches $100,000

- Does the crypto rally have further to run?

- Real gold should have a place in all investors’ portfolios

You’ll be pleased to learn that we have recently assembled a fantastic group of experts for our Gold Summit 2025. Some of the best-known names in the business have joined us to share their thoughts on the current, historic bull market and what they believe will happen going forward. You won’t want to miss it, so be sure to secure your viewing pass here.

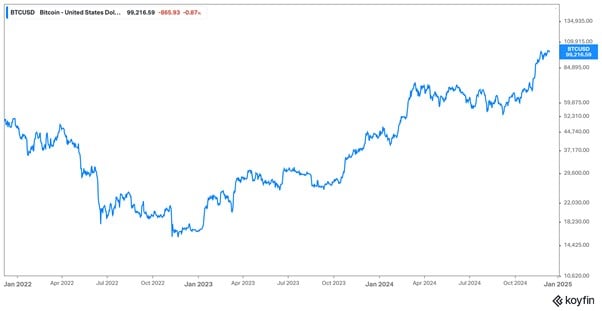

Last week, as some, including my colleague Sam Volkering has long expected, bitcoin rose through $100,000. (At time of writing, it has dipped back below that level.) “Digital gold”, as some choose to call it, remains in a bull market. It has more than doubled over the past year and has risen by 50% in the month following Trump’s election alone.

Bitcoin soars on Trump win (log scale chart)

Source: Koyfin

Source: Koyfin

This is no coincidence: President-Elect Trump in on the record in supporting bitcoin and innovation in cryptocurrencies generally. Some might argue he doesn’t really understand the technology. But that doesn’t matter. The very fact he has said repeatedly that he won’t stand in the way is more than enough fodder for the bulls.

The moniker “digital gold” is somewhat oxymoronic. After all, what distinguishes gold from the other naturally occurring elements is its unique physical properties. But proponents of bitcoin and other crypto will argue that this mixture of physical and digital is precisely what makes it so special and potentially so valuable. Through crypto, one can take the best, natural qualities of gold and combine them with advanced information technology. For some, $100,000 is only the beginning. $200,000 now beckons.

I’ve been a crypto sceptic ever since I began to follow developments with bitcoin and rival crypto back in 2012. To me, it all seemed a fascinating monetary experiment. But an experiment it remains. The practical applications of crypto, other than as a form of speculation, remain strictly limited.

Some argue that this is due largely to regulations. They have a point. Most governments have not been friendly to crypto. They will claim this is because they want to protect the public from crypto scams. Or that they worry crypto is being used for money laundering, tax evasion, terror financing and the like.

In my opinion, such claims are fatuous. The vast majority of scams out there use official money. The same is true of money laundering, tax evasion, terror financing, you name it. The largest fines for all of the above have been paid by some of the largest banks in the world—highly regulated institutions, the leaders of which frequently also serve in government during their careers.

No, the regulatory witch-hunt against crypto must be about something else entirely. In my opinion, it is about protecting governments’ monetary power. That power is massive. It allows governments to inflate and to tax. It allows governments to track and trace transactions. It allows governments to impose economic sanctions on others.

To borrow a metaphor from Tolkien, the coin of the realm is the “all seeing eye” of Sauron. Viewed in this way, crypto represents a real threat to the powers that be.

Hence the prospect of a crypto-friendly individual occupying what is arguably the most powerful office in the world has been welcomed by the crypto community as strongly bullish. With that, I don’t disagree.

But I do take issue with crypto proponents’ claims that it is somehow better than gold. Better at what, exactly? I’ve engaged in countless debates with crypto enthusiasts through the years and none of them have ever been able to convince me that “digital gold” is better at anything than real, physical gold.

If that sounds anachronistic, you’re not wrong. But I’m no Luddite—I fully embrace technology. In fact, I like the idea of combining the timeless properties of gold with modern tech. There’s no reason why physical gold, securely stored in a trusted vault and traded among reliable counterparties, shouldn’t have a digital counterpart. As long as it’s backed by actual, physical gold, digital gold works for me.

But what I won’t do is throw out the baby with the bathwater and do away with physical gold in favour of something backed by a vast and impressive but nevertheless man-made digital infrastructure.

In early 2012, I wrote a long report asking the question as to whether bitcoin could ever supersede gold as the ultimate money. I conclude thus:

As Lord Acton observed, power tends to corrupt; absolute power corrupts absolutely. By corollary, monetary power tends to corrupt; absolute monetary power corrupts absolutely. So now I lay my monetary cards on the table: No form of money can possibly replace that which transcends all government, all laws, and, indeed, all things created by man.

The bitcoin and crypto ecosystem may have evolved by leaps and bounds in the interim by my view above remains unchanged. Gold is the ultimate money.

I’m not alone in this view—several of the gold experts we’ve assembled for the Gold Summit 2025 share it. If you haven’t already registered, now’s the time. Don’t miss out—sign up here.

Until next time,

John Butler,

Investment Director, Fortune & Freedom