Editor’s note: This report is just the first part of some very important research Nick has been working on – a revelation that could affect the wealth of millions across the UK, including you, our readers. That’s why we want to bring this briefing straight to your attention, with everything you need to know – and crucially, what steps you can take now, before it’s too late.

In this report:

- The day democracy died

- Who really governs the UK

- Liz Truss’ garotte will be Sir Keir Starmer’s puppet strings

I thought she’d gone batty too. It was forgivable, at first. Perhaps former Prime Minister Liz Truss was just trying to promote her book?

After just 45 days in office, it can’t be much of a yarn. So she had to make the news somehow. But claiming the Bank of England had fired her?

Seriously?

Even her own Chancellor of the Exchequer didn’t back her “conspiracy theories.” That’s what Kwasi Kwarteng called them on Rory Stewart’s and Alastair Campbell’s podcast. And he got the boot himself when his mini-budget blew up the bond market. And the pension system to boot.

Besides, wasn’t it the Bank of England’s rescue package that saved the country?

But Truss’ story was just interesting enough to take a closer look at. Or so I thought at first. What I discovered was extraordinary. I can’t believe we didn’t see it at the time.

Liz Truss is understating what happened. Her conspiracy theory doesn’t go far enough in describing the truth.

Our democracy is an illusion. The bond market rules the country. And the Bank of England controls the bond market.

Governments are mere puppets. The moment they get out of line, the puppeteers at the Bank of England pull them by their purse strings – bond yields. Or cut them loose altogether, as Liz Truss and Kwasi Kwarteng found out the hard way.

But did you realise the significance of what happened at the time?

You may be interested in

| The Shocking Truth Behind Starmer’s Win

A “Shadow Prime Minister” is pulling the strings behind Labour’s victory. Find out how this could affect your investments. Click here to uncover the full story and protect your wealth. Capital at risk |

The price of lockdowns was democracy, and we paid it to the Bank of England

In 2020, government spending and borrowing went berserk while the economy collapsed. The only way to prevent a sovereign debt crisis was for the Bank of England to print the money needed to fund government spending. It did this by buying government bonds – loans to the government.

This was supposed to be a short-term fix. Because central bank funding of government deficits results in inflation. But who cares about inflation during a pandemic? The government needed the money to pay us all to remain home.

The energy crisis of 2022 added another budget busting amount of government spending. By this time, the government debt-to-GDP ratio had blown out well beyond the 90% level which academics identify as dangerous, and even surpassed 105%. The government had become reliant on the Bank of England to pay its bills and keep interest on the debt low.

At the same time, the inflation we warned about in The Fleet Street Letter hit. It humiliated the central banks. And forced them to rein in support of government spending.

This shift created the opportunity.

The Bank of England’s coup

On 6 September 2022, Liz Truss came to power promising radical spending and tax cuts. She also wanted to reform the Bank of England, which she very publicly blamed for allowing inflation to reach double digits.

It was a radical agenda that drew the ire of Bank of England Governor, Andrew Bailey. He wanted to remain independent from government interference. And he warned about a debt crisis if the government got its way.

Truss even claims he vetoed her choice of who would lead her Treasury:

“I still resented the fact that I had been obliged to block the chancellor’s preferred candidate at the behest of the bank governor, Andrew Bailey, who warned of an adverse market reaction.”

Those words “adverse market reaction” have come to mean a lot since then. In hindsight, they were not a warning. They were a threat.

Anyway, the leader of the government and the Bank of England were at loggerheads. And the Bank had already claimed one scalp in Truss’ government.

This battle for control was the motive for what happened next.

On 15 September 2022, the media reported that the Chancellor Kwasi Kwarteng was planning to reveal an extraordinary mini-budget on 23 September.

The day before that mini budget, the Bank of England held its monetary policy meeting. It decided to begin £80 billion of bond sales. It also decided to raise interest rates by half a percentage point to 2.25%, the highest level since November 2008, despite declining GDP.

The change meant the Bank of England would go from buying government bonds in support of government spending during the pandemic to selling government bonds to reduce inflation. It also meant interest rates had soared from pandemic levels.

Not only would the government be left trying to fund itself at higher interest rates, the Bank of England would actively be undermining those efforts by selling their bonds too.

These moves were the murder weapon.

They made the UK bond market incredibly fragile by heaping a dangerous load onto the camel’s back. Bonds had already crashed in price over the previous months due to inflation. It would only take one more straw to trigger trouble.

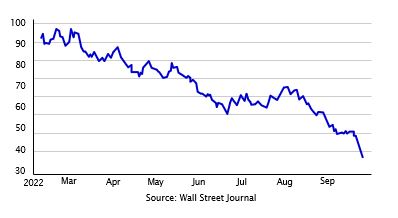

UK bonds had already crashed

Crucially, the Bank of England did this the day before they knew the mini budget would be released.

The die was cast.

The day democracy died in the UK

The next day, the Chancellor Kwasi Kwarteng went ahead and revealed his mini budget on schedule. It laid out enormous £45 billion tax cut. But failed to provide the corresponding spending cuts.

The bond market cracked. It was too much: the tax cuts, the Bank of England’s bond sales, the cost of energy crisis policies, the mountain of debt accumulated during the pandemic and the Bank of England’s higher interest rates on government debt… the camel’s back broke. The pound plunged. Bond prices crashed, but only a little… at first.

The drop in bond prices triggered a peculiar crisis in the pension system which only worsened the crash. Pension funds, presuming that the Bank of England was backing the bond market, had borrowed money to invest in bonds. When prices fell further than they had considered possible on the Bank of England’s watch, they panicked and began to sell the bonds. This created a self-sustaining plunge.

But here’s the crucial thing to notice: the Bank of England did not intervene in the crash. It failed to prevent the drop. It failed to restore calm to markets by buying bonds as it had in other crises. It was this failure to act that unseated the government.

To be clear, we don’t know if the Bank of England actively sabotaged the government by dumping government bonds onto the market, as it had announced it would begin doing the day before. We don’t know if it contributed to the crash deliberately either.

But we do know there was a deafening silence from the very institution created to manage the national debt. You could call it negligence. But…

It was the crime.

How to get away with monetary murder

The Bank did eventually intervene to calm markets. Five days later!

On 28 September it announced a new bond buying programme. This was amusing at the time. The Bank went from buying bonds during the pandemic, to selling them for a few days during the budget crisis, and straight back to buying them because of the budget crisis. It also announced a return to selling them again shortly after the budget crisis… which was also reversed.

It reminds me of that iconic scene you see in many a Western movie. The Cowboy shooting at the feet of the mayor to make him dance. That’s what the Bank of England was doing in the bond market. And Liz Truss and Kwasi Kwarteng were dancing like a pair of puppets in the media each day.

Anyway, the principle that the Bank could decline to intervene during a bond market panic had been established. And what happened next made it obvious that the politicians had learned the lesson the Bank of England had dished out.

The first victim

The Bank of England announced that the emergency bond buying programme designed to end the mini-budget panic would end on 14 October. And so Liz Truss fired her mini-budget Chancellor on that very day.

He was the first victim.

A sacrificial lamb provided by the Prime Minister to show she knew who’s boss – the Bank of England.

Here’s how the Chancellor Kwasi Kwarteng described it on the Leading podcast with Rory Stewart and Alastair Campbell:

“And what the Bank of England said was, ‘OK, we’ll open this window, so you can borrow the money, and we’ll support you, and we’ll buy back the bonds. But the window will close on 14 October.’ Which was the day I was sacked. Because the Prime Minister was terrified that when the market opened on the Monday the 17th, the Bank wasn’t providing any support and there would’ve been a massive a freefall.”

The UK’s Prime Minister was so terrified the Bank of England governor would allow the bond market to crash again that that she fired the Chancellor of the Exchequer to signal she had given in to the Governor.

Adding insult to injury, as soon as the Chancellor had been dealt with, the Bank of England announced it planned to delay the restart of bond sales after all. This was Truss’ reward for giving in. She could rest easy that the Bank of England would not undermine the bond market again.

But, like all good crime stories, there was another victim to come. Because Liz Truss was still secretly plotting to get rid of the Bank of England governor.

He got there first.

The Bank of England governor picks the Prime Minister, not vice versa, and certainly not you

Within weeks of the bond market meltdown, Liz Truss joined her Chancellor on the back-benches thanks to the reputational damage which instability in the bond market had caused.

Who had caused it remains up for debate. But the failure of the Bank of England to prevent it is not. They specifically waited long enough for the political damage to the government to be done.

So we know who holds all the cards, then. The Governor of the UK, not the Prime Minister. And if you think I’m exaggerating, here it is, in black and white, in the Wall Street Journal:

Revenge? If this were to occur in a third world country, we’d call it a coup. An unelected government bureaucrat manipulating financial markets to undermine a democratic government. And then get rid of its two key leaders.

But, truth be told, it’s not that unusual in Western democracies… In fact, you could say it’s been the norm since the 2008 financial crisis sent government debt to the moon in parts of Southern Europe. And then the pandemic did the same in most of the rest of the world in 2020.

We now find ourselves with…

Central bankers running the world

Let me give you some examples. You’ll probably remember them. And their effect on your portfolio at the time.

In 2018, a highly eurosceptic government was elected in Italy.

Fears they would leave the EU, euro, or both sent financial markets into a spin. It was the worst period for investors since 2008.

Each time the Italian government attempted to impose the policies it was elected to, bond yields would surge. The threat of higher interest rates causing a budget crisis repeatedly triggered stockmarket crashes. And brought the government back into line. Eventually, it caved in on all its election promises.

And the bond market magically stabilised, and the crisis was averted.

Some Italian politicians claimed this was stage-managed blackmail. The European Central Bank controls European bond markets, they alleged. So any yield spikes must be political interference by the ECB. Even if only by omission, when the ECB failed to buy enough Italian government bonds to stabilise the market. (That’s what Liz Truss claims happened to her too.)

It was the same story for Greece three years before. The country was going broke. But the Troika demanded the Greek government impose austerity in exchange for any bailout. The Troika included the European Central Bank, which was heavily active in the Greek bond market at the time.

The Syriza party was elected to oppose the Troika’s austerity. It held a referendum in 2015 to strengthen its negotiating power. A national government can’t just ignore a referendum, after all.

But the bond market was more powerful than democracy that day too. Bond yields surged each time the government stood up to the Troika. It was a threat to remind the Greeks they cannot stand on their own two feet.

The Greek government eventually gave in and implemented the reforms. And the ECB was suspected of causing, or just allowing, the bond market to impose the austerity programme which the government and the people had both rejected.

Greece’s finance Minister Yanis Varoufakis was “resigned” during this period, just like Liz Truss and Kwasi Kwarteng. He called the government’s acceptance of austerity a new Treaty of Versailles and “Greece’s Terms of Surrender”. A clear reference that the bond market controlled the nation’s policies, not its democratically elected government.

Nobody beats the bond market

Even the Americans are governed by their bond yields.

In October 1993, US bond yields suddenly surged out of control. They called it “The Great Bond Massacre,” even though it pales in comparison to the bond market losses of 2022.

President Clinton wasn’t booted out of office like Liz Truss. But the surge in US bond yields forced the US government to reverse its spendthrift economic policy. The deficit plunged and yields followed as fiscal order was restored.

These days, Bill Clinton is known for being a fiscal conservative… among other things. He even managed to achieve a budget surplus, depending how you crunch the numbers. But the truth is that he was forced into this by bond yields.

And so the lesson that bond markets govern the US was learned. President Bill Clinton’s political adviser James Carville famously put it like this:

“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

At the time, the reminder of who is really in charge of heavily indebted governments was blamed on…

The bond vigilantes

These shady speculators operated in the dark corners of financial markets, moving government bond yields to try and profit from a country’s fiscal woes. Dangerously undemocratic, of course.

And this was partly true at the time. But the bond vigilantes were primarily anticipating what would occur when the US government tried to raise enough money to pay for its vast deficits. The lenders would balk, and demand higher interest in return for lending the government money.

So, the idea that financial markets controlled governments was true in the sense that lenders control the behaviour of borrowers. Misbehave and they charge you more interest. At some point, the interest becomes unaffordable and you change your spending behaviour.

But that is not the world we live in any longer. Which brings us back to our key question…

You may be interested in

| Uncover the True Power Behind Number 10

Who’s really in charge of the UK? Discover the shocking truth about the “Shadow Prime Minister” and how it could affect your future. Click here to watch the eye-opening interview now. Capital at risk |

Who controls the bond market?

Central bankers killed off the bond vigilantes years ago. These days, bond market yields are not set by investors. They are controlled by monetary policy committees at central banks. They call it QE, QT, yield curve control and operation twist. At least they’re getting more creative over time…

These unelected and unaccountable bureaucrats have an unlimited budget to buy bonds. And a mandate to maintain order in financial markets.

Financial markets which conveniently include the government bond market.

If a government borrows so much money that it might cause unrest in the bond market, central bankers must prevent this tragedy… by printing money and buying government bonds. That’s what happened during the pandemic, after 2008 and during the European Sovereign Debt Crisis.

But if someone is always standing at the ready to bail you out, you tend to behave badly. Politicians didn’t reign in their deficits, knowing the central bank would just print the money they needed if the bond market threatened not to provide it.

Over time, government bond markets have become reliant on central banks to remain stable. Not always explicitly. Sometimes, the mere promise to print money and buy bonds in the event of any trouble is enough to prevent a crash.

This means central banks control the bond market. And the bond market controls the government.

By a bait and switch, central bankers are now the ones who can “intimidate everybody,” as Carville put it. If he is reincarnated as the bond market, he would be bitterly disappointed to discover these technocrats are now in charge.

They can decide to support governments like Mario Draghi’s in Italy by buying Italian government debt. Or they can undermine governments like Liz Truss’ by failing to buy government debt. Or they can force policies on governments by threatening to sell government debt if they don’t.

It’s not always that blatant. Central banks can influence negotiations about government policy by massaging bond yields up and down depending on how acquiescent the government is being to central bankers’ “advice”.

It’s entirely up to central banks. There is no accountability, public awareness or consequences.

Nobody blames them. Well, anyone trying to warn you about all this is discredited and then fired, like Liz Truss and Yanis Varoufakis.

Although, this speech by Daniel Hannan in the House of Lords reveals the Bank of England’s silent coup is dawning on those supposedly in power…

The choice between democracy and bond yields

Italy has been living under the tutelage of the European Central Bank for more than a decade now. And Italian politician Claudio Borghi explained all this to you in 2018:

In a way I am very happy because we have finally wiped the bull**** off the table. We now know that it is a choice between democracy or comfortable bond spreads.

You have to swear allegiance to the god of the euro in order to be allowed to have a political life in Italy. It worse than a religion.

What we are seeing is the fundamental problem with the eurozone construction; You can’t have a government that displeases the markets or the spread club. The ECB and the Eurogroup will use this to crush your economy.

You are very lucky in the United Kingdom that you still live in a free country.

Why Borghi believed the UK is any different is simple. The UK’s national debt was not yet high enough to give the Bank of England complete control over the country and government.

And that’s a crucial point to understand. At low debt levels, central bankers are not in control of the government. The government does not yet rely on central bankers to fund their deficits and keep the bond market stable.

It’s only when the government debt-to-GDP ratio gets dangerously high that power is ceded to central banks. Because, at that point, the bond market relies on the central bank to remain stable. Central bankers can choose to withdraw their support from the bond market, leaving governments high and dry.

What is the magical threshold that transfers power to central banks? The truth is, we don’t know until it’s too late. There are too many factors to consider.

But we do know it happened in the UK some time before Liz Truss took power. Because she was the first UK Prime Minister to be fired by the bond market since the 70s.

That means this election is the first which does not matter.

This is the first election that government debt is high enough for us to conclude the Bank of England governor is the one running the country, no matter how people vote.

Sir Keir Starmer is as powerless as Liz Truss was in September 2022. Completely at the mercy of the Bank of England.

This headline from Bloomberg sums it up nicely: “Liz Truss Won’t Come Back, But the UK’s Gilts Trap Is Still There.” It’s waiting for Sir Keir Starmer to put a foot wrong. Bond yields controlled by the Bank of England will whip him back into line. Liz Truss’ garotte will be Sir Keir Starmer’s puppet strings. Or should I say purse strings?

The French are next

The French elections demonstrated precisely what I am trying to convince you of. When French President Macron called national elections, bond markets responded immediately. The yield of French government debt exploded higher. European stocks plunged too.

Source: World Government Bonds

And the French Finance Minister was quick to warn that, “A debt crisis is possible in France, a Liz Truss scenario is possible,” if voters have the gall to vote for anyone but the political centre.

The European Central Bank was allowing markets to apply pressure to the French voter and French political parties. If they want to escape a financial crisis, they had better toe the line and vote for the mainstream parties.

But it’s not just the French.

The head of the US Congressional Budget Office, a bit like our Office of Budget Responsibility, recently warned of a Liz Truss type bond market meltdown in the US. All it would take is the announcement of radical economic policy and the bond market could crash.

“The danger, of course, is what the UK faced with former prime minister Truss, where policymakers tried to take an action, and then there’s a market reaction to that action,” Phillip Swagel said in an interview with the Financial Times.

You’ll never guess what policies presidential contender Donald Trump is proposing. That’s right, tax cuts, just like Liz Truss did.

The US central bankers are preparing to use the Liz Truss bond crash playbook against Trump should he be elected.

Is it really a cabal?

The French Finance Minister and the head of the CBO clearly grasped what is going on. But nobody understands all this better than alumni of the firm Goldman Sachs.

There’s a reason they’re also known as “Government Sachs”. Alas, it is not because they use the bond market to sack democratically elected governments. But that is surprisingly close to the truth.

Goldman Sachs alumni have a habit of being installed in powerful government posts after the bond market undermines the democratically elected one. They are the technocrats which central bankers put in charge to do their will. Prime Ministers, Presidents of Italy, the European Central Bank, the New York Federal Reserve and, of course, our current Prime Minister have ties to Goldman.

For the sake of disclosure, I did an internship at Goldman’s Australian business during the Global Financial Crisis. And they paid for my university scholarship. But I’m not expecting a call to become the next PM anytime soon…

My point is that the central bankers who decide the fate of indebted governments come from somewhere. They have views, ideologies, beliefs and personal interests which control how they behave. How they govern you.

If we want to understand what the Bank of England has planned for the country, now that it is running the government, we need to consider what they believe.

What does the Bank of England’s coup mean for investors?

The first conclusion you need to reach is that national politics is going to be a lot less exciting than any political analysis might suggest. Even if Reform win an election, I think they’d soon be cowed by the Bank of England’s control of the bond market. Even if populist upstart parties govern France, they will only end up like Italy – cowed by the bond market. And even if Donald Trump wins in the US, the Fed will keep him on a tight leash.

Central bankers will keep politicians in line, whoever is elected. They will dictate what policies are and are not acceptable.

If a government attempts to impose a policy which rocks the boat, we can expect bond yields to surge. And then the politicians will get the message and change course.

That’s why politics is so boring these days, and the parties so indistinguishable. It’s why popular policies like cutting immigration are not delivered, while unpopular ones like high taxes are. The parties are just doing the Governor’s bidding.

Anything else would land them the chop, or just the humiliation of having to reverse course because the bond market crashes again.

As this headline from Bloomberg put it, “The UK election is being shaped by the bond market’s meltdown under Liz Truss.” Nobody is willing to put a foot wrong.

You may be interested in

| The Hidden Tax Raid on Your Wealth

A secret tax could devastate your savings under Labour. Learn about the hidden tax and how to shield your wealth. Click here for the urgent briefing before it’s too late! Capital at risk |

Stability or bondage?

Japan maintains its seemingly impossible government debt of 263% debt to GDP by way of a partnership between the central bank and government. They work together to ensure no crisis occurs in the bond market.

It’s a consensus approach that saw the Bank of Japan buy more than half the national debt to prevent a crash. Anything else would trigger the biggest financial train wreck in history.

The point is that governments and central banks can collude to run this state of affairs for much longer than anyone might think. Under one condition, which must hold: the government must abide by the central bank’s wishes.

Any radical policy, any fiscal shock, any unapproved political surprises and the central bank can pull the plug, as the Bank of England did to Liz Truss. Or the central bank could simply pull the purse strings until the government recognises it is nothing more than the central bankers’ marionette.

To be perfectly clear: central bankers now control our nation’s politics. After all, they’re the ones who have to pay for it…

How financial markets behave under the reign of central banks

If you want to predict what government policies we’ll face, you should not pay attention to politics, manifestos or promises. You’ll need to consider what central bankers believe is the correct politics. Any deviation from this will be faced with a rise in bond yields that pulls the government back in line.

Which begs the question, what do central banks want?

It exposes the dangerous way central banks are planning to deal with our national debt. And what it means for financial markets – the investments to sell and what to buy.

Central bankers’ plan is working very well in Southern Europe already. Government debt-to-GDP ratios are plunging in places like Greece and Spain.

It is their plan for us in the UK too. The government of the next five years just doesn’t know that the next fourteen years of government economic policy is already written in stone by the Bank of England.

Until next time…

Nick Hubble

Editor, Fortune & Freedom