In today’s issue:

- Bubble-shmubble

- 13-fold increase in moolah says so

- The chickens are angry

Editor’s note: Today, we bring you a guest piece by Sam Volkering from his publication AI Collision which was first published on Tuesday 9 July.

You can hear from Sam more often at AI Collision and learn more about the latest developments in AI by simply clicking here to sign up for free on Substack.

Welcome to AI Collision 💥,

AI Collision 💥 No parties like it’s 1999 thanks

Doomers are back!

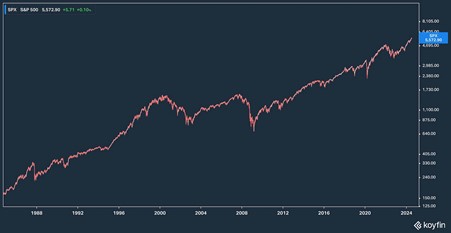

Nothing goes up forever. And unless we’re talking about the S&P 500 (see below) then that statement might be reasonably correct.

Source: Koyfin

Source: Koyfin

Then again, Apple, Microsoft, Amazon… they too have gone up forever. Well, at least in their entire existence as publicly traded stocks they’ve only ever gone up long term.

I won’t chart them all, but they’ve all hit all-time highs recently. If you look closely at that term – all, time, high – you get an indication that indeed the stock price in the long term has only ever gone… up.

But that, of course, is no guarantee that’s what they’ll do in the future!

Of course!

Which means at some point they must go down. Right?

Well if you’ve kept an eye on the news flow into the AI market this week, peeling yourself away from the riveting outcomes of the UK general election, then you might have copped an eyeful of this:

Source: Reuters

This Reuters article takes a close look at the similarities of the late 90s/early 00s dot-com bubble, explaining:

Echoing the dot-com boom, the information technology sector (.SPLRCT), opens new tab has swelled to 32% of the S&P 500’s total market value, the largest percentage since 2000 when it rose to nearly 35%, according to LSEG Datastream. Just three companies, Microsoft (MSFT.O), opens new tab, Apple (AAPL.O), opens new tab and Nvidia, represent over 20% of the index.

Not to be left out, we got the following headline from notable financial blog, The Felder Report:

Source: The Felder Report

Source: The Felder Report

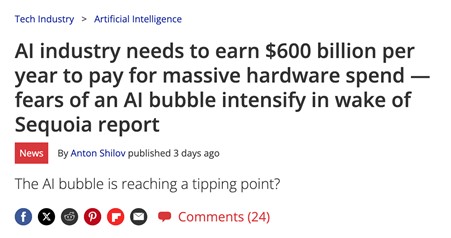

Then from Tom’s Hardware:

Source: Tom’s Hardware

Source: Tom’s Hardware

This piece was referencing a recent Sequoia report about the huge bump in AI-derived revenues to make AI investment worthwhile and for companies to realise the value that the AI hype has been promising.

It notes that amongst the “Magnificent 7” – the big tech stocks all riding the AI train higher – Apple, Google, Microsoft and Meta were all making about $10 billion each from the AI opportunity. And then others like Cisco, Tencent and Alibaba were making about $5 billion each.

But the real kicker is that they’re all still around $500 billion short in terms of revenue needed to justify the spend and the stock price rises.

And then on to Markets Insider with the following:

Source: Markets Insider

This was a different research report taking aim at the AI “bubble”. It noted that unless there were some immediate and fast increases in cash flow thanks to AI, then the bubble would imminently burst.

From that article and the Capital Economics report:

“Ultimately, we anticipate that returns from equities over the next decade will be poorer than over the previous one. And we think that the long-running outperformance of the US stock market may come to an end,” Capital Economics’ Diana Iovanel and James Reilly said.

Yowza!

That’s enough to make you want to run for the hills, take cover and steer well clear of the AI bubble.

I would expect this kind of hyperbole to continue through 2024. And there may even be times when we see a strong pullback in stock prices that are directly tied to the AI theme.

This week could be the start of that too, as we start to see earnings reports flow through into the mainstream media. It is earnings season again!

If you’re not making money hand over fist from AI and you’re not heavily investing in and talking about AI in your earnings reports, then I would defiantly stay at home.

But expect the next couple of weeks to be AI heavy and expect to see some stocks surprise. For me, I would expect the biggest end of town to all be surprising on revenue and profit expectations across the board.

Why do I say that? Why am I not convinced we’re in any form of an AI bubble yet? Well check out the AI Gone Wild section below to understand why…

Doomers, stay at home. Your time has not come, and long term, I don’t think it will come at all.

AI gone wild 🤪

If in one corner you’ve got an increasing number of analysts saying that AI is heading into or already in bubble territory. Then on the other, you’ve got people (like me) saying that’s a view, but also if you’re fearful and out of this market then you’re missing massive profit potential.

And I think another aspect of this market to cast the eye towards is those that make memory chips for the world’s markets.

More specifically, high-bandwidth memory (HBM) chips.

I wrote to you the other week about how AI was bricking my computer. I also wrote about how companies like Arm Holdings (NASDAQ:ARM) and Taiwan Semi (NYSE:TSM) were the ones that were potential benefactors from AI like Apple’s “Intelligence”.

For what it’s worth, Arm is up 16% since that piece on 13 June and Taiwan Semi is up 12%.

But I also noted:

… there’s also the memory makers, the cooling technologies, the cabling and power providers.

This is where the growth in AI comes from. Load me up with RAM and load me up with RAM stocks… that’s the direction I think we need to keep looking just so we don’t all end up with bricked devices.

So who are these “memory makers” and what’s going on with their bottom line?

Well cast your eye no further than a company you maybe don’t first associate with something like HBM…

That company is Samsung (KRX:005930). Well, Samsung Electronics’ part of Samsung.

Yes, the smartphone and telly maker is also a major player in the world’s manufacturing of memory chips.

And the explosion of AI is so fundamental to its potential that it’s expecting to report a 13-fold increase in profits this quarter thanks to AI.

That’s right folks, a 13-FOLD INCREASE!

But it’s not just Samsung that’s deep into the HBM market. SK Hynix (KRX:000660) is another that’s also a key player in this market along with Micron Technologies (NASDAQ:MU).

In fact, Micron is saying that it’s aiming to triple its market share by 2025. The target is around 25%.

And SK Hynix, well, you’ve probably not heard of it, but the company already holds about 35% of the world’s memory chip market. And it’s about to pump a lazy $76.5 billion into its development of AI chips to extend that dominance.

In these three alone – Samsung, Micron and SK Hynix – you’d be hard pressed to find a more important trio to the future of AI technologies, simply because combined they dominate the memory chip market.

The thing is, it’s not all that easy investing in Samsung or SK Hynix as both are traded on the Korean stock market. It’s not that simple to whip into your ISA or SIPP and load up on stock.

Micron, at least, makes investing a bit easier in that it’s traded on the US markets. But then again, check out the stock price over the last year…

Source: Koyfin

Source: Koyfin

That’s a bit over 106% in the last year and it is now carrying a $146 billion market cap… plus in 2023 it made a loss.

So, it’s probably a decent argument to say it’s overvalued. But then again, what is value when you’re talking about such a foundational technology like AI?

And how far into the future do you need to stretch to find earnings to make a stock price valuation worthwhile? Or indeed are we just in a bubble where you need to make your money, then get out?

Well I have my view, and there are my favourite stocks to invest in to take advantage of what’s going on here too.

Which ones? Well I can’t say exactly here – this is after all a free e-letter. But what I am certain of is that right now, bubble or 13-fold increase in profits, if you’re not investing in AI stocks and using AI tools to your full advantage, you need to seriously reconsider your investment approach.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week). [Figures correct at time of writing.]

Boom 📈

- Tesla (NASDAQ:TSLA) up 24%

- Vicarious Surgical (NASDAQ:RBOT) up 32%

- Taiwan Semi (NYSE:TSM) up 10%

Bust 📉

- Cyngn (NASDAQ:CYN) down 43%

- Wearable Devices (NASDAQ:WLDS) down 8%

- Zeta Global Holdings (NYSE:ZETA) down 8%

From the hive mind 🧠

- “It’s-a-me, Mario!” The world’s most popular video game character continues to evolve, continues to find his way into news games, and media. But he’s also saying “It’s-a-no” to AI.

- Intelligence is coming. Sooner than you think. Just remember you need to have the right kind of “silicon” in your device to get it to work properly.

- Bill Gates says… AI and climate change go hand in hand. So, do you believe him? Will AI fight the change or is it all just a part of a secretive agenda? What do YOU think?

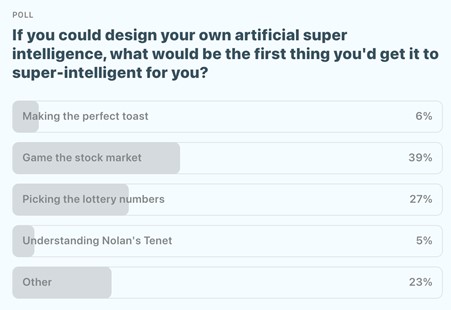

Artificial Polltelligence 🗳️ The Results

After all the “seriousness” of the UK elections, last week’s poll was intended to be positively silly.

And silly it was.

But we still have a responsibility to look at the results which we shall…

However from all this came a tremendous reply from one of our readers, Matt.

I suggest checking out last Thursday’s comments section for his full reply to the poll. But to cut a long answer short, the synthesis of his reply, with my reply, ended up in perhaps the most poignant thing we would and arguably should get ASI to do…

How do you brew the perfect beer?

Weirdest AI image of the day

They’ve finally had enough – r/Weirddallee

ChatGPT’s random quote of the day

“Adventure is worthwhile in itself.” – Amelia Earhart

Thanks for reading, see you next time!

Sam Volkering

Editor-in-Chief, AI Collision

PS If you enjoyed this article, remember that you can sign up for free to AI Collision and you’ll receive a double dose each week on Tuesdays and Thursdays straight to your inbox. Just click here to sign up for free on Substack.