In today’s issue:

- Who’s going to break it into the big leagues first?

- Who is David O. Sacks?

- AI + drones = defence

Editor’s note: Today, we bring you a guest piece by Sam Volkering from his publication AI Collision which was first published on Tuesday 10 December.

You can hear from Sam more often at AI Collision and learn more about the latest developments in AI by simply clicking here to sign up for free.

Welcome to AI Collision 💥,

There’s a lot of chatter online about the next rebalancing of the S&P 500. It’s happening this week and making it into the premier league of indexes could mean big business and big stock price jumps for companies that get promoted.

It’s a funny thing really – when I was chatting to someone about it recently, they likened it to the promotion/relegation system of English football (and other football leagues, yes).

The only difference with the S&P 500 though is that it’s not just about size. As recently noted in an article on MarketWatch, additions to the S&P 500 is “more art than science”.

But the reason addition to the index can mean good things for a stock’s price is that it automatically means trillions in wealth starts to move around.

It’s estimated there’s over $13 trillion in passive index funds. A passive index fund is a fund that just invests in the companies that make up a particular index, such as the S&P 500.

All the fund does is to invest into the companies that make up the index, that’s it. And therefore, is closely correlated to that index’s price movements.

Now if you’re a company that’s exiting the S&P 500, these funds can no longer hold your stock. It’s not personal, just that you aren’t in the index anymore, so they’re out. That money then moves into the companies that are entering the S&P 500. There are no ifs or buts about it, they have to invest in these new companies.

That is automatic demand for a stock at market prices. So, what we tend to see is that a company entering the index gets a nice little run up before entry. What is also a telling sign is that you’ll get no stock trades from insiders in the days before as they’re notified of material non-public information and hence are on a trading blackout.

So, with the rebalance impending, who’s looking to come in… and are there any AI plays that might be seeing a little run up in price this week on the potential of their inclusion?

According to that earlier article from MarketWatch, here’s a list of likely contenders.

It’s a good mix. You’ll see there’s some companies we’ve written about here already. Southern Copper, Vertiv, GlobalFoundries, these are all AI-related companies we’ve covered.

But there are some others too we’ve not written extensively about. Like Workday and Trade Desk, which could be incoming and which are both leveraging AI in their organisations (HR and finance management, and digital advertising and media buying, respectively).

For what it’s worth, I thought I’d also ask Grok (X.com’s AI) who it thought would be likely candidates that are related to AI to be added to the S&P 500…

- Workday ($WDAY): Workday uses AI to enhance its human capital management solutions, offering features like AI-driven insights for workforce planning and employee engagement. Its deep integration of AI in its software suite makes it a strong candidate.

- The Trade Desk ($TTD): While primarily known for digital advertising, The Trade Desk leverages AI for its ad-serving technology, optimizing ad placements and bidding in real-time, which aligns with AI-driven market trends.

- Datadog ($DDOG): Although not as prominently mentioned in the latest discussions for S&P 500 inclusion, Datadog has been highlighted in broader AI stock discussions due to its AI-powered monitoring and analytics tools for cloud applications. It’s seen as an under-the-radar AI play but might be considered for its growth and relevance in AI technology.

My take is that it will most likely be a few. I think Workday is a shoo-in, as is Apollo, Coinbase, Block Inc and one that doesn’t get much mention, but we’ve covered many times, Vertiv.

Of course, we won’t and don’t know until the announcement is made – but for me, these are all ones to watch this week.

AI gone wild 🤪

Who is David O. Sacks?

Well, he’s soon to be the “White House A.I. & Crypto Czar”.

According to President-elect Donald Trump:

But who is David O. Sacks? What makes him the one to lead the US forward to (continue) its AI dominance and (hopefully) build an environment that finally fosters innovation for the crypto industry?

Sacks is originally from South Africa. His first foray into the tech world was as a key executive at PayPal, where he served as the chief operating officer.

That makes him one of the “PayPal Mafia”, a group of early PayPal founders and execs known for their influential roles in tech post-PayPal.

Some of the other notable members of the PayPal Mafia include Elon Musk, Peter Thiel, Steve Chen, Russell Simmons, Yishan Wong and Reid Hoffman.

Sacks though went on to found Yammer, a business social network that Microsoft acquired for $1.2 billion in June 2012.

Using his built-up capital he has been an angel investor in some of the world’s biggest tech companies such as Facebook, Airbnb, SpaceX, Gusto, Eventbrite, Rumble, Slack and Palantir.

In short, Sacks is from tech, understands tech and has deep experience in how the industry works, how the big players work and clearly has the connections to push tech forward.

But Sacks has also been a strong advocate for cryptocurrency, believing in its potential to transform finance. He was also early into bitcoin and sees the potential for blockchain technology as a growth engine in the US.

Moreover, Sacks’s experience with AI through his various ventures, such as Palantir, aligns with the administration’s aim to lead in AI policy.

While I’m always doubtful of politicians’ ability to deliver on promises, Trump seems to be stacking his administration with non-politicians – people from outside of politics whom he trusts and genuinely believes will MAGA.

While his authority to enact change is still somewhat unknown, there’s already a swell of excitement for his appointment.

According to a recent report on Politico:

Rep. Dusty Johnson, a South Dakota Republican who has helped to craft crypto-friendly legislation from his perch on the House Agriculture Committee. “I’m pretty excited, because I do think there’s a lot we have to get done in the AI and digital asset space — and listen, David Sacks is a guy who knows how to charge forward.

I also think this bodes well for some of the companies that Sacks has been involved in previously. It would be hard to ignore something like Palantir for instance and his ties to that company as he enters the administration. But it most certainly is going to be a further bull case for a crypto boom.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week.) [Figures correct at time of writing.]

Boom 📈

- BigBear.ai (NYSE:BBAI) up 47%

- Tesla (NASDAQ:TSLA) up 12%

- Broadcom (NASDAQ:AVGO) up 10%

Bust 📉

- AeroVironment (NASDAQ:AVAV) down 16%

- Brainchip (ASX:BRN) down 11%

- Western Digital (NASDAQ:WDC) down 3%

From the hive mind 🧠

- This is an interesting partnership, Palantir and Anduril Industries. We’ve covered both before, Anduril being the AI and drone defence company founded by Palmer Luckey. it’s controversial, but the US war machine is always in full swing. It does seem Trump will be more pro-drone and AI warfare than putting American soldiers in harm’s way. Maybe Anduril will be the blockbuster IPO of 2025. Watch this space I reckon.

- Back to Sacks, and while Elon and Vivek are the official leaders of D.O.G.E, it seems that Sacks might also be a long-time advocate of cutting back on the red tape too.

- I love a good AI and animals story. A while back we put a link to a report on how AI was helping the hedgehog population with a breeding problem. Well this time AI (and birth control) is helping the Geraldton community with their pigeon problem.

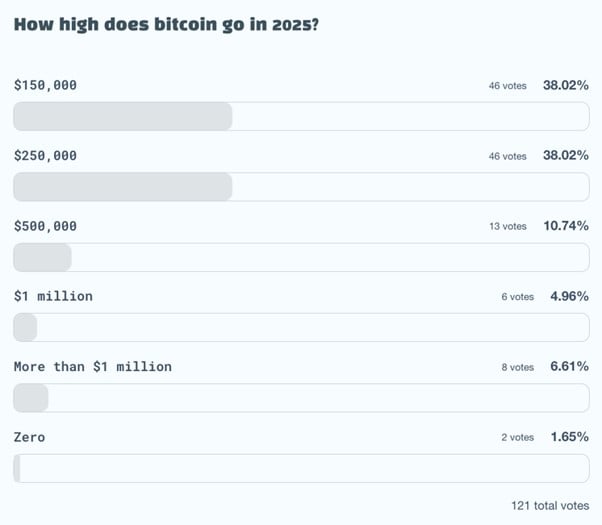

Artificial Polltelligence 🗳️

A huge response from everyone with last week’s poll on the rise of bitcoin! As the infamous cryptocurrency crossed the $100,000 per bitcoin mark for the first time, it sent the predictions and forecasters crowd into a tailspin.

Of course, if you’ve read my work for the last decade, none of this will come as any great shock to you. Through the ups and downs (and some very big downs) over the years, I’ve said bitcoin will continue to march higher. My expectation is $1 million and above and that it will be around a lot longer than you or I are on this world.

So far, that’s exactly what is happening. But asking smart folk like you to make a call on how high it goes in 2025 is certainly something I’m interested in and now you’ve had your say, it’s a pretty close call as you can see.

I’m fascinated with the two people who said “zero” and would love to know your thoughts on that! Also, thanks to those who have given specific price targets for the year. I’ll be collating those come 31 December (so if you’ve not made a specific guess, make sure to head to last week’s post here and leave your comment) and you’ll be in the running for that free three-month subscription to my crypto service that I’ll hand out to the closest to the pin later in the year.

Here are those results:

Weirdest AI image of the day

Uh Oh *𝔹𝔸ℕ𝔾!* – r/weirddalle

ChatGPT’s random quote of the day

“The advance of technology is based on making it fit in so that you don’t really even notice it, so it’s part of everyday life.” – Bill Gates, 2001

Thanks for reading, see you next time!

Sam Volkering

Editor-in-Chief, AI Collision

PS Silicon Valley expert James Altucher has identified a rare opportunity to potentially profit before the predicted $180 billion Starlink IPO. With a track record of spotting pre-IPO successes, James is now sharing a way investors can act to take advantage early, starting with as little as £40. Click now to get started.

Capital at risk.

[AI Collision is a free email. You can unsubscribe at any time simply by using the link at the foot of each email.]