In today’s issue:

- Gambling with $23 billion

- Don’t annoy the Japanese

- Rings of the Future

Editor’s note: Today, we bring you a guest piece by Sam Volkering from his publication AI Collision which was first published on Thursday 25 July.

You can hear from Sam more often at AI Collision and learn more about the latest developments in AI by simply clicking here to sign up for free on Substack.

Welcome to AI Collision 💥,

It takes the utmost belief and conviction in yourself and everything you stand for to say no to a tech giant like Google.

It takes even more courage to say no to Google when it’s waving a cool $23 billion in front of your nose.

What makes this true story even more incredible is the company that just said no to $23 billion from Google is only around four years old.

That company is called Wiz. It said no because it doesn’t think it’s enough. Wiz wants to get an “ARR” annual run rate of $1 billion and then do an initial public offering (IPO).

In the longer term, Wiz thinks it’s worth much more than $23 billion. So, is the company absolutely nuts or is there something in its confidence?

Well, what is Wiz?

It’s a cybersecurity company that provides cloud security. It was founded in 2020 and has quickly become a prominent player in the cloud security market – hence Google’s offer!

I will admit that on the face of it, it doesn’t seem wildly different than a lot of other cybersecurity companies out there. But then again, I don’t use its platform.

But from the information I could find, the platform focuses on the following key areas:

- Visibility and Monitoring: Wiz scans cloud infrastructure to provide a complete inventory of resources, configurations, and relationships between different components. This helps organisations understand their cloud environment and detect any potential security risks.

- Risk Assessment and Prioritisation: Wiz assesses the security posture of cloud resources and identifies vulnerabilities, misconfigurations, and other risks. The platform prioritises these risks based on their potential impact, helping organisations focus on the most critical issues first.

- Compliance and Governance: Wiz helps organisations ensure compliance with industry standards and regulations by continuously monitoring their cloud environments and providing actionable insights to maintain governance.

- Incident Response: The platform provides tools for detecting and responding to security incidents, helping organisations mitigate threats before they can cause significant damage.

What I also found interesting is that in a world of enhanced AI risks, with the threat of AI cyber-attacks being a very real and present danger, Wiz is already well ahead of the game.

The company employs AI and machine learning in several ways to enhance its security offerings. It does this through:

- Anomaly Detection: AI models are used to identify unusual patterns and behaviours in cloud environments that may indicate potential security threats. This includes detecting abnormal network traffic, unusual user activity, and other indicators of compromise.

- Risk Prioritisation: AI helps prioritise risks by analysing various factors such as the likelihood of exploitation, the potential impact of vulnerabilities, and the context of the cloud environment. This ensures that companies can focus on addressing the most significant threats first.

- Automated Remediation: AI-driven automation can help in automatically fixing certain types of vulnerabilities and misconfigurations. This reduces the manual effort required from security teams and speeds up the response to potential threats.

In a nutshell, this is a highly popular company that’s already making money hand over fist and just knocked back $23 billion in order to IPO itself.

That takes coconuts of steel.

It also means that you can expect to see a Wiz IPO on the near horizon. If the company does have a strong element of AI in the mix for its platform, then you can bet your bottom dollar that’s going to attract a bit more hype to the offering.

But is it an IPO to invest in? Right now, I just don’t know. But when the prospectus hits and the IPO becomes a legitimate thing, I’ll take a deep dive on it and figure it out.

AI gone wild 🤪

Earlier this week I put the kids to bed, poured a glass of wine and settled in for an evening just chilling on the sofa.

I couldn’t be bothered thinking that much so I just scrolled through the movie channels till I spotted something I thought, yes, I could watch that tonight.

And I found something reasonably quickly: the Assassin’s Creed movie starring Michael Fassbender.

Now admittedly, a movie based on a video game, that doesn’t typically go very well. Aside from a few recent game-to-streaming series successes (The Last of Us and Fallout being probably the most successful two recently), game-to-movies are usually duds.

And as fun as the Assassin’s Creed movie is, let’s be honest, it’s a bit of a dud.

The game however… HUGELY successful.

It’s a franchise game, which means over the years it’s gone through many iterations and developments, new titles, and improved and (sometimes controversial) new gameplay.

But all in all, the franchise has made somewhere north of $5.5 billion and sold more than 200 million copies across the world.

As you can see, gaming and successful gaming titles are big business.

But the latest version of the Assassin’s Creed game may be the most advanced and most controversial of all time.

Called Assassin’s Creed Shadows, it is set in feudal Japan. Normally the games are set in historic times, sometimes representing real historical figures. But, of course, games often take significant creative licence.

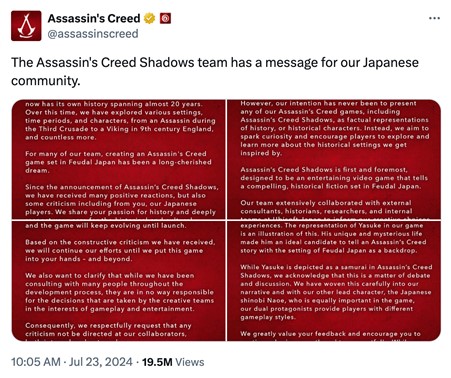

Yet when you take on Japanese culture and history, prepare to be accurate. The latest game has sparked controversy because of the use of Yasuke, the first black samurai. There is furore amongst Japanese players because of the controversial status and contesting of whether Yasuke was in fact a samurai.

The controversy around the historical accuracy of Yasuke in Assassin’s Creed even led Ubisoft, the game’s developer, to put out some “clarifying” statements.

Source: Assassin’s Creed via X.com

Source: Assassin’s Creed via X.com

This game is still likely to be a success. However, the “Yasuke debacle” is not the only thing Ubisoft has done that’s getting the ire of its players.

There’s already a lot of heat in the gaming industry around the use of AI in game development. There are also some fears that AI is set to replace game developers completely.

And Ubisoft isn’t holding back about pressing forward with its use of AI.

Ubisoft has introduced “Ghostwriter”, an AI tool developed by its R&D department, La Forge, to assist video game writers by generating first drafts of non-player character (NPC) dialogue, known as “barks”.

Source: Gamespot

Source: Gamespot

This tool saves time for scriptwriters, allowing them to focus on other narrative elements.

Ghostwriter uses a process of pairwise comparison to improve its output based on writers’ feedback. Pairwise comparison in Ghostwriter involves showing writers two versions of AI-generated dialogue and asking them to choose the better one.

Based on these choices, the AI learns and improves its future outputs. This feedback loop helps the AI produce more relevant and engaging dialogue over time.

The goal is to enhance creativity and efficiency in game development, ensuring NPC interactions remain engaging and realistic.

I think the push to AI is going to continue for a company like Ubisoft. While it’s a highly successful gaming company, it is also a publicly listed company that needs to improve things like profits and reduce things like costs.

In the last year since Ghostwriter was announced, the stock price has fallen from around €30 to around €18.

The last five days alone, off the back of the conjecture around the “Yasuke debacle”, the stock price has dropped from €22 to €18. That’s the impact poor PR can have on a game, especially if you annoy one of your biggest regions for sales.

And if Ubisoft continues to hang its hat on titles like Assassin’s Creed that get incrementally smaller, and alienate players, and then employ more and more AI in order to minimise development costs, then the fall from €30 to €18 might not be the last of the march lower for Ubisoft.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week). [Figures correct at time of writing.]

Boom 📈

- Intuitive Surgical (NASDAQ:ISRG) up 8%

- iRobot (NASDAQ:IRBT) up 6%

- Amesite Inc (NASDAQ:AMST) up 6%

Bust 📉

- Vicarious Surgical (NASDAQ:RBOT) down 15%

- Tesla (NASDAQ:TSLA) down 11%

- AMD (NASDAQ:AMD) down 6%

From the hive mind 🧠

- The Zuck is really pushing forward on the AI chops of Meta. This is something I’ll dive a bit deeper into next week. But for now this is a good look at its approach to AI – I think the fact it’s saying open source at all is a good thing.

- Google had $23 billion to throw at Wiz. So I’m sure a few losses on the AI side of things it can wear. But this will get the bears excited when the words “AI” and “losses” are used in the same sentence.

- For all the nerds out there (like me) this is a cool look at how AI is helping to improve science.

Weirdest AI image of the day

Lord of the Future Rings – r/Weirddallee

ChatGPT’s random quote of the day

“There is no reason anyone would want a computer in their home.”

– Ken Olsen, 1977

Thanks for reading, see you next time!

Sam Volkering

Editor-in-Chief, AI Collision

PS If you enjoyed this article, remember that you can sign up for free to AI Collision and you’ll receive a double dose each week on Tuesdays and Thursdays straight to your inbox. Just click here to sign up for free on Substack.