What if I told you everything you know about rare earths is wrong?

The charts and the prices? Wrong. Old news.

That’s exactly what happened to me in 2019.

Jet-lagged and running on nothing but caffeine, I found myself in a quiet corner of a hotel in Vancouver, listening to someone slowly pull the rare-earths market apart.

Turns out everything I’d read about rare earths from Bloomberg or Reuters doesn’t tell the whole story…

Rare earths make everything better

Despite their name, rare earths aren’t rare at all. They’re abundant in the earth’s crust. It’s just that there aren’t many economical deposits around. Nonetheless, these metals are a mystery for many of us. We know we need them. None of our gadgets and gizmos would work without them. We know that governments are stepping in to keep the industry afloat.

They’re critical to energy transition, and are behind every powerful magnet that we use today. According to data from 2016, the US Defense Department accounts for about 1% of demand in the United States, yet none of their military goods would work were it not for the teeniest trace of a rare-earth oxide.

Think of rare earths as the superpower of metals. Their unusual chemical make-up gives them remarkable properties. They’re extremely magnetic, resistant to corrosion, and can withstand high temperatures.

Finding them is the easy part. It’s separating them from one another that’s the problem. It’s dirty work that Western governments don’t like. Rare earths generally involve open-pit mining and come with toxic waste. Washing with acid is required to pull the metals apart from one other. Also, rare earths are often found with radioactive elements, such as thorium and uranium, so very small and low-level radioactive waste comes with mining them.

The ugly reality of rare-earth mining meant Western governments were happy to give up control in the 1990s when China showed an interest in them. The Middle Kingdom’s then-lax environmental laws and loose labour regulations allowed it to begin to exploit its mammoth rare-earths deposits.

The thing is, though, Western governments didn’t just give up mining rare earths, they lost the ability to process them as well.

A dark market

A few years ago, at the Sprott Natural Resource Symposium in Vancouver, a geologist friend came up for a brief chat. He insisted I speak with a colleague of his that was in town. As I recall, my mate said, “Shae, you really should speak with them.” An introduction was made, we compared calendars, and, a few hours later, we were sitting in a quiet corner over coffee.

Here I was, speaking to one of the very few rare-earth specialists – one who works directly between miner and company. A geologist with two decades of experience can dismantle everything you’ll read in the papers about the rare-earths business. It’s a complicated and highly secretive industry.

You see, major commodities such as gold, iron ore, tin, gas and petroleum, for example, are all established markets and traded through several exchanges. Their prices are clear and dynamic. Most of the time, the exchanges accurately reflect supply and demand. In other words, we know the prices we see flashing up on the nightly news are reliable.

Rare earths, on the other hand, are nothing like that.

Despite the ubiquitous use of rare earths in technology, there is not one clear market or pricing structure behind them. Unlike for major commodities, there is not one exchange. There is no set price for rare earths, either.

Sure, there are companies, such as Argus Media, that keep track of 58 rare-earth elements and oxides prices each month. But this is a guesstimate based on the surveys of traders and consumers. The prices don’t reflect what a miner wanted per pound. As my contact told me that day, no one in the industry talks to the media or research firms. And any of those prices are wildly out of date by the time they are reported.

Each rare-earth metal is a private negotiation between producer and buyer. The final composition of rare earths – how the metal is shaped into a useable product – is completely different for almost every single company.

No single end use of a rare earth is the same as another. In other words, processing of rare-earth elements changes almost every time. So, the price for every single rare earth used is unique to that one contract only, not the entire market, as we are led to believe.

Total control over the supply chain

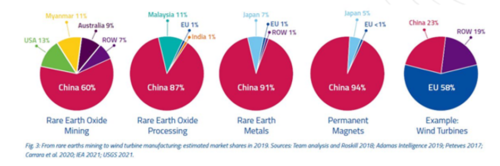

China has dominated the rare-earth sector since the early 1990s. This is half to do with the country’s massive 38% of total global reserves, and half with doing the West’s dirty work for it. That said, having the lion’s share of reserves and questionable mining practices isn’t the reason China still controls the market today.

There are plenty of other countries with suitable rare-earth reserves we can access. A much bigger problem is what to do with them when they come out of the ground. Mining them is one thing, refining and processing them into their final form is another.

China controls the entire rare-earths supply chain

In the three decades since the West turned its back on processing the final form of rare earths, China became highly skilled in not just extraction but the entire downstream process: refining, alloys, oxides, phosphors, and magnets.

To boot, Chinese rare-earths miners are reliant on government handouts and tax incentives to remain in business. As the Foreign Policy Institute recently noted, “Finding a commercially feasible method of extraction continues to be a problem, even for the technologically astute Japanese.”

It doesn’t matter who has the ores – rather, it’s about who can process them.

Australia and the United States are spending big bucks to kick-start the rare-earths industry locally. The question we need to ask now is, will it come with investing opportunities? Let’s find out.

Until next time,

Shae Russell

Co-editor, Exponential Investor