It’s not often I disagree with Sam Volkering, despite knowing him since 2010.

He likes Australian rules football, I like rugby league… He likes crypto, I like gold…

That’s all I can think of, actually.

But we’ve had a proper argument about whether cryptocurrencies like bitcoin have sold their soul to the very devils which they were supposed to unseat – the financial establishment and the political establishment.

I think you need to read it – my initial claims and Sam’s passionate response. At the end, we’ve got a survey for you. You can decide who has it right.

So far, Sam’s side is well in the lead. But I can’t help wondering if that’s because we originally published the articles in his newsletter Exponential Investor, which is free and well worth a look.

Anyway, see what you think about whether cryptocurrencies have sold out, and what it means for the price of bitcoin and others…

The crypto revolution died in El Salvador

By Nickolai Hubble

Sure enough, my thesis that governments manage to make a mess of any and all government policies they try to implement, including privatisation, has struck again. This time, a government has managed to cock-up crypto.

My go-to source for trusty news analysis, CNN, explained what happened…

El Salvador’s “Bitcoin Day” did not go especially well.

The impoverished country’s vaunted adoption of bitcoin as legal tender on Tuesday was marred by street protests, technical glitches and an extreme drop in the value of the controversial digital currency.

What went wrong?

- “Chivo Wallet,” a storage app created by the government, wasn’t immediately available on major app stores. By the end of the day, it had appeared on Apple and Huawei platforms.

- Hundreds of people marched against bitcoin in various protests across the capital city, the Financial Times reported.

- The price of bitcoin started the day around $53,000 before plunging by as much as 19%, according to data from Coinbase. The digital currency has since recovered some losses to trade near $46,270.

That’s what you get for celebrating government initiatives, crypto “enthusiasts”. Partner with a politico and you get what you deserve.

The idea that a government’s adoption of bitcoin gives it credibility is like claiming the government’s monopoly on money is a good idea.

Cue a 99.5% drop in the value of the pound since the Bank of England was founded. Nice work, if you can get it… by government charter.

While crypto investors celebrate the news out of El Salvador, and from crypto-adopting Wall Street, believing the big-government and big-business adoption of bitcoin gives it credibility, I’m declaring the opposite. The crypto revolution is over.

I’ve seen and anticipated something similar before. Let me tell you that story before we get to how it applies to crypto…

In 2016 I found myself sitting in a very large hall in Bulgaria, with a painted ceiling and lots of Roman columns. A speaker at the event had bailed at the last minute, or had been held up by border guards more likely, and so I was asked to jump in and take their place.

This was one of my roles on the Free Market Road Show of 2016 – backup speaker when one of our more radical keynote speakers was held up at the border. That is something that I saw happen in person to my friend Ron Manners in Ukraine.

By the way, you can watch the 2021 Free Market Road Show’s London event here now. The topic was Regulation vs Entrepreneurship.

How disruptive businesses protect themselves from disruption

But back in 2016, I found myself on stage to talk about the disruption which Uber, Airbnb and similar companies had caused to the taxi and hotel industries.

You might remember, they had skirted lengthy and complex regulatory and licensing systems to meet customers’ needs better than their established competitors. Libertarians were rejoicing at the proof that the free market could do what it does. Everyone else was outraged about the use of regulatory loopholes. Or just outright breaking of the law.

As ever, I told the audience what they didn’t want to hear. A message of doom and gloom about how Uber and Airbnb were already kow-towing to the government and becoming the very thing they had been created to challenge.

I also called out a representative of Uber or Airbnb who was in attendance for this hypocrisy. I don’t recommend doing so in Eastern Europe, where criticism of politically-connected big business is a bad idea.

Once disruptive businesses become successful, their incentives radically change from growth and serving customers to a simple question of survival. And, in our over-regulated economy, your best bet to survive is not to serve customers better than everyone else by continuing to innovate, but to capture the regulators and grow the barriers to entry. The banking system being the best example of this. Back to that in a moment, as I’m sure you’ve guessed.

Sure enough, Airbnb began to comply with expensive hotel and safety regulations to ensure that nobody else could challenge its now dominant position by doing a better job of connecting empty bedrooms with travellers. The regulatory and compliance burden would be too much for a start-up these days.

And Uber gave way on complex, expensive licensing and employment rules to try and prevent competitors from emerging who could undercut them by skirting the same rules and regulations that Uber once had.

The regulators are now on Uber and Airbnb’s side, protecting their businesses from precisely the sort of innovation they had once led.

The innovative, disruptive and libertarian companies became part of the regulatory state’s machinery and joined the interest group of the politically connected.

The same process is underway now for cryptocurrencies. The government, the financial sector and big businesses are co-opting them in ways that undermine their very purpose.

The nationalisation of crypto

They have gone from being a libertarian’s dream to slowly becoming part of the system they were meant to evade and then destroy.

This is the opposite to what FA Hayek argued for in The Denationalisation of Money. It is the renationalisation of digital money after a brief period of freedom. It’s the opposite to what Satoshi Nakamoto had in mind when he launched bitcoin to be independent from the existing system.

And yet, bitcoin believers seem to be rejoicing about El Salvador’s use of bitcoin. As Airbnb and Uber shareholders once rejoiced when their companies settled with regulatory agencies and complied with compromises that made competition incredibly tough for anyone who thought they could do better than Uber or Airbnb.

In the eyes of cryptocurrency investors, recognition from big business and government gives them credibility. In my eyes, it removes the one thing they had going for them. That they were apart from either.

Today, everyone from Facebook to Paris St Germain is in on the crypto craze, launching their own tokens.

Even Visa, the company which crypto was supposed to destroy, is enabling cryptocurrency payments.

And banks, who we are told won’t exist in a crypto world, are investing in crypto on the one hand while also trying to prevent anyone from buying the coins. Think about that carefully.

El Salvador is the nail in the coffin of the cryptocurrency revolution. Bitcoin is now a government money. That is precisely what it was designed to avoid.

Let me re-emphasis just how ironic all this is.

The whole point of bitcoin was that it is separate to the government and financial system. A democratisation and privatisation of the money system without middlemen.

Now governments and the financial system are at the forefront of bitcoin, not everyday users transacting between each other. And the same middlemen of the financial system are now the middlemen of cryptocurrency transactions.

Bitcoin, like Uber, Airbnb and the internet, has been co-opted by the government, central banks and the political-industrial complex. And they will muck it up, somehow.

What does all this mean for the only thing that most crypto buyers are really interested in?

No, not establishing an alternative monetary system to undermine banks and governments, with which they can transact quickly, easily and cheaply without risk of interference. They only care about the bitcoin price.

I have no doubt the price of crypto can surge now that it has the backing of the institutions it was supposed to do away with altogether. Perhaps it will even become the pump and dump scheme they accuse it of being, now that they’re involved.

A last hope

Indeed, the adoption of bitcoin in Wall Street has become the key argument for why and when cryptocurrencies will surge. It’s adoption into the existing system which it was supposed to undermine.

Or maybe Dylan Grice of Calderwood Capital is right with this post on Twitter:

Here’s my El Salvador prediction: even though no one points to the countless Latin hyperinflations to say “see? fiat systems don’t work!”, when el Salvador’s bitcoin experiment goes tits up, crypto won’t get the same leniency. everyone will say “see? crypto systems don’t work!”

Either way, buying crypto was supposed to be about using it to evade the banking system and the government, not to speculate on the price. It has lost the former. The latter may remain intact.

My last hope is that a coming monetary crisis and the mass adoption of crypto as a speculative asset will be a combination that leads to a surprise rejuvenation of what crypto was all about. When people need an alternative monetary system that evades government and big business, they will know where to turn.

With some student debt-loaded graduates paying a marginal tax rate of over 50% while working from home, we might just be close…

Nick Hubble

Editor, Fortune & Freedom

The crypto revolution thrives in El Salvador

By Sam Volkering

I love our business.

The main reason is because in the (almost) nine years that I’ve been a part of it, never once have I ever been told” “you can’t write about this idea or that”.

Since day one, I’ve had complete and utter intellectual freedom to publish my investment ideas, and sometimes my non-investment ideas too.

Not many publishing organisations can ever truly, hand on heart say they allow such freedoms of their editors.

But here, at Southbank Investment Research, at Exponential Investor, we have such freedom.

And yesterday you saw it in full, beautiful display from my colleague, and friend, Nick Hubble.

Nick was filling in for Kit Winder who’s away this week.

What I love about Nick’s work is he’s never afraid to say what he truly believes. He doesn’t pull any punches and if he doesn’t like it, you’ll know about it.

Yesterday Nick had this to say about the “crypto revolution”.

While crypto investors celebrate the news out of El Salvador, and from crypto-adopting Wall Street, believing the big-government and big-business adoption of bitcoin gives it credibility, I’m declaring the opposite. The crypto revolution is over.

Nick argues that government, big business and the financial sector are co-opting crypto for their own ways.

He has got a decent point.

What happened in El Salvador?

A clear and recent example is the adoption of bitcoin as legal tender in El Salvador.

And, yes, the first day of the launch was rocky to say the least.

It also didn’t help that the US dollar value of bitcoin fell by about 10% as well.

Subsequently, though, the Chivo app (the app they’ve rolled out for Salvadorians to use in adopting bitcoin) is the now the most downloaded app in that country.

It’s followed by Bitcoin Wallet and the Bitcoin Beach Wallet.

Also, because the basis of the Chivo app is bitcoin’s Lightning Network, the cost to send bitcoin from Chivo app to Chivo app is $0.

This is crucial information, and here’s why.

What benefit does bitcoin bring to the people of El Salvador?

El Salvador is a remittance country.

That means that billions of dollars are remitted into the country each year. Remittances from Salvadorians working abroad in the United States and elsewhere are crucial to the economy.

In 2020 around $6 billion was sent into El Salvador from those working overseas.

That’s about 23% of El Salvador’s GDP.

Much of that is remitted through companies like Western Union. But companies like Western Union have been leeching off countries like El Salvador in the remittance market for years.

In some instances, the fee to send money to El Salvador, charged by Western Union is more than 10%. In other examples, a $100 transfer can have fees as much as 12.5 % attached. The smaller the send, the higher the fee. A $10 transfer can cost 33% in fees.

That’s the old way.

If someone sends bitcoin from their Chivo wallet to a family member who also has a Chivo wallet, the fees are $0. If you’re an Salvadorian citizen, and you send any amount to family through Chivo, it doesn’t cost anything.

That is how bitcoin fixes a systemic problem in a country that is immensely reliant on remittance to fuel their own domestic economy.

It’s not going to be a flick of the switch, overnight, instant solution. It will take time to ease this kind of system into operation and to get people to understand the benefits.

But this is how mass change takes place.

Here is what really matters: El Salvador is only adopting bitcoin, it’s not co-opting the entire system. The system has been built already: the Salvadorians can’t change it, but they can use it to their advantage.

The same goes for Visa, Square, all of Miami, or anyone, anywhere.

You can’t change or control something like bitcoin, but you can use it for its features and benefits.

But while I disagree with Nick, I thank him for providing a counter argument.

I’m sure plenty people will agree with him. Which is fine. Seeing both sides of an argument helps to make you a better investor and to understand all considerations when deciding what action to take… or not to take.

What is another danger that you need to look out for?

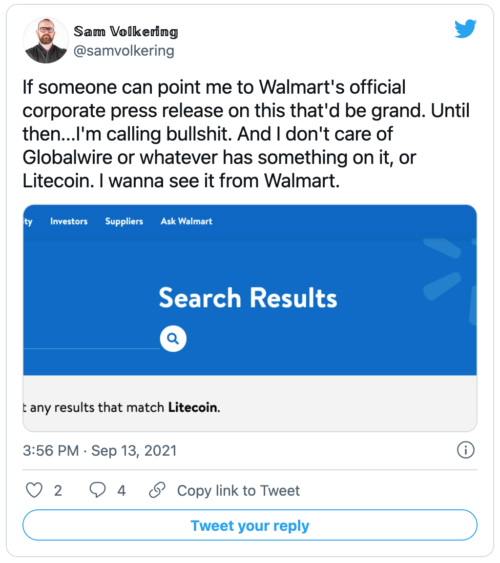

While researching what is actually happening to bitcoin in El Salvador, I could not help but notice what is (not) actually happening with Litecoin at Walmart.

This week major news outlets (such as Reuters and CNBC) reported that Walmart had started a partnership with Litecoin to accept Litecoin as crypto payment in the retail giant’s stores.

Now considering this came as a press release through GlobeNewswire and was then picked up by Reuters and CNBC (amongst others), it sent a rocket up the backside of Litecoin’s price.

Straight away, I smelt something fishy – if you’ll excuse the mixed metaphor.

Even with major news outlets reporting this, even from the official press release, I was calling the story out as a lot of [NB word redacted as this is a family-friendly publication].

Source: Sam Volkering, on Twitter

Source: Sam Volkering, on Twitter

When you’ve been in crypto long enough, you just know when something is off. And this was very, very off.

For example, before even bothering to search more there was no way Walmart would accept Litecoin over something like bitcoin, or even Ethereum… in fact, I’d say that company would go with Dogecoin before Litecoin.

Then a simple search of its corporate page confirmed that the story was complete rubbish.

Those who’ve been around crypto long enough knew the Walmart news was nonsense.

As for the newcomers to crypto – the “noobs”– and the mainstream media… they couldn’t get enough of it.

Sadly, when it comes to the mainstream media, I feel as if this “Brainlet” meme applies…

Source: Know Your Meme

As it pans out, the press release was fake, the news was fake. No Litecoin and Walmart partnership…

We all knew it, the mainstream media did not.

And it caused the Litecoin price to spike… and crash.

The point is, you’ve got to know your stuff. People would have bought Litecoin without thinking because of the mainstream reporting.

But it’s not the mainstream that will catch the eye of who’s to blame here. The point will be made that crypto is a risky, dangerous place where you will “lose all your money”.

Yes, there are risks. Yes, it can be volatile and wild. Yes, it can also be the most fun investing in your life.

But the dangerous thing is getting your information from rubbish sources like (all too often) the mainstream media.

When you’re looking at the crypto markets, ask yourself, is it that hazardous? Or is it more perilous to your financial wellbeing to listen to the mainstream, to sit it out, to stay on the sidelines?

Is it better to stick with the traditional system, to information from Reuters, CNBC, and companies like Western Union? Are those the future of how we transact, interact, obtain information?

Or is the crypto revolution really here, and here to stay?

It is your call as to which way you lean.

But I think it’s clear that the revolution is not over, it is just beginning.

How much will one bitcoin cost in 12 months’ time?

Until next time,

Sam Volkering

Editor, Exponential Investor