Because we live in a global financial centre, it is easy for British investors to profit from any conceivable trend. From Australian small-cap gold miners to the likes of global behemoth Pfizer, you can find anything on the London Stock Exchange. And that means you have the opportunity to profit from just about all that happens in the world. It just takes is a few clicks of your mouse.

Figuring out what’s going to happen, and how it will move markets, is a lot more difficult…

This report aims to help you profit from Brexit, and all the trends it’s creating. It has three distinct parts.

The first sets the scene. In order to profit from Brexit, you need to understand why Britain will benefit from Brexit at all.

At Fortune & Freedom, we believe our readers need to understand the why behind our claims. After all, we’re trying to help you become more financially independent, not more dependent on us.

Besides, you might disagree about some (or all) of what you read. In which case, you’ll know what you don’t want to invest in. Nigel Farage insisted that there be no “company line” in Fortune & Freedom. We like to disagree about many things, too. But we certainly agree on Brexit.

Once you understand the forces that create the Brexit Boom, I want to tell you what not to do with your money if you want to benefit. You see, I expect that most Brexiteers are going about investing in the Brexit Boom in precisely the wrong way. Instead of seeing Brexit boost their wealth, misguided decisions and misunderstood investments about Brexit will likely hold them and their money back.

Last, but obviously not least, let’s take a look at which stocks, and types of stocks, appear set to benefit most from Brexit.

As you’ll see, there’s a golden thread running through almost all of our reasoning. But first…

Will Britain really boom after Brexit?

The biggest caveat to the Brexit Boom is simple. In and of itself, Brexit doesn’t inherently benefit the economy. That’s because it merely decides who makes the laws, not what laws they make.

In other words, Brexit reassigns power from the European Commission to the UK Parliament. So, we may be free to govern ourselves going forward. And that is both good and likely to benefit us, especially over time. But it also means being free to make our own mistakes… Mistakes that could cause trouble for the UK economy and stock market too.

So, what makes me believe that Brexit will put the UK on a better path than it was on inside the EU? The first big reason is the restoration of democracy. Or, more precisely…

1. The return of political accountability

The UK is much more democratic than the EU, where the unelected European Commission holds the key powers. And a return to democracy, by way of Brexit, will mean the return of democratic accountability.

Our leaders will no longer have the excuse that they’re bound by European directives from our unelected leaders in Brussels. They’ll be able to deliver on political promises, not just make them. And, if they don’t deliver, the threat of other parties will hold them to account.

This threat will lead to better government over time. The UK’s political class fears its voters much more than the EU’s does.

Indeed, as Nigel Farage pointed out in the past, do you think Herman van Rompuy would’ve been one of our most important political leaders if being elected was a requirement?

The very fact that Brexit happened at all demonstrates the point I’m trying to make. When the Remainers in Parliament tried to ignore and overturn the referendum result, as so many similar referendums on the EU were ignored, the UK electorate had its say in emphatic fashion and got Brexit done. The threat of Nigel Farage’s Brexit Party played a key role.

So it didn’t take long for evidence of Brexit’s benefits to emerge. Our politicians are scared of us again because they’re accountable again.

2. Speed, flexibility and self-interest

During the referendum campaign, we were often told that being part of a big bloc benefits us by giving us more clout on the world stage. Meanwhile, Nigel Farage would often point out that well-governed small nations are actually the most prosperous. And that the EU acts in its own self-interest, not in the interest of its individual nations. Not to mention that those interests often differ.

Well, the argument was settled within months of Brexit.

The UK’s ability to secure vaccines (whatever you might think about those vaccines) left the EU in the dust.

In the EU, there was utter fury about delays. But the democratically elected politicians could simply blame Brussels for the debacle.

A government that can act fast, with flexibility and in our national interest, is preferable to… whatever the EU gets up to. The evidence is now overwhelming.

3. Trade with the world, not just the EU

You might think the EU is in favour of free trade. But it is really a protectionist bloc with an “us and them” mentality. It doesn’t believe in free trade with those outside the EU.

The UK’s ability to secure trade deals that benefit the UK is greatly improved after Brexit because we don’t need to secure approval from the rest of the EU. Nor do we have to fear vetos from small nations that can hold the whole process to ransom.

And so we have managed to do the deals which the EU did not, such as those with Australia, and trade deals which caused the EU endless negotiations, such as with Japan.

But this is just the beginning. Instead of being part of a trade bloc at the expense of the rest of the world, we are now free to do trade deals with whomever we decide, with whomever it benefits us to do them.

Eight new free ports, joining the Trans-Pacific Partnership, and plenty more opportunities are already being taken. The UK’s listed companies and their shareholders can benefit from these new economic ties, while the EU’s trade barriers hold the continent back.

4. Deregulation

The biggest promise of Brexit is the longest-standing one. We can get rid of the EU’s most ridiculous regulations.

So far, the “bonfire of red tape” hasn’t really kicked off. At least, not in the ways Brexiteers might’ve wished.

But it’s still on the table. And merely avoiding the EU’s latest hare-brained schemes is an achievement. Unfortunately, Northern Ireland is still subject to many of them – 4,000 in 18 months alone, according to the government. This leaves Northern Ireland at a disadvantage which would apply to the whole of the UK if it were still in the EU.

I discuss just how powerful deregulation can be in your Fortune & Freedom welcome series. Look out for an article about Germany’s no-deal Brexit in your inbox in the coming days.

5. A boom that began in 2016

The last reason I’d like to give for being optimistic about Brexit is the historical evidence. No doubt the media has been telling you the world ended since the country voted to leave the EU. And no doubt you noticed it didn’t – despite the pandemic and all.

But consider some of what did happen…

Unemployment hit record lows. Foreign direct investment into the UK hit record highs. The FTSE 100 hit record highs. As did house prices. We registered a monthly trade surplus for the first time in eight years. In April 2022, exports to the EU reached record levels.

All this was in direct contradiction to the doom and gloom of Project Fear.

And the run was set to continue, with the UK economy growing the fastest of the G7 in 2021. It was also expected to in 2022 until the war in Ukraine began.

The UK’s good economic performance post Brexit shouldn’t have come as a surprise. Before 2016, Britain’s highest ever recorded annual GDP growth rate was 6.5%, in 1973. That’s also the year we joined the European Economic Community… but the year after Brexit finally passed, we set a new record of 7.5%!

These five reasons why I believe Britain will boom “despite Brexit” provide examples of what a self-governing, democratic and independent nation can do, while those stuck in the EU are hampered every step of the way. The divergence will add up over time, and it has already begun.

But what about the terms of the Brexit deal? Have we chained ourselves to the EU too much to truly benefit from Brexit?

Has Boris blown Brexit?

The UK’s new relationship with the EU is not the Brexit anyone would have wished for. But the EU’s primary concern was to make leaving the EU look bad. And when you’re negotiating with a bitter opponent instead of a future partner, success and failure is measured in damage done instead of opportunities created.

We remain tied to the EU on many issues. And the position of Northern Ireland is downright bizarre.

But even EU politicians can only harm their own voters for so long before seeing a serious backlash. The nonsense we’ve seen at the border and the absurdities of the deal are only highlighting the need to come up with something better. And, in the end, barriers with Britain don’t benefit anyone.

Speaking of which…

How not to invest for Brexit

Investing isn’t about figuring out what goes up and what goes down in price. It’s about choosing between alternatives. After all, if your portfolio went up 10% but the FTSE 100 index rose 20% you’re not really doing as well as you should be.

So, let’s take a look at how not to benefit from Brexit. Which investments will Brexit likely disadvantage? Which investments should you avoid if you want the chance to benefit from the Brexit Boom?

Unfortunately, one of the investments most commonly held in the UK is top of the list.

Before we get to that mistake, a more general warning…

Beware of the Brexit Bias

Most investors in the world suffer from what’s known as “domestic bias”. They overinvest in local stocks because that’s what they know best (and it usually costs less in brokerage fees). This is doubly dangerous, because we are usually overdependent on the local economy in our everyday lives already.

Our jobs, the small businesses we own and the value of our homes, for example, are all dependent on UK economic conditions. Adding UK investment exposure just piles on the risk. But investing internationally means you diversify, and thereby reduce your reliance on things going well in the local economy.

“Diversification is the only free lunch [in investing]”

– Attributed to Nobel Prize laureate Harry Markowitz

Now, UK investors who hold local UK stocks are probably already quite internationally diversified. That’s because the London Stock Exchange is home to so many international companies, or even small companies from overseas that have chosen the London stock market ahead of their local one for various reasons (despite Brexit).

So, on the one hand, you’re likely doing better than most investors around the world when it comes to “domestic bias”. However, for believers in Brexit (like me), there is the risk that we let our enthusiasm lead us astray. That we become overexposed to the UK by overinvesting in UK-focused stocks.

So, while I highly recommend being invested to profit from Brexit, DO NOT OVERDO IT.

The pandemic, the war in Ukraine and the global financial crisis of 2008 demonstrate that surprises happen. We don’t yet know who will be leading Britain in its post-Brexit future, let alone how…

Having an unusually large exposure to UK stocks that stand to benefit is a good idea. But beware that you may already have this in your portfolio, or just your assets, already.

With that in mind, let’s look at which investments, which you might own, will not benefit from Brexit.

How to miss out on the Brexit Boom

You might think that profiting from Brexit is nice and simple. All you need to do is buy a portfolio of UK stocks and then you’ll be set to benefit. Why make things more complicated?

Because they are more complicated.

There’s one big fly in the ointment to keeping it simple. Strangely enough, it’s the same fly that kept our economy outperforming Europe’s despite the referendum result. And it’s the same one that sent our stock market soaring to record highs after the referendum. It’s called the British pound.

In short, the pound is threatening to rob unsavvy Brexiteers of their future investment gains. Ironic, isn’t it?

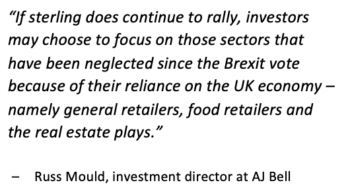

I’ll explain the details next. But realise that this is perhaps the most important and underappreciated message I have for you in this report: if Brexit is a success, the pound will rally, particularly in the long term.

And this, in turn, means that, if you are a believer in Brexit, you should not invest in the UK stock market’s FTSE 100 index, nor most of its shares. And here’s why…

How the pound will rob the FTSE 100

The UK’s stock market index, the FTSE 100, trades inversely to the pound. This means that a falling pound props up our stock market and a rising pound holds our stocks back. It might be counterintuitive, but it’s pretty simple.

The UK stock market features many huge international companies with vast foreign earnings denominated in foreign currencies. When the pound goes up in value on foreign exchange markets, those companies’ profits aren’t as valuable in terms of pounds. So their share prices fall.

When the pound goes down, the international profits of the companies in the FTSE 100 index are worth more in pounds, so the share prices rise.

That’s why, after the Brexit vote, the pound tumbled but the FTSE 100 outperformed, even hitting all-time highs. A lower pound meant bigger profits for large international companies listed on the London Stock Exchange. Here’s a newspaper headline from October 2016 which demonstrates the point:

That effect works both ways.

Will you be robbed by the pound?

Now, if you were an Australian investor who owns UK stocks, a rising pound would benefit you. That’s why the UK is becoming such a popular place for foreign investment. People are optimistic about the pound.

But if you’re a UK investor, the rising pound spells trouble. Or at least a challenge. If you own the wrong shares, such as a broad holding in the FTSE 100, you probably won’t benefit from Britain’s Brexit Boom. Because, if the pound surges over time, as I expect if Britain booms after Brexit, then the FTSE 100 will be held back. It will underperform the alternative investments I’ll reveal below.

Keep in mind that we’re talking about a major long-term change here. The pound has been in a long-term downtrend for decades. The investment strategies that have worked during those decades – stocks with international sales – will no longer work. It’s like sailing with the tide. When the tide changes…

So, what about stocks that don’t source their earnings overseas? Companies that have local earnings are not disadvantaged by the exchange rate. In fact, it may benefit them, as we’ll look into below.

This report is largely about that distinction. So, let’s dig into which shares I believe are the wrong ones, and then which are the right ones, if Britain booms “despite Brexit”.

The type of shares to avoid in a Brexit Boom

As I said above, the FTSE 100 as a whole trades inversely to the pound. So, passive investing, or buying an index ETF which follows the FTSE 100, is not the best option if you want to profit from a prosperous future for Britain.

To be clear, I still expect the FTSE 100 to rise as the Brexit Boom unfolds, but not as much as certain more carefully chosen stocks.

The stocks that will drag the FTSE 100 under are any stocks with foreign earnings, whose value will fall as the pound rises.

If you want to profit from Brexit, here’s what you should do…

1. Avoid exporters and multi-national global companies

The London Stock Exchange is home to many multinational behemoth corporations which have few ties to the UK economy. If the pound rises, their profitability will fall in pound terms, reducing the value of their shares priced in pounds.

To be clear, this doesn’t really suggest the companies themselves are doing any worse. It’s just that their profits will be worth less in our specific currency, which makes their shares worth less in our specific currency.

Valued in other currencies, those shares could still go up. But what matters to us is their shares priced in pounds.

It’s a bit odd to think that exchange rates can play such a role. But that’s the key to understanding any investment advice involving Brexit. Ignoring it is also the mistake I expect nine out of ten UK investors to make in coming years. I hope you won’t, thanks to this report.

So, which are some of the major multinational corporations I expect to underperform as the pound rises?

Diageo (DGE.L), GlaxoSmithKline (GSK.L), Associated British Foods (ABF.L) and Burberry Group (BRBY.L) all have a huge chunk of their sales revenue coming from overseas. That puts them at the mercy of a rising pound.

To be clear, they might still go up. But I expect them to underperform the stocks exposed to the Brexit Boom as the pound rises over the subsequent years.

2. Avoid commodity producers listed on the London Stock Exchange

For the most part, commodities are bought and sold in US dollars. So avoiding companies that sell commodities is an obvious choice. As the pound goes up, each sale will be worth less.

This is disappointing, because I expect commodity prices to surge and commodity firms to have a bright future. But if you believe in Brexit, and a rising pound, then you can expect them to underperform stocks exposed to the local economy, at least in terms of pounds.

Oil stocks such as Shell (RDSA.L and RDSB.L), miners like BHP Billiton (BLT.L), Glencore International (GLEN.L), Rio Tinto (RIO.L) and many others will struggle under a rising pound, relative to more local stocks.

3. Reduce your exposure to overseas assets

Despite warning about “domestic bias” above, a key way to benefit from the Brexit Boom is to be overexposed to UK stocks (to a sensible extent). You can do this by shifting what UK investments you own, as I’ve just discussed. But you can also do it by owning fewer investments overseas, such as foreign currencies, foreign property, or investments in foreign shares and bonds. These will be held back in terms of pounds, if the pound rallies.

There are non-financial reasons to hold such assets, of course. I’m not saying you should sell your holiday home if you enjoy going there. In fact, it could become cheaper than ever to visit your holiday property, or to pay off its mortgage, as the pound rallies.

Similarly, the crackdown on those who oppose the powers that be, as we saw in Canada at the start of 2022, suggests holding some of your wealth overseas is a good idea. So, act in moderation and be aware of how exposed you are to the UK’s success already.

The type of shares to consider in a Brexit Boom

Now that we’ve covered what to avoid, if you’re seeking to profit from a Brexit boom, let’s take a look at the sorts of stocks you should consider holding more of…

1. Consider importers with domestic sales

Just as it’s worth avoiding UK stock market-listed companies with foreign earnings, it’s a good idea to focus on buying stocks with UK domestic sales, particularly if they import what they sell. A rising pound would benefit those stocks twice over – their imports would be cheaper, and sales would be growing as the UK economy booms.

Furniture and furnishings retailer Dunelm (DNLM.L) is a prime example of a UK-focused retailer that imports its stock and sells locally.

Stagecoach Group (SGC.L) is another example of a company that should ben

efit from Brexit. Having sold out of its non-core businesses, it is now a UK-focused bus operator. A

lthough it’s not quite an importer of goods, its key costs are exposed to currency moves in much the same way. Stagecoach imports buses and pays for imported fuel. These will become cheaper as the pound rises.

This is not a recommendation for Dunelm or Stagecoach. Instead, they’re prime examples of companies that stand to benefit from Brexit by way of the pound and trade.

2. Domestic industries exposed to the UK economy

Companies that operate entirely or mostly within the UK economy stand to benefit if that economy does well – as it did with UK GDP growth topping the G7 in 2021.

Companies that operate locally aren’t as affected by the pound’s swings, so they can benefit both from the pound’s drop (like in 2016) and from the rising pound, as well as from Brexit itself.

One way to benefit from such a boom is to consider a fund such as Merian UK Smaller Companies Fund GBP Acc. It’s 100% UK invested, and into small companies. The fund focuses on growth stocks. The major holdings, by sector, are what we’re looking for:

Merian UK Smaller Companies Fund top five sector holdings

Why invest in small companies? Because they are less likely to be exporters or importers. They’re exposed to the UK economy’s boom, not trade flows.

If you’d like to be more specific, retailers which primarily or entirely sell in the UK market are an excellent way to profit from a booming UK economy. Companies like Tesco (TSCO-L), for example.

3. Invest in UK property

There’s nothing more domestic than investing in UK property.

London house prices took a hit in the wake of the Brexit referendum. But the rest of the country began to see house-price gains. That’s an extraordinary shift: the country’s most prosperous region seeing falls while the rest of the country sees rising prices…

But what does it mean? I think it’s a strong signal for a bright future in UK property because of domestic demand. It tells us that the London bubble may be struggling because of its ties to the EU, but that the real economy outside London is looking promising. This is just the sort of rebalancing the UK needed for the entire economy, and not just London, to boom.

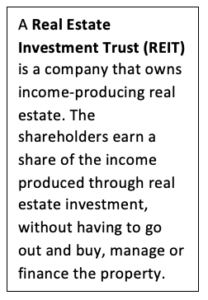

Investing in Real Estate Investment Trusts (REITs), homebuilders and other property exposed companies is a simple way to profit. But before I detail a few, consider this. If you own your own home, or more property, you’re likely already heavily exposed to property prices. Adding even more exposure may not be a good idea. As always, I’m going to let you decide, because nobody knows your personal circumstances better.

Investing in Real Estate Investment Trusts (REITs), homebuilders and other property exposed companies is a simple way to profit. But before I detail a few, consider this. If you own your own home, or more property, you’re likely already heavily exposed to property prices. Adding even more exposure may not be a good idea. As always, I’m going to let you decide, because nobody knows your personal circumstances better.

iShares UK Property UCITS ETF (IUKP.L) is the one-stop shop for investing in UK property related companies. It mostly holds UK property REITs and is 99% UK invested. Many of my subsequent watchlist stocks feature within this ETF.

REITs are a popular way to invest in UK property itself, but via the stockmarket. They focus on commercial property of various kinds. The iShares MSCI Target UK Real Estate UCITS ETF (UKRE.L) invests in the major UK REITs. It has been in an uptrend since the referendum drop.

Brick maker Ibstock Bricks (IBST.L) and the construction-materials provider Forterra (FORT.L) are companies exposed to a UK property boom. They’re very similar and direct competitors. The key distinction is that Forterra is a little more diversified.

Ibstock’s shares almost doubled in the two years after the Brexit referendum. Forterra’s a little more.

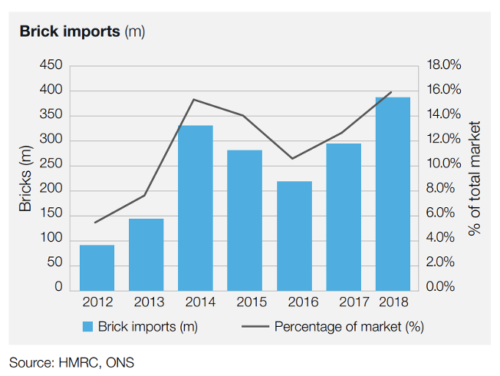

Why the focus on bricks? Forterra’s 2018 annual report puts it nicely:

For a number of years, in addition to a base demand from commercial and specification projects seeking the aesthetics of brick types not manufactured in the UK, brick imports to the UK have been used to bridge the gap between domestic supply and demand. Imports have increased in recent years in support of the capacity-constrained domestic market.

The low value to weight ratio of bricks coupled with the UK’s island geography make the importing of bricks a costly exercise. With 16% of the UK demand for bricks being satisfied by imports in 2018 this creates future opportunity for the Group following the announcement of the project at Desford, which will increase the Group’s brick manufacturing capacity from 2022.

Source: Forterra 2018 annual report

Source: Forterra 2018 annual report

The idea that Britain doesn’t produce enough of its own bricks is remarkable. And yet, there is, according to the industry website The Construction Index, “The great brick shortage conundrum”, which has persisted for years. But that may change thanks to the likes of Ibstock and Forterra’s new investments. And if there are any trade disruptions, these two will be the companies that benefit.

Over at UK Independent Wealth, Nigel Farage and former (reformed) investment banker Rob Marstrand have another property-related company – probably the best one to profit from a UK property boom. But, because it’s an open recommendation (at the time of writing), I can’t reveal what it is.

If you’d like to find out what specific shares Rob recommends, you can find out more about UK Independent Wealth here.

4. Stocks that could benefit from deregulation

Margaret Thatcher’s Big Bang turned the City into something that could rival New York, and left Europe’s financial centres in the dust.

Well, Brexit creates the opportunity for Big Bang 2 – an opportunity for the rest of our economy to be unleashed from the ball and chain of overregulation too.

Now I’m not optimistic enough to think this will happen overnight… or even fast. But it could happen in certain key industries, just as it did in the 80s. And you could stand to profit by investing in them.

But which industries?

Top of the list is the same one that benefitted from the last Big Bang. The UK’s financial sector has been struggling under some of the EU’s stranger efforts. These days, the City is keen to benefit from Brexit instead of disparaging it:

Source: The Telegraph

Source: The Telegraph

If you’re wondering why bankers have had such a change of heart over Brexit, here’s your answer from Bloomberg:

London Bankers Seen to Be Primed for Bigger Bonuses After Brexit

-

- Lloyd’s of London chairman says U.K. is now free from EU rules

- British banker bonuses have been capped relative to base pay

Where do you think the bankers will prefer? The bonus-capped EU or the UK?

We’ll need to wait and see what other industries are targeted by the UK government for deregulation. But it’ll pay to keep an eye on them.

5. Stocks to profit from trade deals

Europe’s deepest, darkest fear is that Brexit will allow Britain to break free from Europe’s crazy regulations and constraints. Success would be humiliating to the EU’s leadership and enticing to EU voters.

But perhaps escaping the EU’s trade barriers and finding new trade partners is just as big an opportunity to the UK. In the past, Europe’s economic doldrums dragged Britain down. That’s because Europe dominated our trading relationships. But what if that were no longer the case?

What if Europe were just another trading partner alongside many others? What if we could make our own trade policy? Then British business could be exposed to parts of the world that are booming. And the country’s economy would boom with them.

Contrary to the drama you’ll hear in the media, trade deals are much easier for small individual countries to make. Austria’s recent veto of the EU trade deal with the South American trade bloc known as Mercosur is a great example. The veto, which stops all the nations of the EU from having a free trade agreement with the Mercosur countries, was based on the fires in the Amazon…

No doubt there will be plenty UK companies looking to boom as a result of freer trade with the world. And plenty of companies are itching to sell us products that the EU tried to keep out of its single market. Australian wine producers, for example.

Keep an eye on the trade deals yet to come for more profitable opportunities.

Nick Hubble

Editor, Fortune & Freedom