In today’s issue:

- Christmas jokes at the Treasury

- Mapping out the complex drivers of the gold price

- Top global experts identify gold’s key drivers

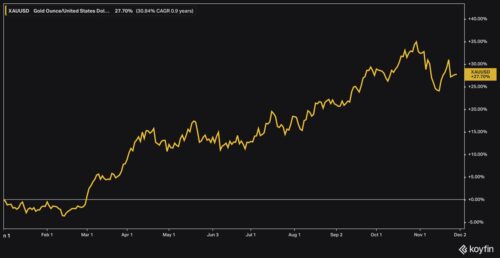

In what can only be described as a chart onslaught, a week ago we looked at all the wide-open questions around gold.

Separately, on Monday 25 November, gold suddenly plunged 3% in a day, breaking an almost undisturbed run of steady gains this year. This was as it had just started to recover from the post-Trump-election stumble, so is a second warning shot for gold bulls.

Source: Koyfin

Source: Koyfin

Having taken a very high bird’s eye view last week, I’d now like to do the opposite and delve into the complexity of a single issue which seemed largely behind that big Monday move – the appointment of Scott Bessent as US Treasury secretary.

Zooming in on the last ten days, you can see the fall on Monday 25 November clearly.

Source: Koyfin

Source: Koyfin

The fall came in two parts. One was for Bessent; the other was the response to ceasefire talks in the Middle East. Lower inflation in the US and falling global tensions are both bad for gold, because they’re good for almost everything else.

Today we’re only going to look at Bessent, though. He’s a good but not great hedge fund manager, has been in the Trump camp for a while and doesn’t seem to have any dramatically unusual views. So why did this appointment concern gold investors more than the rather more unorthodox, and certainly more criticised, Matt Gaetz and Pete Hegseth picks?

What’s the punchline?

I haven’t heard many comedians open with, “How many hedge fund managers does it take to reduce the deficit?” – but it turns out people think the answer might just be one: Scott Bessent.

A serious, experienced, private sector figure with a strong track record as an investor and a balanced approach to most topics, he seems well regarded in the industry and politically palatable in Washington. Gold, however, disagreed. Let’s dig into why.

In the interests of brevity, here are eight implications of Scott Bessent’s appointment for gold:

- He adds to the balanced budget brigade in the new administration, making inflation less of a risk, which makes gold less attractive as an inflation hedge.

- However, this could also mean lower interest rates. Given inflation is already down by 3%, this could be a net positive if real (inflation-adjusted) rates fall.

- It was a sensible pick, which reassured stock markets. This lessens gold’s relative appeal, and its role as a safe haven.

- The direction of the dollar matters hugely. Bessent represents more discipline and stability, reducing the (already slim) odds of the dollar losing its reserve status. Dollar strength is bad for gold, but it must be noted that in other currencies, most notably the euro and the pound, gold had hit new highs before Bessent’s appointment. His experience working with George Soros during the famous trade on the pound enhances the view that he understands currencies and the risks from unserious management.

- Bessent also reduced tariff fears, as he is expected to moderate Trump’s stance on these. Tariffs are generally viewed on Wall Street as bad news all round. So this lifted the mood of the stock market which again lessens gold’s relative appeal.

- Tariffs also specifically impact gold via inflation. By making goods more expensive to purchase, they increase the cost of the CPI basket. Thus, lower tariffs mean lower inflation, which reduces the need for gold as a hedge against it.

- Bessent has proposed a 3-3-3 Plan, based on Shinzo Abe’s “three arrows” in Japan in the mid 2010s. It involves targeting 3% real economic growth, getting the annual spending deficit from 7% down to 3%, and raising oil production by 3 million barrels. Growth favours risk assets like stocks over protection like gold; lower deficits strengthen currencies and confidence and so are bad for gold; and pumping more oil will lower prices and therefore inflation. So his three central goals are all anti-gold.

- Finally, Bessent came out and said that he expected the Trump camp to be more supportive of a stronger dollar and its reserve status than people thought. This feeds into the same themes.

So, a combination of his past, his views, goals, comments and the circumstances of his appointment were, in sum, a negative for gold. And that only deals with a single factor, which only drove the gold’s price on a single day!

It is such a fascinating asset as there are just so many angles to study it from. And it relates to everything: it has a role as a safe haven, a store of value, a risk diversifier, a geopolitical hedge, a speculative asset and a zero-coupon bond. It responds to absolute and relative economic performance, rates, inflation, foreign exchange rates, politics, military developments, market sentiment, central banks decisions, and plenty more.

Finally, it wouldn’t be a good gold piece without at least one more chart. This time, it’s the 10-day performance of gold (in yellow) and the oil price (red daily lines). Bessent’s desire to pump more barrels means they are moving in sync right now, as more barrels means lower prices, which means lower inflation, which means a lower gold price.

Source: Koyfin

Source: Koyfin

For now, the theory is holding, but gold is currently the second most expensive it has ever been, when priced in barrels of oil. One of these assets will have to re-price if the long-term relationship is anything to go by….

It’s complicated, and Bessent and oil are just two of so many factors that impact gold. Understanding what really drives it is the real challenge.

To help you unpack it all and drill down to the key drivers, we at Southbank recently got together an incredible group of experts on gold to do just that. They are full of insight and surprise, all hosted admirably by our very own Nickolai Hubble.

To sign up to our exclusive online event, sharing all their interviews, insights and more…

You might say, to secure your free golden ticket…

Until next time,

James Allen

Contributing Editor, Fortune & Freedom