What is inflation?

Inflation is a general increase in prices and a decline in the purchasing power of money.

I once studied under an influential member of the US Federal Reserve Bank. He taught us that inflation occurs due to sustained growth in the money supply.

We’ve seen an increase in the money supply for years now. And he would argue that the effects of that are being felt today.

What is the UK inflation rate?

In the UK, inflation is often measured using the consumer price index, or CPI, which reports the change in the price of consumer goods and services over time. The annual inflation rate in the UK increased to 7% year-over-year in March. That’s up from 6.2% in February, and it’s at its highest level in 20 years.

Not surprisingly, the greatest increase came from motor fuel and petrol costs. But prices are up across the board.

Why is inflation dangerous?

Inflation is dangerous because it robs you of your purchasing power. One pound buys less.

That affects everyone.

Even if you don’t see price increases, the size of the packages at your local store will shrink, so you’ll pay more per unit.

The money you hold in your savings account becomes less valuable. It buys less.

Alternatively, because prices rise, those who own assets can benefit on a nominal basis. In other words, the value of the assets they hold grows.

You will have seen this if you own your home or other real estate. Inflation has raised rents, which has in turn pushed the price of real estate higher.

However, interest-rate hikes by central banks to fight inflation will temper the increase in real estate values. We’re not there yet, though. Prices are still strong.

How to invest to stay ahead of inflation

So, what else can you do?

Another “real asset” you can consider is gold. Throughout history, this precious metal has been known to protect people’s purchasing power in times of inflation.

Does gold keep up with inflation?

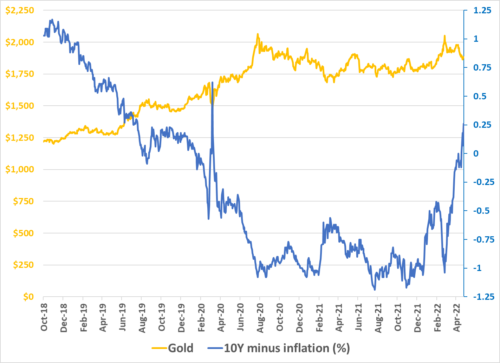

It’s helpful to compare gold with the real interest rate, also known as the inflation-indexed interest rate. This is the US 10-year Treasury rate minus the CPI mentioned above:

Gold helps you protect what’s yours

Source: Bloomberg, analyst calculations

Gold inflation correlation

From mid-October 2018 to April 2022, the correlation between gold and the real rate was a negative 0.93. That’s a strong inverse relationship, and shows that gold tends to move in the opposite direction of real rates. (A perfect negative correlation is a negative 1.)

In this chart, you can see gold rising from October 2018 until the real rate bottomed at just below a negative 1% in August 2020.

Following that, the gold price trended between $1,700 and $2,050 an ounce, while the real rate trended between a negative 1% and a negative 0.5%.

Since March, we’ve seen the real rate bottom and rise with the 10-year, while gold has slipped.

As inflation rises, I expect the real rate to fall. If inflation rises faster than rates, we’ll see the real rate turn negative again. That’s bullish for gold.

Practically speaking, you should care about gold because it tends to help you maintain your purchasing power. As the power of a unit of fiat currency erodes, gold rises. It’s the true currency you should follow. Fiat currencies can be printed at the whim of governments.

Many of us have seen prices rise more than the government numbers suggest. This is true in the UK, the United States and elsewhere. It’s a sad fact of our current lives – especially for those on fixed incomes – and it’s exactly what we’re trying to protect ourselves against.

Today, earning a return on your investment should be secondary to staying afloat. Maintaining your purchasing power is paramount.

Gold is one of the ways you can do that.

So, is inflation eating away at your money?

Simply… Yes.

Inflation reduces the value of each dollar in your wallet… or your bank account.

Owning assets that move higher in spite of inflation is key.

Still not sure what to do?

Our Inflation Survival Guide

Are you still worried about inflation? Our Inflation Survival Guide is one of our complimentary reports which covers inflation from many different angles, including what drives it and who the winners and losers are.

Read our inflation survival guide

Read more from Fortune & Freedom

Does this make sense? Have you experienced this? I encourage you to subscribe to the daily missive Fortune & Freedom with Nigel Farage for free. Editor Nick Hubble has been on top of this currency story for years. I recommend you learn more about it. You don’t have anything to lose. The service is free!

If you’re not already subscribed, you can do so by entering your email address in the sidebar and clicking subscribe now!

And look for more ways to protect your purchasing power going forward in these pages.