In today’s issue:

- Three down, more to come

- Something to watch

- The most descriptive weird AI yet!

Editor’s note: Today, we bring you a guest piece by Sam Volkering from his publication AI Collision which was first published on Tuesday 13 August.

And while we’re on the subject of AI, you don’t want to miss what James Altucher over at Altucher’s Investment Network UK has to say – he’s sharing his three AI wealth-building strategies for regular investors. You can find out more over here.

Welcome to AI Collision 💥,

Earlier this year on 7 March I wrote about the sneaky little way in which expensive stocks get cheap.

Considering the week we had last week, we’re not talking about a market crash making them cheap today.

No, the way in which you make a pricey stock cheap is to hope for life and death the company decides to split it up.

The stock split is a mechanism companies can utilise to make their pricey stocks more affordable to regular investors.

For example, in March we said:

Take a look at the prices of the following stocks:

- Nvidia (NASDAQ:NVDA) – stock price $880

- Super Micro Computer (NASDAQ:SMCI) – stock price $1,121

- Meta (NASDAQ:META) – stock price $550

- ASML Holding (NASDAQ:ASML) – stock price $984

- Broadcom (NASDAQ:AVGO) – stock price $1,360

- Microsoft (NASDAQ:MSFT) – stock price $402

What do you notice about them all?

Yes, they’re all traded on the Nasdaq.

What else?

I’ll help out: they’re related to the AI investment boom we’re in the midst of right now.

But also…

They’re all very bloody expensive on a per-share basis.

A lot of these were tied directly to the AI boom we’ve seen in the market, but not exclusively.

We also went on to point out:

[It’s] not just AI stocks either. Netflix is at $595, MicroStrategy is over $1,100, Adobe is at $540.

I think 2024 is going to see a whole range of companies split their stock. It will be the year of the splits. And it will benefit holders of some of these stocks as they unlock that demand and excitement for their companies.

Well, we’re now five months down the track, so the question is…

Were we right?

Turns out, yeah, we were (mostly).

Nvidia announced a 10-for-1 split effective from the start of June.

The stock now trades at $109.

And what about the others?

Broadcom also announced a stock split, a 10-for-1 split too. Its stock now trades at $148. Super Micro has also announced a stock split, also 10-for-1. Its stock will trade (when it comes into effect) for one tenth its trading price at the time of the split.

That means looking down our list…

- Nvidia (NASDAQ:NVDA) – ✅

- Super Micro Computer (NASDAQ:SMCI) – ✅

- Meta (NASDAQ:META) – ❌

- ASML Holding (NASDAQ:ASML) – ❌

- Broadcom (NASDAQ:AVGO) – ✅

- Microsoft (NASDAQ:MSFT) – ❌

MicroStrategy has also gone through a 10-for-1 split recently. It now trades for a bit over $131. So, five months on and we’re tracking at a 50% success rate.

We don’t expect the splits will stop there. Microsoft is still expensive and hasn’t split in around 20 years. Meta, very expensive on a per-share basis, has never split its stock, and ASML… it’s about 14 years on from its last split.

Point being, they’re all expensive and they’re all due.

It also means a stock and multiples of stock are much easier to add to a portfolio than they’ve been before. Now, the market might not be as “toppy” as it was in March and April when we pointed this out. However, we expect this time next year that all of these stocks will be worth more than they are today, and the splits just put them in reach of far more investors.

So, splits can be good, and we’re expecting to see that other 50% of the ones yet to split head down the path of those who have. 2024 is indeed already the year of the splits, and there’s much more to come.

AI gone wild 🤪

This isn’t so “wild” but when you do think about and look at the potential use cases of AI in the real world, then actually things do start to get a little wild.

Nonetheless, I saw this during the week, and thought that it was quite good, balanced and insightful. And sometimes, there are so many events and conferences around it’s hard to filter out what’s useful and what’s not.

But this session from BBC News World Service is definitely worth the time to watch.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week.) [Figures correct at time of writing.]

Boom 📈

- Appen (ASX:APX) up 20%

- Amesite (NASDAQ:AMST) up 21%

- Taiwan Semiconductor (NYSE:TSM) up 13%

Bust 📉

- iRobot (NASDAQ:IRBT) down 23%

- Tesla (NASDAQ:TSLA) down 1%

- Vicarious Surgical (NASDAQ:RBOT) down 10%

From the hive mind 🧠

- Worldcoin. It’s weird. It looks like it wants to literally harvest your data in the weirdest way. However, there are many who find it hugely exciting and interesting. But best to get all the facts you can before you decide to hand over your eyeballs.

- Let’s face it, politicians are liars. They will lie to get your vote and lie to stay in power. They will do whatever it takes. And in the US it seems that AI use in the manipulation of popularity is all over this election.

- The good news here is that we’ve gone from AI will destroy jobs to AI will transform jobs. That rhetoric is softening as the realisation continues that AI is here to stay.

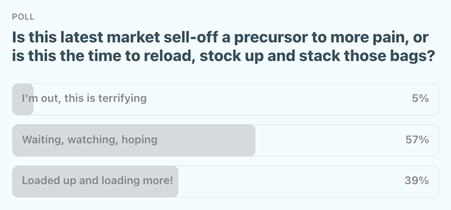

Artificial Polltelligence 🗳️

It had been quite a week by Friday, so much action in the market, so much to absorb.

Monday to Friday felt like an eternity. And it was. But it was also enough to shake the most hardened investors to their core.

Which means, you had some decision making to make. Buy, hold, sell?

Many would have sold. Many would have held. The courageous bought more.

And I wanted to know, after the antics on Monday, what action were you taking?

The good news is, I think on the balance the approach is sound. I’d have thought maybe the buys would have taken the prize, but a little patience isn’t the worst thing in the world.

Just don’t wait too long!

Weirdest AI image of the day

ChatGPT’s random quote of the day

“Timing, perseverance, and ten years of trying will eventually make you look like an overnight success.” – Biz Stone

Thanks for reading, see you next time!

Sam Volkering

Editor-in-Chief, AI Collision

PS Don’t forget to check out what James Altucher is announcing over here. He’s discovered a “wealth window” for AI investors and you don’t want to miss what he has to say.