In today’s issue:

- The UK economy is slowing yet again

- Recent tax hikes are unlikely to raise revenue

- Government finances will continue to deteriorate

Have you ever wondered from where this idiom originates? What exactly is this “other shoe,” and why is it so significant when it “drops”?

Some argue it’s American in origin, while others insist it’s English. The meaning, however, is plain enough: once one event occurs, another related event with known, unpleasant consequences becomes both inevitable and imminent.

The supposed origin of the phrase is from the days when many workers wore heavy boots that, when taken off and dropped on the floor, would land with a thud. Naturally, once the first boot was dropped, the second would inevitably follow, its thud anticipated as an unavoidable conclusion to the sequence.

The best way to imagine this is if you lived in a flat with an upstairs neighbour. You’re relaxing at home after a day’s work, and you hear steps above as your neighbour returns home too. A moment later, you hear a loud thud. You then know another is shortly on the way.

Well, one economic “shoe” has recently dropped: the economy has begun to slow again. According to the Office for National Statistics (ONS), growth in Q3 was a mere 0.1%, well below the 0.5% in Q2.

Over the past year, the economy has grown by 1% but, due to population growth, real per-capital income is down by 0.1%.

That’s before income tax, by the way. And now taxes are going up even though growth is effectively zero.

Meanwhile, the rate of inflation is no longer declining. The ONS reports that, following a long decline to a 2.6% annual CPI rate in September, in October it rose back to 3.2%.

It should thus be no surprise that the Bank of England decided at its most recent meeting that interest rates were going to remain on hold. Even at 2.6%, that’s slightly above target. Now it’s back above 3%.

The Consumer Price Index (CPI) has consistently exceeded the target since July 2021, marking nearly three and a half years of persistent inflationary pressures.

Has the definition of “target” changed perhaps? Or is “moving target” now a more apt way to describe whatever it is that the Bank of England claims to be aiming at?

Regardless, the bond market seems to have noticed that the UK continues to have an inflation problem, one that might even worsen as a result of large public sector pay rises in the budget. The 10-year gilt yield, which had fallen below 4% earlier this year, has climbed back to around 4.5%, despite a slowdown in economic growth during the same period.

Source: Koyfin

Source: Koyfin

Uh-oh. Those hopeful that mortgage rates were going to decline might be disappointed.

And so will the government. Debt servicing costs, a huge portion of the overall budget, aren’t going to fall in line with budget projections.

This helps to explain why the October government borrowing figures were surprisingly high at £17.4 billion, up from £15.8 billion in October 2023.

And so, we now brace for the inevitable “second shoe” to drop: the realisation that, given all of the above, the tax hikes outlined in the budget are unlikely to fill the so-called “black hole” in public finances. This “discovery” by the Chancellor – made upon crossing to His Majesty’s Government’s side of the Commons and finally reading the books right-side up – seems destined to fall short of its intended mark.

Government finances are going to keep right on deteriorating. With that goes away any hope Labour had that they can somehow tax their way out of the mess they’ve inherited and already made even worse.

As if we needed any more evidence that we are already the far side over the “Laffer Curve” where increases in taxation don’t generate any additional revenue and could in fact reduce it, well, there you are.

Growth: zero. Inflation: rising. Bond yields: rising. Tax revenue: declining.

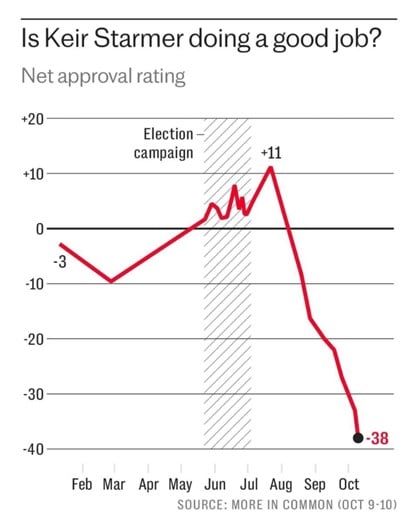

Public support for the government: collapsing.

But is there really no way out? What about the rest of the world? Could the UK just devalue and export its way out of this mess? No. The global economy has been slowing too.

That doesn’t mean they won’t try. The UK has a long history of trying to devalue its way out of its debts. But then it’s in good company. Many countries around the world are carrying large debt burdens and might be tempted to try to devalue and export their way out.

[If they do, the big beneficiary is going to be gold. In this environment, all investors should hold some gold, whether that be physical bullion or a portfolio of mining and royalties companies, or both.

This is why we’ve organised our upcoming 2025 Gold Summit, bringing together many gold market experts. You won’t want to miss it, so click here to register your interest now.]

And now incoming President Trump is threatening to introduce tariffs. A global trade war is brewing; just what a relatively small, open economy such as the UK needs.

Not.

No, Labour can’t tax their way out of their financial woes. They’re going to have to cut spending instead.

I’m going to make a prediction here that, even if Labour makes it through the current fiscal year without modifications to their first budget, their second budget will include some sort of freeze on public sector pay – whatever they choose to call it – including on the NHS and local councils.

Yes, their core base of support will be in an uproar and demand Ms Reeves’ head and possibly Sir Keir’s too. They might not drive toy tractors down Whitehall in protest, but they’ll find a way to express their anger.

Perhaps they’ll go on strike. What then? What happens to tax revenues when the NHS and local councils go on strike? It doesn’t go up, that’s for certain.

I can’t predict exactly how it will unfold, but it feels as though we’re on the cusp of something reminiscent of the 1970s. Back then, Labour were forced to confront the hard truth that they had hit the practical limits of tax-and-spend policies, leading to an awkward and inevitable volte-face.

As we know, Thatcher came to power soon thereafter, followed by President Reagan in the US, who was carrying much the same message: that the era of government largesse was over. Such things tend to follow a “Winter of Discontent”.

This time round, it appears the US may be in the lead, with entrepreneurs Elon Musk and Vivek Ramaswamy appointed by president-elect Trump to direct the Department of Government Efficiency (DOGE).

Or does Argentina’s President Milei, having now completed a full year in power, deserve the credit for starting the “chainsaw heard round the world”?

Until next time,

John Butler

Investment Director, Fortune & Freedom

PS If you have yet to register for our upcoming 2025 Gold Summit, you can do so by clicking here. You won’t want to miss it.