In today’s issue:

- Being early can be difficult, people don’t always like it

- The themes we are looking at today

- One sector we think will be a big winner in the future

Here at Southbank Investment Research, we pride ourselves on being ahead of emerging trends. This often means being early, sometimes too early. And it often makes our ideas seem crazy, unlikely or plain wrong.

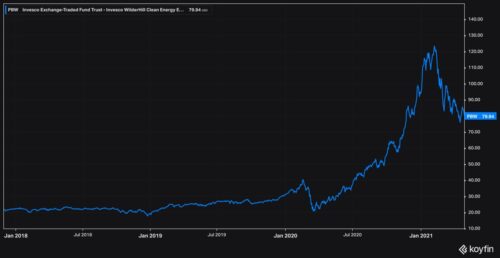

That’s how it felt back in April 2018, when I launched a service to help people invest in the best small companies that were tackling the main problems of the energy transition head on. It might not have felt like a hot sector at the time but, two short years later, the sector hit the turbo boosters and took off. Patience was rewarded.

Source: Koyfin

Source: Koyfin

Now, following the Russian invasion of Ukraine, the gas price crisis in Europe, the AI revolution and the developing issues in the Middle East, many different parts of the energy multiverse have been sucked into the vortex.

Themes such as nuclear, lithium, batteries and the grid are all key parts of our portfolio of recommendations today.

Nuclear has been a key theme for us since 2022. Looking at the performance of the VanEck Nuclear ETF, our thesis that it was an overlooked and underestimated part of the energy mix has been borne out:

Source: Koyfin

Source: Koyfin

Since the energy crisis of 2021, the importance of existing zero-carbon baseload power like nuclear has been clear and has driven numerous investments in nuclear by Southbank publications. One even declared, in 2022, that “The second nuclear age has begun”.

Two years on, and nuclear remains a key thematic in our portfolios. (And here’s why.)

Another key theme is the grid. AI is causing electricity demand to surge – those data centres are hungry for power. And electrification of transport and other sectors were already putting pressure on ageing grids.

Faced with huge bottlenecks to connect to the grid, new solar and wind farms are sitting idle, with Europe suffering greatly from this waste of infrastructure.

In the UK, the National Grid unveiled the largest capital raise in almost a decade to fund a (much needed) £60 billion grid expansion plan, to modernise and expand it ready to enable the next phase of the energy transition.

China, meanwhile, is set to spend an extraordinary $800 billion on the grid over the coming years, as over 100 solar projects have been stalled by grid connection issues.

The US is also investing in grid expansion and modernisation. Joe Biden and Kamala Harris just announced a $2.2 billion investment in eight projects across 18 states, with the hope of catalysing another $10 billion of private co-investment.

Finally, lithium and batteries are another big theme. Lithium prices have come all the way back to their pre-Covid levels, having spiked hugely in the meantime. We think that means opportunity, as electric vehicles (EVs) have continued to grow and battery storage is becoming far more available and common.

Supply has grown and the shortage fears have subsided accordingly, but the demand story is still very strong and could surprise people once again.

The forgotten metal? Lithium prices, last five years

The forgotten metal? Lithium prices, last five years

Source: Koyfin

On that note, I tell you who won’t be caught out the next time the price surges – Rio Tinto. The mining major is spending $6.7 billion to acquire the Western world’s third largest producer, Arcadium Lithium. “What we are doing today is saying: We are committed to lithium”, said Rio’s CEO, describing the deal as transformative for the company’s asset portfolio.

Acquisitions like these by key industry players are useful signals – unencumbered by the sentimentality and short-termism of markets.

The battery market and the related lithium story have been adopted and forgotten by markets in rapid succession. In the rubble of this bubble, the theme is very much intact – and we are positioned to benefit once the demand trend reasserts itself.

At the centre of the universe

Nuclear, lithium, batteries and the grid are all big themes, and we have recommended companies here at Southbank to help our subscribers benefit from each of them.

But there’s one industry that taps into all of these at once.

But before we get there, I just want to take a quick detour via the Russian Central Bank. That’s because, given all the media speculation about the dollar and the possibility of its reserve status getting eroded, Russia is something of a test case for what an ex-dollar world looks like.

Since the US froze its dollar reserves in its Ukraine sanctions package, Russia has been forced to diversify. China, keen to dethrone the dollar, is certainly watching what it does closely. And Russia’s latest move is to invest in the very same asset that serves every single key theme I’ve mentioned today.

We’re incredibly excited about the opportunity in fact, as some of my readers at Southbank Growth Advantage can testify.

Big companies are interested in it, too. In fact, one of our plays in the sector just got bought out at a premium, the latest deal in a market that is proving ripe for consolidation.

(You can find out more about what my colleague Sam Volkering has got his eye on at the moment right here.)

As you will know, we at Southbank are dedicated to seeing big trends early and getting ahead of the markets, and the mainstream narrative. That makes us look early or even foolish sometimes.

It always requires us to think deeply, and differently. To me, there is one classic example – a forgotten asset with huge potential.

That’s why we’re sharing all this with you now, so you can get ahead of the next bull run. Leading the herd, not following it.

Click here to find out what it is, how we’re invested and how you can participate.

Until next time,

James Allen

Contributing Editor, Fortune & Freedom